Fed will keep rates above 4% after 2023, economists predict

According to the majority of leading economists as voted by the Financial Times.

Latest survey, conducted in partnership with the Global Markets Initiative at the University of Chicago’s Booth School of Business, shows that the Federal Reserve is far from ending its monetary policy tightening campaign. It raised interest rates this year at its strongest pace since 1981.

Fluctuating near zero as recently as March, the federal funds rate is currently between 2.25% and 2.50%. The Federal Open Market Committee regrouped on Tuesday for a two-day policy meeting at which officials expected to make a rate increase of 0.75 percentage points for the third time in a row. That move would lift the rate to a new target range of 3% to 3.25%.

Nearly 70% of 44 economists surveyed between September 13 and 15 believe that this tightening cycle’s loan-finance ratio will peak between 4% and 5%, with 20 % opinion that the level should be crossed.

“The FOMC has yet to determine how high they need to raise rates,” said Eric Swanson, a professor at the University of California, Irvine. “If the Fed wants to slow the economy right now, they need to raise the deposit rate above.” [core] inflationary. “

While the Fed typically sets a 2% rate target for the “core” personal consumption expenditures (PCE) price index — which excludes volatile items like food and energy — the Fed also closely tracks just that. consumer prices. Unexpected inflation acceleration in August, with the core measure up 0.6% on the month, or 6.3% year-over-year.

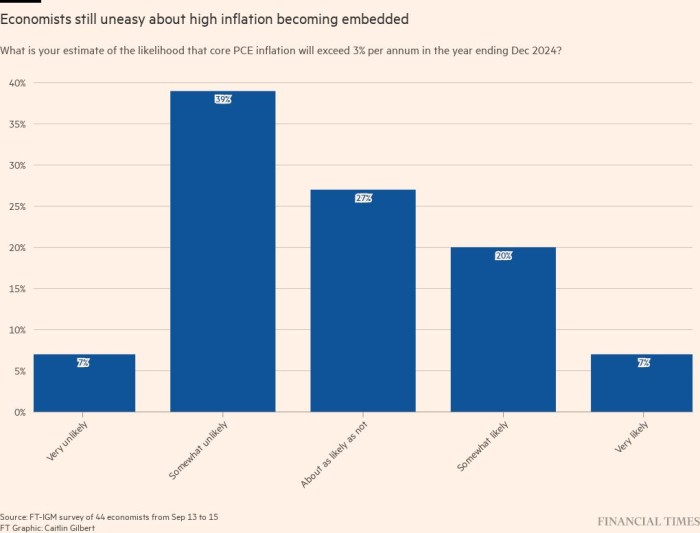

Most respondents expect core PCE to fall from July’s most recent level of 4.6% to 3.5% by the end of 2023. But nearly a third predict it will still exceed 3. % for the next 12 months. Another 27% said it was “likely not” to stay above that threshold at the time – indicating great uncertainty about high inflation increasingly ingrained in the economy.

“I fear we have reached a point where the Fed faces a serious risk of its credibility being eroded, and so they need to start being aware of it,” said Jón Steinsson at the University of California, Berkeley. clear about that”.

“We’re all hopeful that inflation will start to come down, and we’ve all been disappointed from time to time.” More than a third of economists surveyed warn the Fed will not be able to adequately control inflation without raising rates above 4% by the end of the year.

Aside from raising interest rates to a level that limits economic activity, the majority of respondents expect the Fed to keep them there for a long time.

Easing price pressures, financial market turmoil and worsening labor markets are the most likely reasons for the Fed to pause its tightening campaign, but no lending rate cuts are anticipated. earliest prediction until 2024, according to 68% of respondents. Of those, a quarter do not expect the Fed to lower its benchmark policy rate until the second half of 2024 or later.

However, few believe that the Fed will increase its efforts by shrink Its balance sheet is close to $9 billion through the sale of its entire dealer mortgage-backed securities holdings.

Such aggressive action to cool the economy and eliminate inflation will come at a cost, Jay Powell, the chairman, made the point. recently appearance.

