Glass bottle shortages keep US distillers tall and dry

St Augustine Distillery, a spirits company, has about 5,000 cases of vodka, gin, rum and whiskey sitting in containers, waiting for bottles to arrive on liquor store shelves.

The company prides itself on its custom packaging, from a striking bottle of vodka to a distinctive flared container that showcases the rich bourbon flavors to their full potential. Across the US, however, bottle shortages are threatening sales as the peak Christmas season approaches.

Florida-based St Augustine used wine bottles to pack nearly a quarter of its production, sending apologetic notes with each shipment explaining the reasoning behind the replacement packaging.

Co-founder and chief financial officer Mike Diaz said customers in their gift shop understood, but wholesalers turned down the new bottles “because a change in size would require alteration. in the warehouse”.

The problems Florida distilleries are facing are playing out across the U.S. wine and spirits industry, with major players like Brown-Forman, Jack Daniel’s whiskey maker, expressing concerns in recent months about what glass supplies will mean for their prospects.

Causes of shortages range from demand for spirits to labor shortages and logistics problem in the broader economy. Jennifer Bisceglie, chief executive officer of supply chain risk consulting firm Interos, says that some glass manufacturing industries have even been redirected to vial production. Vaccines against covid-19.

Diaz noted that one of his suppliers had closed its Missouri plant and moved to India, leaving St Augustine’s Distillery dependent on the spot market for bottles. Another spirits producer, Eastside Distilling, said its Mexican bottle supplier told them this summer that their custom bottles would no longer be available, forcing them to look for alternative suppliers. .

A wine’s packaging is part of its consumer appeal, but distillers are ready to use bottles instead, because, as Diaz explains, “I couldn’t sell it until I was.” have it in the bottle.”

The Glass Packaging Institute says the problem isn’t just glass shortages. U.S. production of spirits bottles increased about 3% year-on-year in the first nine months of 2021, while imports of 750ml bottles for wine and spirits increased 14%.

Instead, GPI president Scott DeFife said problems stemming from “excessive demand” have put strains on the entire supply chain, from trucking capacity to warehouse space.

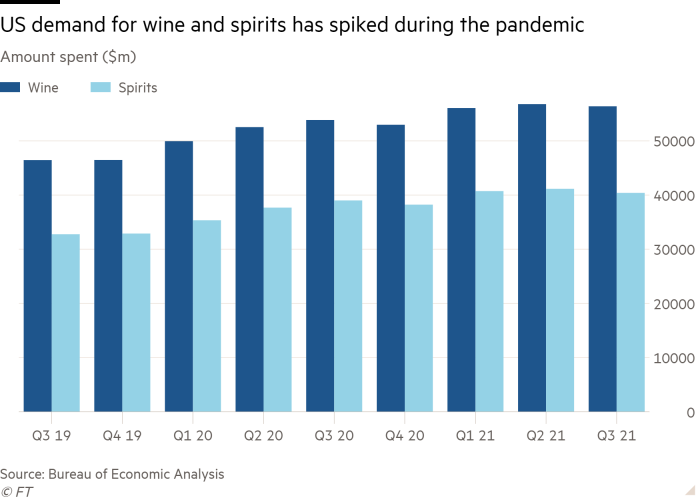

Spend on alcohol increased during the pandemic, up nearly 13% for wine and 14% for spirits between Q1 2020 and Q3 2021, Bureau of Economic Analysis data showed.

Many beverage groups have responded to disagreement by using unconventional packaging, sometimes accepting smaller or larger bottles than they normally use, said Lisa Hawkins, senior vice president at the Spirits Council. used — or plastic containers, said Lisa Hawkins, senior vice president at the Distilled Liquor Council.

For many, however, the timing of the current bottle shortage is dire. “The holidays are an important sales season for the spirits industry with entertainment and giveaways,” notes Hawkins.

Michael Kaiser, Vice President of Government Affairs for the National Association of American Wineries, said bottle shortages also pose a major challenge for wineries operating on fixed timetables. determined.

“If a winery doesn’t have access to bottles of wine, the wine in the casks or casks that need to be bottled is going to be in trouble. Tanks and casks have specific bottling schedules, and any change to that could affect how a winery does business,” he said.

The shortfall is affecting profits. Vintage Wine Estates of California said in a recent press release that it has been unable to deliver approximately $7 million worth of products because glass shortages have prevented production and delivery to one seller. large odd is delayed.

Andres Lopez, chief executive officer of OI Glass, one of the main US bottle suppliers, told analysts last month that demand for glass was “continuously increasing” but was about to peak. sometimes “hard to service”. Falling imports are adding to the challenge of tight inventories, he said.

As beverage groups rely more heavily on imported bottles, they are worried about rising shipping costs and extended delivery times. Jeff Quint, owner of Iowa-based Cedar Ridge Distillery, says that while his custom bottles made in Taiwan and Europe are ready to ship, the global supply chain difficulties forced him to use substitute products.

Some foreign manufacturers have halted production after running out of storage capacity, adding to the problem, he said.

Cedar Ridge’s shipping costs have increased from about $3,000 a container to $13,000. “It definitely affects the cost of our product,” Quint said.

Diaz said his company is looking at raising prices next quarter as its shipping costs have increased from just under $4,000 per container to more than $18,000.

Many wineries and distilleries said they expected the problem to continue into the second half of next year.

In the short term, however, industry executives are telling consumers to take holiday orders early. “If you have a spirit that you like or a product that you like, you better get it now, because no one can guarantee product availability because no one else can,” says Diaz. can guarantee the availability of glass”.