Evergrande share trading halt pushes HKEX suspensions to record $61bn

The prolonged suspension of Evergrande’s shares has helped push the price of frozen shares in Hong Kong to a file US$61bn, throwing into stark assist the city’s restricted shareholder protections.

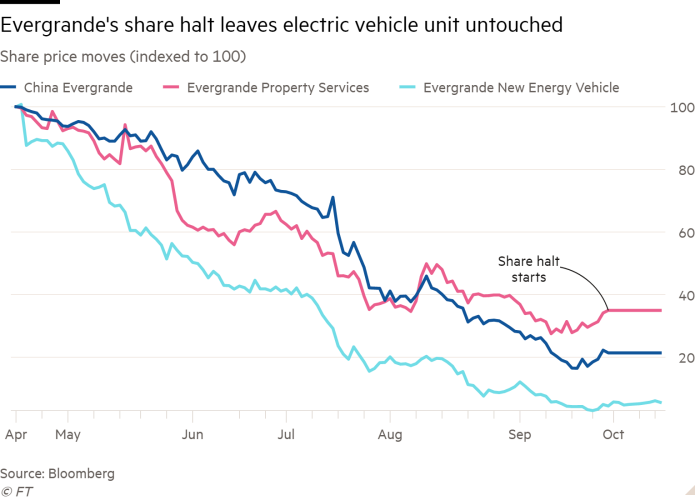

Troubled property developer Evergrande halted trading of its Hong Kong-listed stock and that of its property suppliers unit on October 4, stating in an change submitting from the latter that the switch had been taken ahead of a “potential regular provide” for its shares. Nonetheless after higher than two weeks, the company has however to disclose the remainder regarding the apparent deal, nor make any assertion about 5 missed funds totalling higher than $275m to worldwide bondholders.

Firm governance professionals talked about the stonewalling of shareholders by Evergrande, whose high-profile liquidity catastrophe is being monitored by worldwide markets, struck at Hong Kong’s standing for providing a base for investing in China grounded in worldwide financial norms.

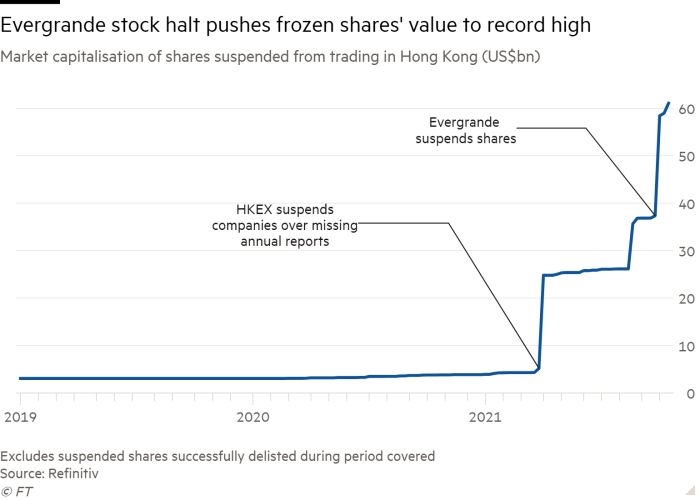

The suspension has moreover helped to push the price of shares beneath a shopping for and promoting halt to a file extreme of merely over $61bn, in response to Refinitiv info, up from merely $3.9bn on the end of 2020.

“Therein lies the draw again to having a market the place you do have an entire lot of listed firms with majority shareholding,” talked about Jane Moir, evaluation director on the Asian Firm Governance Affiliation, referring to the comfort with which controlling shareholders can freeze shopping for and promoting. “Minority shareholder rights are being eroded day-to-day . . . [Evergrande] is a barometer for Hong Kong.”

A person close to a number of of Evergrande’s offshore bondholders described the dearth of disclosure pertaining to its liquidity factors as “odd and out of line”.

“It’s such a high-profile situation, it could be exhausting to imagine the change was not writing to the company [about the issue].”

