How Brazil’s Nubank became a $30bn fintech

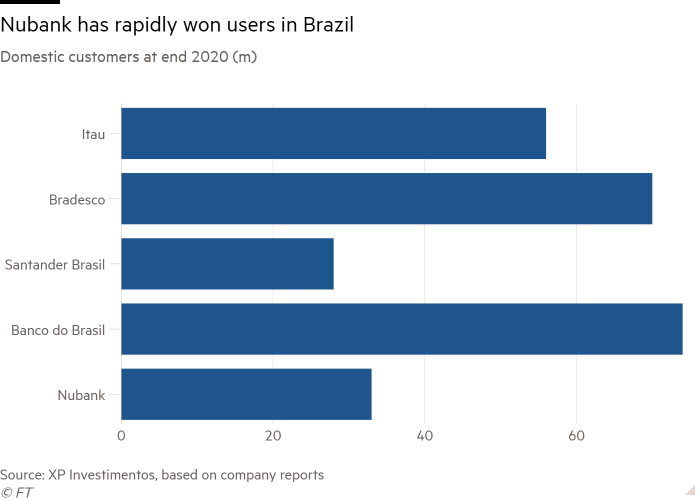

Backed by legendary investor Warren Buffett, with greater than 40m clients and Brazil’s greatest pop star on its board, Nubank is on the rise.

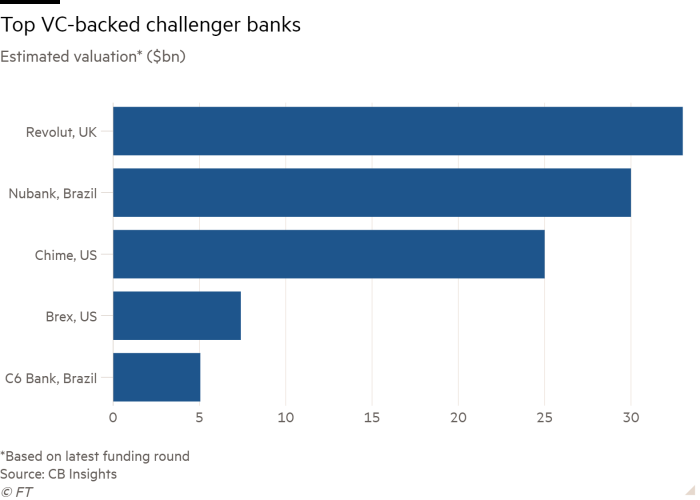

After hitting a $30bn valuation in a funding spherical earlier this yr, the Latin American start-up on Wednesday filed for an preliminary public providing within the US that would seal its place among the many world’s hottest monetary expertise firms.

Based in 2013, the São Paulo-based group started providing a zero-fee bank card managed by a cell app, earlier than shifting into free digital accounts.

Its manner of doing enterprise has come as a welcome change in Brazil. The nation’s bureaucratic banking industry has historically levied excessive rates of interest and prices for fundamental providers and left swaths of the inhabitants excluded. However in a tech sector the place the road between imaginative and prescient and hype is commonly blurry, Nubank should persuade inventory market traders that it justifies the excitement.

Having expanded into Mexico and Colombia, the corporate has claimed to be the biggest impartial digital financial institution outdoors Asia by buyer numbers.

Nubank executives declined to be interviewed. However its mission to tackle the massive banks and promote monetary inclusion was captured lately by chief govt David Vélez on LinkedIn, the place he posted: “First they ignore you, then they snigger at you, then they combat you, then you definitely win”.

A profitable float could be one other achievement for Brazil’s booming start-up scene, which has greater than a dozen “unicorns” — privately owned firms valued at greater than $1bn — in response to data provider CB Insights.

The variety of shares to be offered and the value vary of the proposed IPO haven’t but been decided, stated Nubank, which additionally intends to have Brazilian depository receipts traded on the São Paulo bourse.

Nubank was born out of Colombian co-founder Vélez’s frustration when attempting to open a checking account in Brazil whereas an govt at Sequoia Capital. The Silicon Valley enterprise capital agency — recognized for its bets on Google, PayPal and ByteDance — would offer seed funding.

Co-founder Cristina Junqueira now oversees the Brazilian operation and a 3rd founder, Edward Wible, works in a expertise position.

A number of former staff, who requested to not be named, spoke of a give attention to customer support, information science and innovation. But in addition they described a tradition of perfectionism that has generally slowed product launches.

Joelson Sampaio, a professor of finance on the Getulio Vargas Institute, stated Nubank’s greatest impression has been to convey extra competitors to Brazilian banking.

“The elimination of charges, ease of interplay with the technological platform, with extra accessible and fewer distant communication between the financial institution and the shopper — all this facilitated and innovated service,” he stated.

Nubank by numbers

$30bn

Valuation following newest funding spherical

40m+

Variety of Nubank clients

Since first launching its distinctive purple playing cards, Nubank has sought to evolve right into a full-service monetary establishment. Immediately, it gives private loans, financial savings and enterprise accounts, insurance coverage and, via acquisition, has entered funding merchandise.

An endorsement got here when Buffett’s Berkshire Hathaway invested $500m in June. It joined a listing of big-name shareholders that features US investor Tiger International Administration, Chinese language tech group Tencent and Singapore’s sovereign wealth fund GIC which have taken Nubank’s whole fundraising to about $2bn.

In line with evaluation by brokerage XP primarily based on central financial institution information, the corporate has constructed a 5.4 per cent share of Brazil’s retail bank card market. Its ambitions are underscored by an inside objective of reaching 100m “fanatical” purchasers.

Nevertheless, glitches have come alongside the best way. Customers have complained of disrupted providers on a number of events in 2021, with stories of the app being down and a few folks briefly unable to pay payments or make transfers. Nubank didn’t reply to questions on these incidents.

The corporate additionally drew consideration this yr with the unorthodox board appointment of Anitta, a well-liked 28-year-old singer.

As customers have rocketed from simply 3m on the finish of 2017, so too has turnover. Revenues rose 79 per cent to R$5bn ($896m) final yr, whereas internet losses shrank by 1 / 4 to R$230m. Buyer deposits elevated 2.6 occasions to R$29bn.

Debt score company S&P upgraded Nubank by three notches to brAA-following its newest capital elevate and highlighted its “resilience within the face of the impacts from the Covid-19 pandemic”.

“Our base case in 2021 is they may break even and we anticipate profitability to progressively enhance going ahead,” stated S&P analyst Guilherme Machado. “They’ve a way more mature [credit] portfolio proper now, which ought to have the ability to readily lead to optimistic bottom-line outcomes.”

That’s already taking part in out. Nubank recorded a internet revenue of R$76m ($13.6m) in Brazil throughout the first half of 2021.

However not everyone seems to be glad. Final month, the corporate — which regardless of its title doesn’t have a full banking licence — discovered itself dragged right into a social media row between Brazil’s fintechs and its established lenders over charges and who presents cheaper borrowing charges.

But if Nubank has rattled Brazil’s 5 dominant banks, it has additionally maybe compelled them to speed up reforms. Many have closed branches to cut back prices.

On the similar time, a flock of rival upstarts are snapping at Nubank’s heels. These embrace C6, a unicorn that’s 40 per cent owned by JPMorgan since June and valued at simply over $5bn, in response to CB Insights.

“Nubank in the present day is a trendsetter and each product it launches will quickly be copied and perhaps improved slightly by some contenders,” stated former worker André Diniz Bégio, who labored in enterprise growth. “The market will at all times be catching up with Nubank. If it turns into too assured, this might change into a entice.”

Extra reporting by Carolina Pulice