Bitcoin ETFs should not exist

This text is an on-site model of our Unhedged publication. Join here to get the publication despatched straight to your inbox each weekday

Good morning. Numerous nice responses to yesterday’s margins piece; I handle just a few of the factors raised under. However first, a quick screed concerning the incorrect form of monetary innovation. Electronic mail me: robert.armstrong@ft.com

Bitcoin ETFs: a nasty thought whose time has come

Now you can purchase a bitcoin trade traded fund. Or somewhat, a Bitcoin derivatives ETF: ProShares Bitcoin Technique, which tries to seize returns from the cryptocurrency utilizing futures contracts, began buying and selling yesterday.

I’m positive that is excellent news for somebody, however on the face of it, it’s exhausting to think about a much less interesting monetary product.

The unique thought of an ETF was that it supplied an inexpensive solution to obtain the beta obtainable in a given market, beta that might be exhausting to effectively seize in any other case. Reproducing the return of the Russell 3000 could be a ache within the ass for me to do at dwelling, however Vanguard’s ETF does an nearly excellent job of it for me, for all of 10 foundation factors.

Bitcoin Technique gives an costly solution to seize among the beta in a market, which it could be simple to seize, extra effectively, one other means. The annual price is 1 per cent. It attracts its publicity to modifications in bitcoin’s worth from short-term bitcoin futures contracts, that means that it has to repeatedly promote expiring contracts and purchase new ones. As a result of the longer-term contracts are normally costlier than the shorter ones, rolling the contracts over creates a drag on efficiency that, it has been estimated, may run to 5-10 per cent yearly. The probabilities that the ETF will carry out practically in addition to bitcoin are very low.

This isn’t very engaging, given than I can soar on to a crypto trade and purchase bitcoins instantly, get the entire digital asset’s efficiency, and pay a decrease price.

Different bitcoin funds is likely to be even worse. The nice large Grayscale Bitcoin Belief owns bitcoin instantly, nevertheless it expenses 2 per cent. It’s a closed-end fund, that means new shares will not be created when belongings move into it. The belief models due to this fact commerce in keeping with provide and demand, somewhat than sustaining a hyperlink to the worth of the underlying belongings, as could be the case with an ETF. This yr the worth of the models have fallen to a 25 per cent low cost to the underlying bitcoins (maybe as a result of buyers noticed an ETF coming), that means its relative efficiency has been terrible. However at the least a reduction to internet asset worth doesn’t recur yr after yr, like the prices of rolling futures contracts.

Grayscale wants to convert the belief to an ETF, one which owns bitcoins somewhat than futures, to lose the low cost. Which raises a query: why has the Securities and Change Fee accepted a bitcoin futures ETF, and never but a plain bitcoin ETF? Bitcoin is difficult sufficient. Including futures compounds the trickiness.

I’m undecided what the reply to that is, nevertheless it appears to be that bitcoin scares the SEC, as a result of God is aware of the place it originates (in a server farm someplace in China?), who holds most of it (cyberbaddies?), what it’s used for (criminal activity?), or what dangers it could entail (hacking? Fraud?). Bitcoin futures, against this, are created and traded inside the confines of the CME, below the watchful eye of the Commodity Futures Buying and selling Fee, within the upstanding American metropolis of Chicago.

Now, it appears to me that any derivatives market ought to have all of the dangers of the underlying money market and extra. However then I’m not a monetary regulator.

So why would anybody wish to purchase the ProShares fund? Or any bitcoin ETF? I requested an govt within the bitcoin fund trade, and here’s what they mentioned:

“The analogy I seek advice from when requested this query is gold. Buyers owned it for years in bars or cash, however then in 2004 a gold ETF was created, and tens of billions [of dollars] have been invested in it . . .

“It is about comfort and entry. If you consider the place your buyers’ swimming pools of capital lie — in a 401k, brokerage accounts — the very fact is that methods to entry bitcoin usually lie exterior that system . . .

“Within the case of a bitcoin ETF, it takes the custody facet of proudly owning these cash out of particular person buyers’ arms, and that may be a great factor. Purists will say if you happen to don’t maintain your individual non-public key, and so forth, you don’t have actual management. However numerous buyers need entry and don’t wish to do analysis into the myriad custodial choices. They simply wish to purchase a easy product from somebody they belief.”

That is the guts of the matter. Individuals need entry to crypto returns, however they need the method to work like an ordinary monetary product, and so they need bitcoin to sit down proper alongside the opposite merchandise of their portfolio. That is the explanation merchandise reminiscent of ProShares’s exist.

However it’s a dangerous motive. Bitcoin is by no means like commonplace monetary merchandise. It’s supported by extremely complicated know-how, the supply of its worth is essentially open for debate, and by far its commonest present use is as a car for the purest hypothesis. Should you can’t be bothered to be taught the distinctive subtleties concerned in proudly owning these things, you’ll be able to’t probably perceive the dangers, and so you shouldn’t personal it in any respect. Bitcoin ETFs mustn’t exist.

