How China’s tech bosses cashed out at the right time

In China, there isn’t a clearer sell-sign than when Xi Jinping, the Chinese language president, begins personally attacking an business.

So when Xi complained in March that relentless home-schooling was a “cussed illness” that was placing an excessive amount of strain on Chinese language youngsters and their mother and father, the heads of at the very least two Chinese language tutoring firms began promoting their shares in New York.

In a single beforehand unreported commerce, a shell firm holding shares for executives at GSX Techedu, whose market capitalisation in New York was about $24bn on the time, launched the sale of shares value as a lot as $119m simply three days after Xi spoke.

The sale is amongst a whole bunch of information reviewed by the Monetary Instances that present one of many first appears at how and when executives at China’s largest New York-listed tech firms commerce their shares.

In public, Larry Chen, the chief govt of GSX, who doesn’t look like linked to the shell firm that bought, expressed confidence in his enterprise, promising on the finish of March to purchase $50m of shares together with his personal cash.

However one particular person near GSX mentioned its leaders have been conscious on the time of the commerce that Beijing was contemplating stricter rules on the business.

By July, the Chinese language authorities had banned the complete sector from making earnings, crashing the share costs of all the most important tutoring firms. At present, the block of GSX shares that was put up on the market in March could be value solely $4m. Chen doesn’t seem to have but fulfilled his $50m pledge.

GSX (which has since rebranded as Gaotu Techedu) declined to touch upon the share sale and mentioned any share purchases by Chen could be famous in public filings. None has to date occurred.

Within the run-up to the July earnings ban, executives at one other Chinese language schooling firm additionally cashed of their NY-listed shares.

The husband and spouse crew who co-founded on-line English tutoring platform 51Talk started promoting shares on April 1 and bought blocks of shares roughly each different day by means of to the top of June. Their gross sales represented as a lot as half the traded shares on a couple of days. By the point Beijing introduced its new rules, they’d cashed out $4.3m. 51Talk didn’t reply to repeated requests for remark.

The paperwork reviewed by the FT present dozens of different well-timed gross sales by Chinese language executives. Whereas there isn’t a proof of insider buying and selling, lots of the offers got here forward of regulatory motion or the discharge of disappointing earnings stories.

Some executives seem to have hit the highest of the market. Ten executives and administrators at VIPshop, a web based low cost buying web site, bought about $527m of shares in March, nearly three-quarters of all of the shares they bought over the previous 18 months, simply earlier than the collapse of Archegos Capital Management triggered a sell-off in its shares. Its share worth is at present down 70 per cent from its degree in March. VIPshop declined to remark.

The trades by Chinese language executives have been little observed as a result of they’re held to totally different reporting guidelines by the US Securities and Change Fee, which insists that US executives need to report share gross sales inside two days. In Hong Kong, administrators have three days to report, whereas executives of firms listed in mainland China should give 15 days’ discover earlier than they will promote.

In contrast, executives at overseas firms listed within the US as a substitute are inclined to report their complete shareholding a few times a 12 months, or by no means, relying on the scale of their stakes. Firms together with the web buying large Alibaba have used their US listings to realize exemptions in Hong Kong, arguing that any extra disclosure is “unduly burdensome” on its “company insiders”.

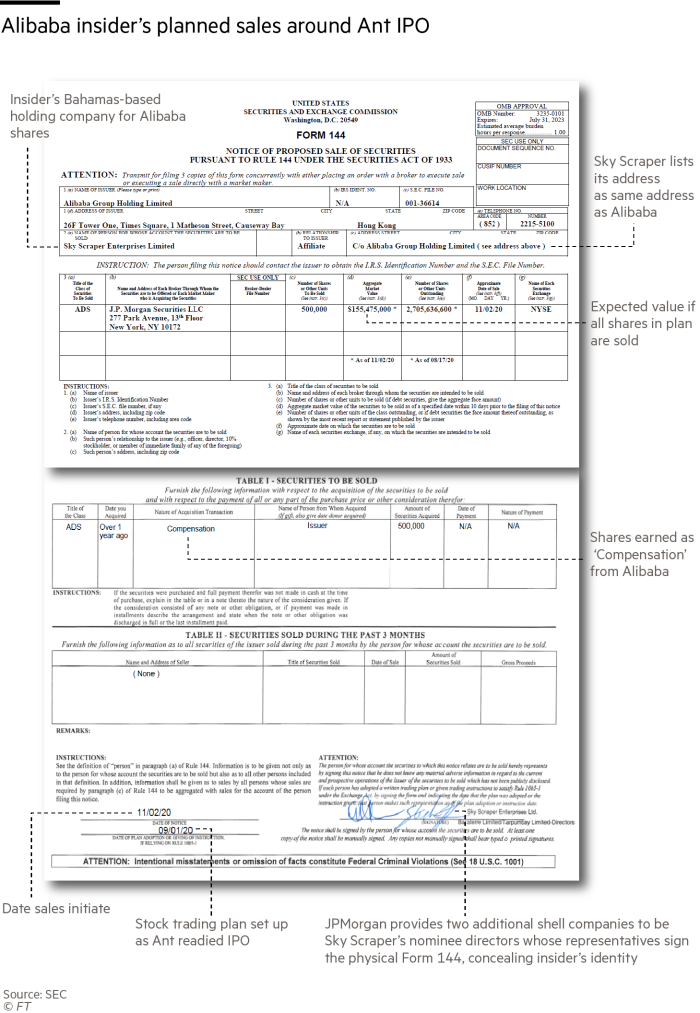

Within the US, beneath Rule 144, overseas executives need to report after they provoke plans to promote restricted inventory both by importing paperwork to EDGAR, the principle disclosure system, or by mail.