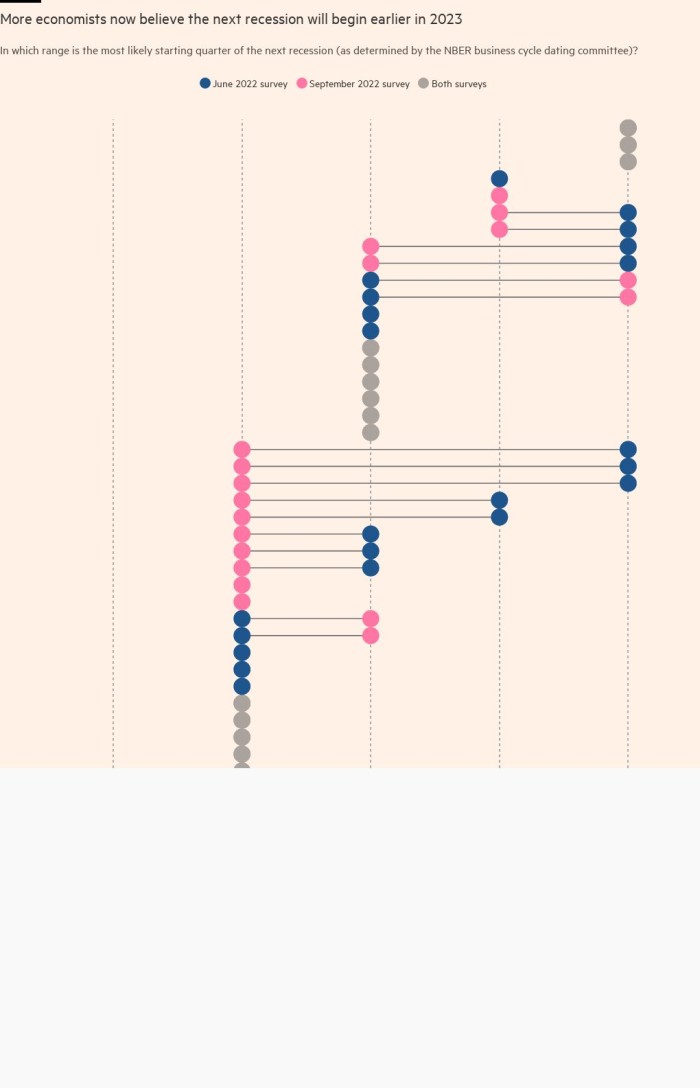

Nearly 70% of respondents expect the National Bureau of Economic Research – official referee on when US recessions start and end – claim one in 2023, with large numbers holding the view that it will happen in the first or second quarter. That compares with about 50% of those who see Europe falling into recession by the fourth quarter of this year or earlier.

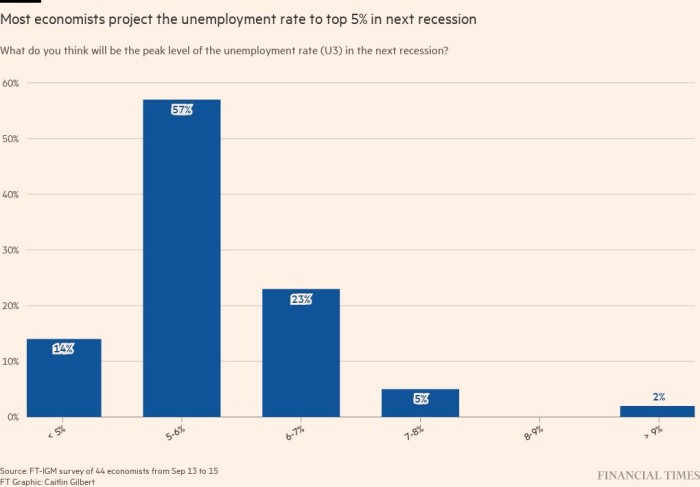

Most economists calculate that a U.S. recession is likely to last through two or three quarters, with more than 20% expecting it to last four quarters or more. At its peak, the unemployment rate can settle between 5% and 6%, according to 57% of respondents, much higher than current Level 3.7%. A third see it eclipsed by 6%.

Julie Smith at Lafayette College warns: “This is going to fall on workers who are least able to pay as we increase unemployment as the rate rises at some point. “Even if it’s a small amount – a percentage of the unemployment rate goes up – a percentage or two – it’s a real pain for households that are really not prepared to cope with these challenges. this kind of shock.”

The easing of supply-related constraints related to the war in Ukraine and the Covid-19 lockdowns in China could help mitigate the extent to which the Fed needs to reduce demand, said Ebnem Kalemli-Özcan. demand, which means the eventual economic downturn will be less severe,” Şebnem Kalemli-Özcan at the University of Maryland. But she cautions that the outlook is highly uncertain.

“Obviously this is shock after shock, so I don’t believe this will happen immediately,” Kalemli-Özcan said. “I can’t tell you the timeframe, but it’s moving in the right direction.”