The itemizing pointers of Hong Kong Exchanges and Clearing require that any suspension “have to be for the shortest potential interval”. Nonetheless the metropolis’s guidelines of frozen shares now stands at about 140, in response to Refinitiv info — constituting 6 per cent of the market’s full. A suspension can remaining 18 months sooner than a corporation risks being delisted by HKEX — triple the prohibit of the London Stock Commerce.

HKEX declined to the touch upon the suspension of Evergrande shares, nonetheless a person accustomed to the change’s pondering talked about that its priority was stopping shares from shopping for and promoting improperly.

A corporation can request a shopping for and promoting halt on its shares for lots of causes, comparable to if it has been subject to a takeover provide or goes into liquidation. The change can individually droop shopping for and promoting if it detects unexplained or unusual actions in a corporation’s shares.

Totally different exchanges internationally, along with these in New York and London, moreover allow the suspension of shares beneath explicit circumstances, nonetheless Hong Kong’s shopping for and promoting halts are acknowledged for his or her frequency and dimension.

“It is going to be easy to infer that Evergrande is using the suspension for tactical causes to stay away from talking with patrons,” talked about Nigel Stevenson, an analyst at Hong Kong-based GMT Evaluation. “Evergrande has clearly didn’t protect the market educated about why a shopping for and promoting suspension continues to be needed.”

The electric vehicle subsidiary of Evergrande, which has no glorious bonds and may also be listed in Hong Kong, has continued to commerce freely in present weeks.

On a reputation on October 8, advisers to bondholders talked about that that they had received no “meaningful engagement” from the developer and expressed points over the potential sale of the property suppliers unit along with the sale of part of a stake in a regional bank in China.

Patrons in Evergrande have raised points with attorneys inside the metropolis regarding the lack of disclosure, in response to at least one particular person close to the matter. A lawyer who had appeared into the situation on behalf of patrons talked about the developer “nonetheless has an obligation to make disclosures spherical supplies price-sensitive events” whatever the shopping for and promoting suspension.

The lawyer acknowledged that there “won’t be any breach per se” as a result of the agency is entitled to droop shopping for and promoting pending announcement of a attainable transaction. “Nonetheless usually in these situations a correct announcement follows imminently, inside each week.”

Critics and firm governance proponents talked about that the change has improved enforcement in current instances. In late March, HKEX suspended shopping for and promoting in about 150 firms, largely for failing to submit annual financial outcomes. In January, HKEX delisted Huiyuan — as quickly as China’s largest fruit juice maker — no matter a variety of appeals from the company.

Nonetheless that call was of restricted help to minority shareholders, who make up lots of Hong Kong’s investor group due to the huge number of issuers who’re managed by each majority or family shareholders. At Evergrande, as an illustration, 71 per cent is held by its chair Hui Ka Yan, beforehand the richest man in China.

“It’s a reminder of how robust it’s as a minority shareholder in Hong Kong to take any remedial movement in direction of these firms,” talked about Moir from the ACGA. “The system isn’t constructed for the underdog.”

Moir added that there was little recourse for shareholders locked into holding suspended shares in Hong Kong. Taking firms to courtroom docket over shopping for and promoting halts is prohibitively pricey and the type of outdoor shareholder pressure that’s widespread in London or New York is usually rendered impotent by majority administration.

Even primarily probably the most dogged makes an try at shareholder activism have yielded little pay-off. US hedge fund Elliott Administration spent higher than six years pushing for the sale of lending operations at Monetary establishment of East Asia, which was co-founded in 1918 by Hong Kong’s extremely efficient Li family. Lastly, BEA agreed to advertise solely its life insurance coverage protection unit to Asian insurer AIA for about $650m.

This yr, the activist fund suggested patrons it was leaving Hong Kong. BEA continues to perform branches all by the city.

Additional reporting by Thomas Hale in Hong Kong

https://www.ft.com/content material materials/b3bb2c37-252b-430d-99dc-bde7b3d2f179 | Evergrande share shopping for and promoting halt pushes HKEX suspensions to file $61bn