Almost all of them have traditionally filed by mail, and the SEC permitted entry to the paperwork in its Washington DC studying room however didn’t add them to EDGAR. Since final April, the SEC has additionally accepted e mail notifications, however doesn’t add these to EDGAR both. A personal firm digitised the filings to promote to institutional traders and banks.

“This technique exists not as a result of there are some folks that say, yeah, we don’t suppose foreigners have to report their insider trades — it exists as a result of folks haven’t recognised the asymmetry in disclosure guidelines,” mentioned Daniel Taylor, a company finance knowledgeable on the Wharton College.

“Once I inform folks that the trades are reported, however mailed-filed with the SEC, few folks imagine me till I present them the precise mail filings,” he added.

The SEC is contemplating altering its guidelines to mandate all Type 144s be filed to EDGAR.

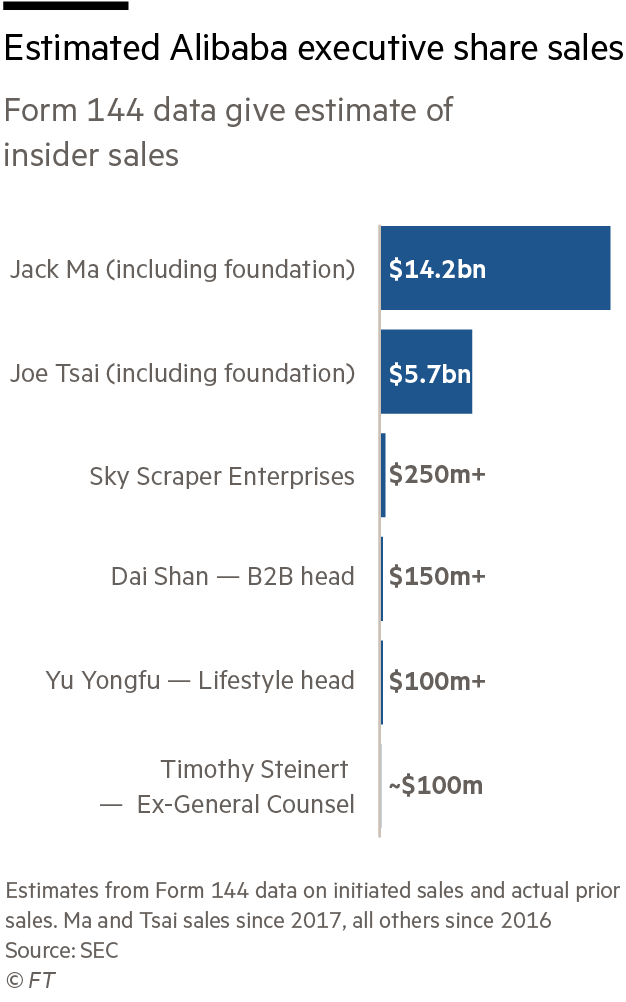

Some Chinese language tech executives additionally use shell firms which conceal their identities. One prime Alibaba govt has used a Bahamas shell firm known as Sky Scraper Enterprises Ltd to provoke plans to promote shares value a whole bunch of tens of millions of {dollars}.

One plan was launched to promote as a lot as $155m of shares within the weeks across the deliberate blockbuster IPO of Alibaba’s sister firm Ant Group. The plan stumbled after Beijing intervened to dam the IPO.

Whereas the id of the chief couldn’t be confirmed, there have been some clues: she or he gained bigger and bigger share packages over the previous decade and is among the many firm’s best-compensated leaders. The FT recognized totally different shell firms utilized by nearly all of Alibaba’s prime brass, aside from chief govt Daniel Zhang and Eric Jing, the chair of Ant.

Alibaba mentioned it had “a strict coverage and rigorous procedures in place to make sure that all our staff, particularly our administrators and officers, absolutely adjust to all relevant securities legal guidelines”. The spokesperson added that every one govt officers should promote shares in accordance with passive plans with 30 or 60-day cooling off durations earlier than trades mechanically execute. Ant declined to remark.

Deliberate buying and selling schemes are ostensibly supposed to stop any illegal insider buying and selling, however Taylor has done research that exhibits their potential for misuse. A number of Chinese language executives made well-timed trades beneath plans adopted on the finish of the businesses’ monetary quarters, elevating issues that they might have made them whereas being conscious of forthcoming quarterly earnings.

In 2016 and 2017, the chief executives of New York-listed Cheetah Cellular and Tarena Worldwide initiated the sale of shares value as a lot as $31m and $10m a couple of weeks earlier than reporting quarterly outcomes that despatched their share costs down 30 per cent and 24 per cent, respectively. Each males had adopted the buying and selling plans on the finish of the quarter.

“This can be a large pink flag. The truth that these plans have been adopted at quarter-end and initiated trades previous to the earnings announcement is extremely regarding,” mentioned Taylor.

Cheetah Cellular didn’t reply to repeated requests for remark. Tarena declined to remark.

Extra reporting by Hudson Lockett in Hong Kong