Just a few extra factors on margins

A number of readers urged that the explanation margins are excessive and (I imagine) sustainable is that the US economic system is dominated by industrial oligopolies, notably in know-how. This is likely to be true. Definitely, rising margins at all times point out one thing about competitors. It’s only as a result of competitors is restricted that every one company positive factors in productiveness and effectivity will not be handed over instantly to the buyer. Software program shouldn’t be an incredible enterprise simply because its marginal value of manufacturing is sort of zero. It’s a nice enterprise as a result of its tiny marginal prices are paired with a authorized system that protects mental property.

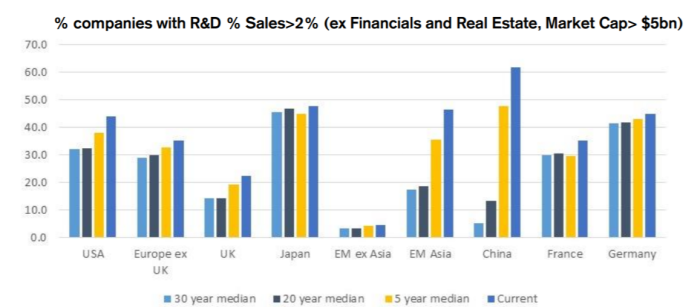

I not suppose we have to fear a lot about this. In the end, an uncompetitive economic system will cease innovating and rising, and returns to buyers should fall. However I’m undecided what we see in public markets is a degradation of competitors as such. Fairly, I’m starting to suppose we’re seeing the combo of public firms, and the combo of companies inside public firms, shift in direction of merchandise which might be model, analysis and mental property intensive, and these merchandise have greater margins. Here’s a chart despatched to me by Michel Lerner of Credit score Suisse that I believe captures this level. It exhibits the altering proportion of public firms in numerous markets that spend considerably on analysis and growth. The US is on the left:

I’d additionally observe that whereas tech firms are a giant driver of rising margins, they aren’t the one ones. We’ve got seen notable margin will increase in, for instance, industrials and shopper discretionary firms as properly. No matter kind of phenomena is unfolding, it isn’t restricted to tech.

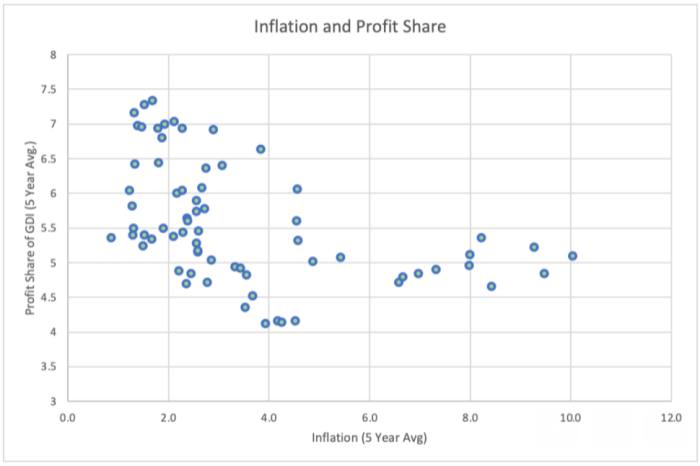

Different readers pointed to a different, extra urgent menace to margins: inflation. Paul O’Brien famous that whereas inflation doesn’t trigger margin degradation, “some inflationary forces — rising wages, provide constraints — are dangerous for margins. And better inflation can also result in tighter financial coverage and recession, additionally not good for margins.” He despatched alongside this scatter chart, which plots earnings as a share of gross home earnings towards inflation (utilizing knowledge from the Federal Reserve). It exhibits a nasty pattern when inflation will get a lot above 4 per cent:

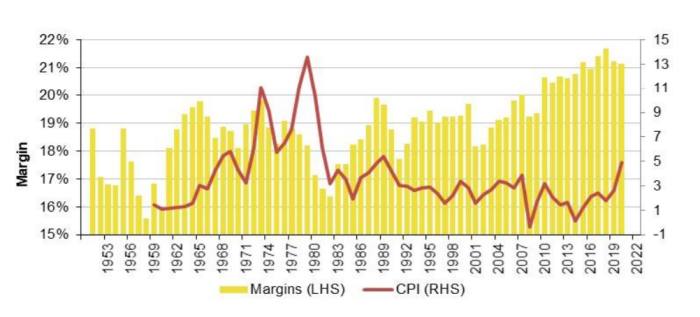

Right here is one other means of trying on the identical thought, once more from Credit score Suisse. It exhibits how inflation spikes have been adopted by falling working margins within the US within the Seventies and Nineteen Eighties. The sequence is definitely suggestive:

If inflation will get dangerous, it is smart that margins would fall.

One good learn

Sotheby’s is auctioning off the gathering of the late grasp magician Ricky Jay. He was tremendous cool. Here is {the catalogue}, and right here is a superb write-up from The New York Occasions. Possibly I can afford a poster.