Euro affected by bets ECB’s monetary policy will be different from its major peers

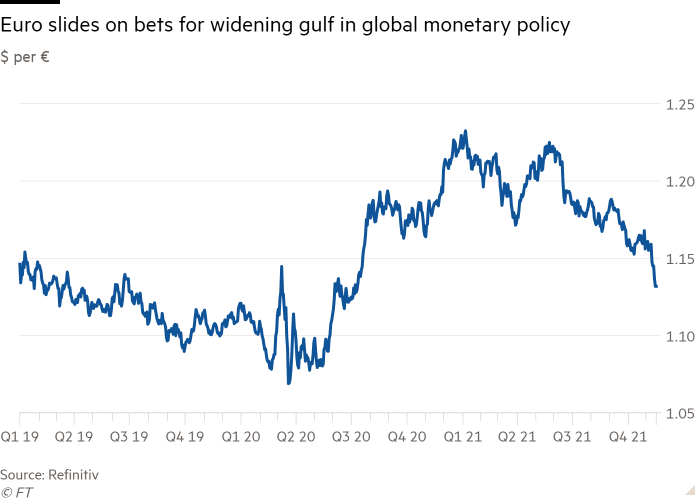

The euro hit a 16-month low this week as traders bet the European Central Bank will stick to its accommodative policies despite common inflation is prompting US and UK policymakers to raise interest rates.

Traders are dialing their bets that the Federal Reserve and the Bank of England will lift interest rates from historic lows next year at a time when the ECB is pushing back on market expectations that it also will increase borrowing costs in 2022.

As a result, the euro has fallen sharply against the dollar – the most traded exchange rate – ending a period in which currencies have largely escaped the turmoil raging in the bond market. promissory note.

“The market is positioning the difference between the Fed and the ECB,” said Athanasios Vamvakidis, head of G10 forex strategy at Bank of America.

The euro fell below $1.13 on Wednesday, its weakest since July of last year, and fell sharply from nearly $1.16 in the middle of last week.

While part of the euro’s recent weakness has been the flip side of a broad rally in the dollar, the currency has also lost ground against peers benefiting from the outlook. higher interest rates.

Against the pound, it reversed its early-November rally and continued to fall to its weakest since the early stages of the Covid pandemic in February 2020.

The latest losses against the pound were triggered by data on Wednesday showing UK inflation hit 4.2% in October.

Investors, blinded by the Bank of England’s surprise decision to leave rates unchanged this month, are now betting that UK rates will rise to 0.25% in December, from 0.1% currently, in an attempt to tame a faster-than-expected price increase.

Consumer prices in the Eurozone have also picked up fast, with year-on-year gains reaching 4.1 percent in October, according to Wednesday’s data, but investors have lower expectations for longer-term inflation – in part. legacy of the years the ECB failed to hit its 2% inflation target. .

As a result, ECB chief Christine Lagarde has repeatedly emphasized that bets on the ECB’s 2022 rate hike that are inconsistent with central bank guidance are beginning to be adopted by investors, according to analysts. accumulate.

Markets are currently pricing in a tenth of next year’s rate hike after Lagarde told the European Parliament on Monday that tightening monetary policy now would do “more harm than good”. “.

“Ultimately the markets have settled on the fact that all central banks are not going to move together at the same pace,” said Jane Foley, head of foreign exchange strategy at Rabobank.

In recent weeks, interest rate hike expectations from the BoE, along with the Reserve Bank of Australia and the Bank of Canada, have fueled selling pressure in global bond markets as investors bet that Other central banks will respond similarly to inflationary pressures.

“Perhaps it’s surprising that these moves didn’t happen sooner,” Foley said. “Up until a week ago, investors seemed to be assuming that all of these economies were similar. You’ve got the global market pulled in by the UK, Canada or Australia. It all seems a little bit out of date.”

According to Leandro Galli, a senior portfolio manager at Amundi, the ECB is likely to also be cautious in tightening policy so as not to cause any increase in borrowing costs for members. eurozone members are more indebted like Italy.

“The Fed always tries not to be too hawkish, but it is moving in that direction,” said Galli, who is betting on further dollar gains against the euro. “But it is harder for the ECB to come out of its stimulus and they have more time.”