China expands property tax trials in next step of ‘common prosperity’ drive

China has expanded trials for a property tax, a call that pitches President Xi Jinping towards deeply entrenched vested pursuits throughout an economic system fuelled for many years by actual property growth.

The state council, China’s cupboard, will develop pilot schemes to tax residential and business property in cities, in accordance with an announcement by the Nationwide Folks’s Congress — the rubber-stamp legislature — on Saturday. The areas weren’t disclosed however rural households can be excluded.

The reform threatens to be far thornier to implement and have an effect on a larger variety of folks than a regulatory assault that has been launched over the previous 12 months on the earth’s second-largest economic system. A property tax might alter China’s economic model, reshaping authorities income streams from land gross sales to taxes and deterring property hypothesis.

Xi privately instructed financial planners in August to forge forward with growing a property tax, the subsequent step of his broader “common prosperity” reforms, that are supposed to redistribute wealth and “regulate excessively excessive incomes”.

However the proposals have raised considerations amongst some strange Chinese language, whose financial savings are enmeshed within the value of the property they personal. Others concern it’s too dangerous and will trigger a housing market crash.

How would a property tax work?

Proposals to introduce a property tax have been mentioned for nearly 20 years. The tax is envisaged as an annual levy on residence possession and can be set and picked up by native governments.

Yilin Hou, a professor of public coverage at Syracuse College who has suggested Beijing on the levy, has mentioned the tax base ought to be “as broad as doable” however with reduction measures for economically susceptible folks.

“If the tax is environment friendly and equitable, satisfactory and clear, then it will likely be a lot simpler to levy, gather and implement. On this method, the tax will . . . even be politically acceptable,” Hou added.

Many tax specialists and economists consider it is going to additionally assist wean native governments off their continual dependence on promoting and leasing public land to builders. This relationship has contributed to widespread property hypothesis and pushed land and home costs larger in a cycle that many specialists consider is unsustainable.

In line with an evaluation by Capital Economics, the analysis group, an efficient tax price of 0.7 per cent of the entire property worth would have generated Rmb1.8tn ($282bn) final 12 months in China, in contrast with Rmb1.6tn from land gross sales.

The tax, and subsequent strain on costs, might additionally assist dent the attraction of property funding, redirecting non-public capital in the direction of sectors resembling high-tech exports and companies that enhance home consumption, in accordance with its proponents.

What stands in the best way?

Many consider earlier efforts to tax residential property failed due to resistance from rich and politically related elites, notably in cities resembling Beijing, Guangzhou, Shenzhen and Hangzhou, in addition to native authorities officers throughout the nation.

Some specialists say a probably larger drawback for the Chinese language management is the concern of instability that may very well be attributable to a market crash.

“In speculative markets, as soon as costs cease going up, they have an inclination to go down. If this had been to occur to Chinese language property costs, this might not solely be terribly damaging to the banking system, however it will additionally reverse the main supply of wealth accumulation amongst Chinese language households,” mentioned Michael Pettis, a finance professor at Peking College. “How do social, monetary and financial establishments adapt after 40 years of inexorably rising costs, throughout which the assumption developed that Beijing won’t ever let actual property costs fall?”

China’s actual property sector has been thrust into the worldwide highlight by the plight of Evergrande, the world’s most indebted property developer with $300bn in liabilities.

Official knowledge launched this week confirmed the primary month-on-month decline in new residence costs throughout 70 of China’s greatest cities in more than six years, indicating {that a} slowdown is already feeding via into the housing market.

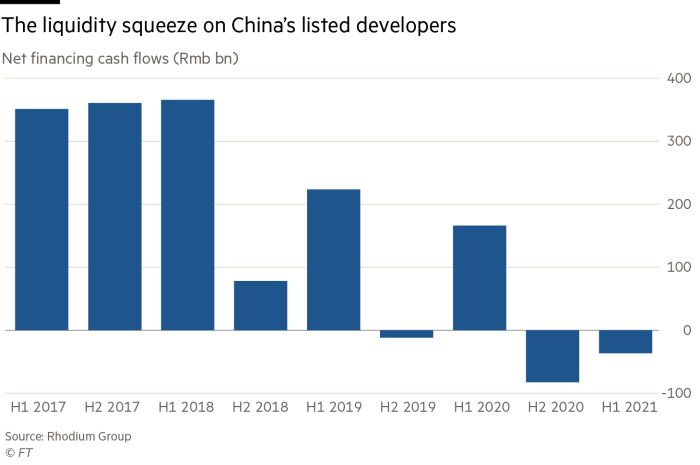

The downturn has heaped pressure on the leadership in Beijing, which final summer time launched deleveraging rules to constrain the amount developers could borrow. The measures had been launched at a time when price cuts and an industrial increase to counter the financial hit of the pandemic had raised fears of asset bubbles.

Xi’s need to push forward with the tax mirrored rising confidence in Beijing that China might handle a plethora of acute housing market problems and other economic risks regardless of the potential hit to short-term progress, mentioned Gan Li, a professor of economics at Texas A&M College.

“The president has mentioned himself overtly that we have to set up a property tax,” mentioned Gan. “We’ve all realized that we have now to take him very severely. What he says, he’ll ship.”

When would it not be applied?

Beijing has not mentioned when the tax can be rolled out, nor the place it will likely be launched.

Some economists would really like the levy to be deployed nationwide as quickly as doable however the consensus view is that trials in Shanghai and Chongqing, operating since 2011, can be step by step expanded, beginning with wealthier cities.

“By our design, a superb tax system is one which grants authority to native governments to levy this tax,” Hou added. “They resolve whether or not they need to begin now or years later. They resolve for themselves how excessive the tax price can be, how excessive the evaluation ratio can be.”

Regardless of reviews of political opposition, the probabilities of a nationwide tax being applied are a lot larger than earlier makes an attempt, mentioned Mark Williams, chief Asia economist at Capital Economics.

“Opposition from insiders isn’t new. The correlation between occasion membership and possession of a number of properties might be pretty excessive,” he added. “However demographics means the 25-year property increase is ending. Land gross sales will not be a sustainable supply of presidency income any extra. A modest property tax may very well be.”

What do Chinese language folks take into consideration the tax?

Interviews and on-line discussions replicate a pointy division over the tax in China.

“No person likes taxes, however it received’t have an excessive amount of impact on me as a result of I’m not an actual property speculator,” mentioned a businessman in Zhejiang province.

Some consider the levy can be ineffective in addressing inequality, is just getting used as one other authorities income stream, or each.

Others are betting property costs will proceed to rise within the medium to long run, with native authorities officers unlikely to implement a tax that cuts immediately towards their very own pursuits.

“As a result of the category that owns essentially the most property is definitely the forms, it’s most definitely that the property tax will develop into a formality and has no precise impact ultimately,” mentioned an organization supervisor in Beijing. “I’ll proceed to put money into homes.”

Further reporting by Emma Zhou in Beijing