High-growth startups should start eliminating risk on the road to IPO now • TechCrunch

High growth companies often set important goals, knowing full well that the idea of “overnight success” is for storybooks. However, there’s no better time than in the middle of a market downturn to start planning for the leap from private to public.

Eliminating risk on the road to going public requires strategic planning, which takes time. As a result, companies that aim to go public in less than three years must plan for it now – despite the downturn – to start operating, they will need to navigate the market. open.

Discover why this adverse economy is ideal for planning an IPO and what to do about it.

Growth investors have recently pulled back

While some companies delay IPOs, others can catch up and prepare for when the open market wants to invest again.

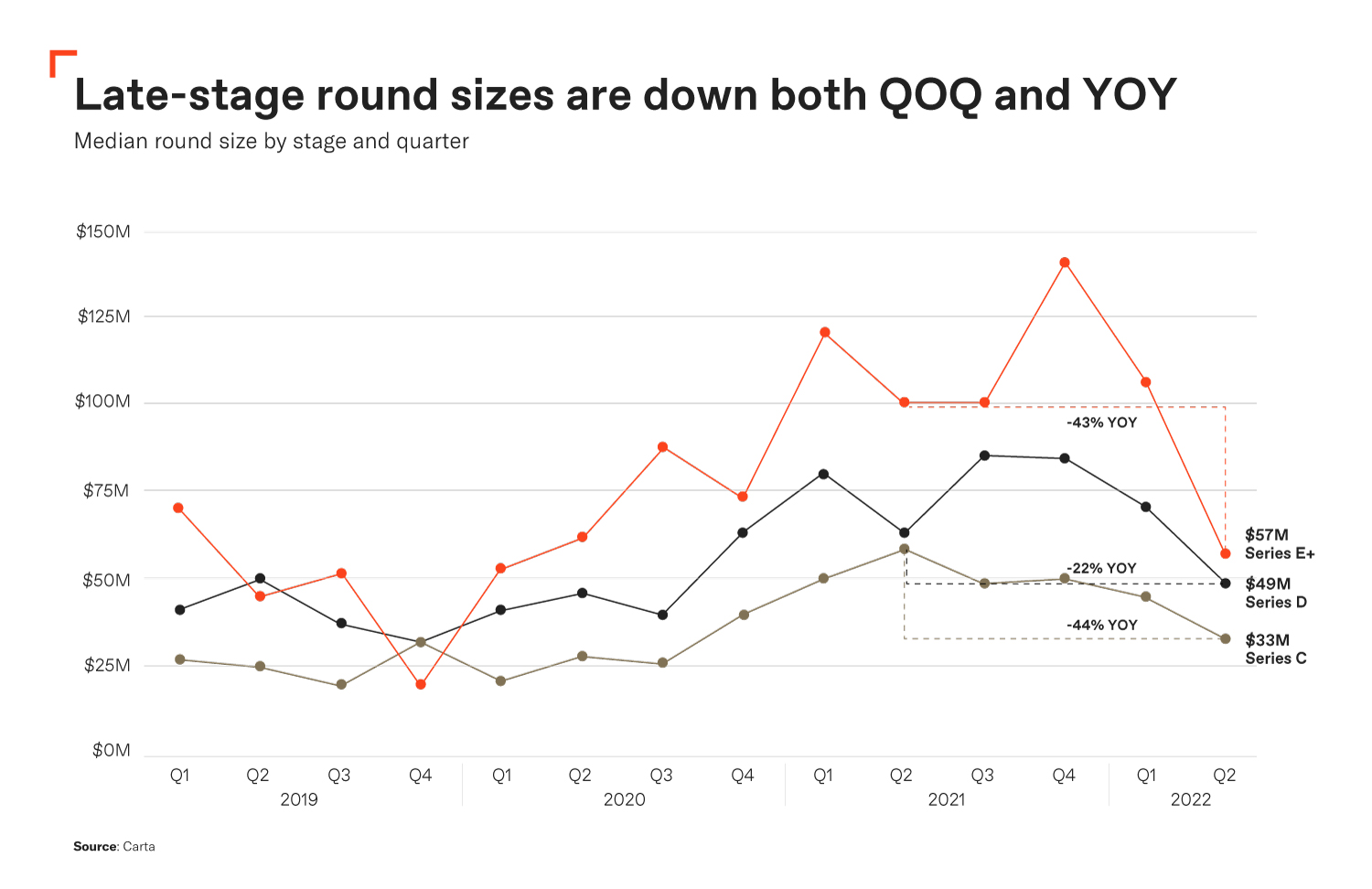

Carta reported that private fundraising levels have dropped across the United States from record-breaking levels in 2021. It is not surprising that late-stage companies have suffered the brunt of the blow.

Market experts are now encouraging leaders Not to put their hope in the venture capital dry powder, even though there are many. As the chart below shows, the size of late-stage funding rounds has shrunk.

Image credits: Founder Shield

While few people enjoy market downturns, the manner in which the event unfolds can provide insights for late-stage companies to pay attention to. On the one hand, many leaders are embracing the message of Sequoia Memorandum. We can agree with their idea of prioritizing profit over growth – the scale is different than it used to be and we have to swallow that jagged pill.

On the other hand, cutting costs and giving up hope of raising capital isn’t everything. After all, when there is money, some innovative founders will find it. We look at it every day; only now, the path looks different.

Market downturn prompts valuation adjustment

Directional correction is a concept frequently discussed in the context of market downturns. The pendulum oscillates in one direction for a period of time, then begins its journey towards a more balanced standard. In this case, the open market thrives on overpricing — most startups are overvalued before 2021.

Furthermore, many consider 2021 to be a magical year, especially as VC investment nearly doubles to $643 billion. The US has sprouted more than 580 new unicorns and seen over 1,030 IPOs (more than half are SPACs), which is significantly higher than the previous year. Only about 170 public listings have been welcomed this year.