IMF warns of need to be ‘very, very vigilant’ over rising inflation risks

The worldwide economic system is getting into a part of inflationary threat, the IMF warned on Tuesday, because it referred to as on central banks to be “very, very vigilant” and take early motion to tighten financial coverage ought to worth pressures show persistent.

The fund was highlighting the brand new dangers in its twice-yearly World Financial Outlook, which additionally warned of slipping momentum in international development after a robust restoration up to now this yr.

Gita Gopinath, the IMF’s chief economist, stated the power of the financial restoration meant it was too early to “say something about stagflation”, regardless of some provide shortages which have additionally boosted inflation.

“We at all times knew popping out of this deep contraction that the supply-demand mismatch would pose issues,” she advised the Monetary Instances.

“The hope was that it might even itself out by round this time of the yr . . . However we’ve been hit with extra shocks, together with some weather-related shocks, that actually makes that imbalance persist longer,” Gopinath stated.

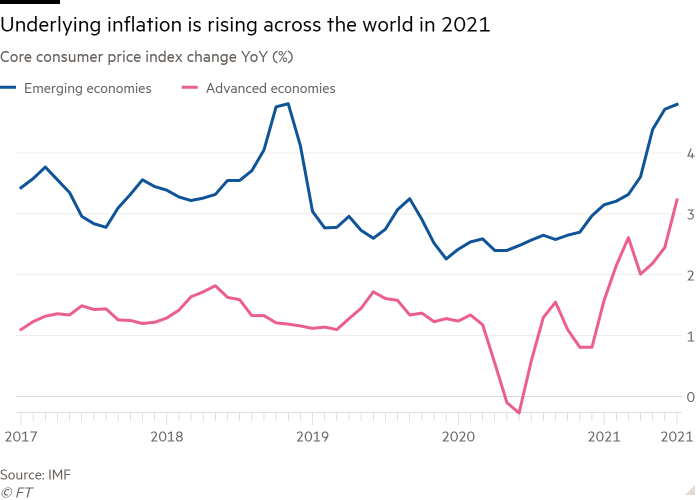

The IMF’s central forecast is that inflation will rise sharply in the direction of the tip of the yr, reasonable in mid-2022 after which fall again to pre-pandemic ranges. However its report additionally famous that “inflation dangers are skewed to the upside” and suggested central banks to behave if worth pressures confirmed indicators of lasting.

The fund stated central banks ought to typically ignore larger costs that stemmed from vitality worth shocks or short-term difficulties in bringing merchandise to market. Nevertheless it ought to act if there are indicators that corporations, households or staff begin to count on excessive inflation to linger.

“What [central banks] should be careful for is the second-round results [with] these will increase in vitality costs feeding into wages after which feeding into core costs. That’s the place you need to be very, very vigilant,” Gopinath stated.

The report was clear that “central banks . . . must be ready to behave rapidly if the restoration strengthens sooner than anticipated or dangers of rising inflation expectations turn into tangible”.

That meant getting forward of the curve on costs even when employment remains to be weak, the IMF really helpful, as that’s preferable to permitting inflationary mindsets to turn into ingrained.

“A spiral of doubt may maintain again personal funding and result in exactly the slower employment restoration central banks search to keep away from when holding off on coverage tightening,” the IMF warned.

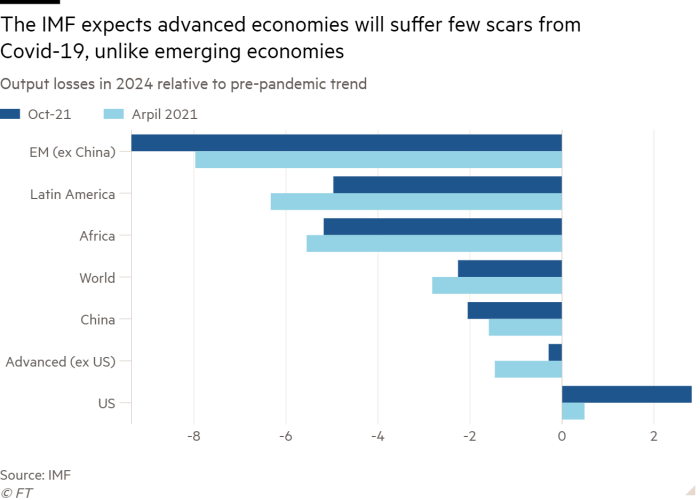

If central banks efficiently navigate the inflation dangers forward, the fund expects superior economies to get better absolutely from the pandemic, returning to the trail that they had been on earlier than coronavirus struck.

Defending the integrity of IMF forecasts following the manipulation of the World Financial institution’s Doing Enterprise rankings when Kristalina Georgieva, now the top of the fund, was its chief government, Gopinath stated the World Financial institution’s difficulties “don’t have anything to do with the IMF”.

“Now we have an extremely sturdy and thorough evaluate means of our knowledge and our forecasts, the place we’ve got a number of economists in a number of departments who evaluate it and supply detailed feedback.”

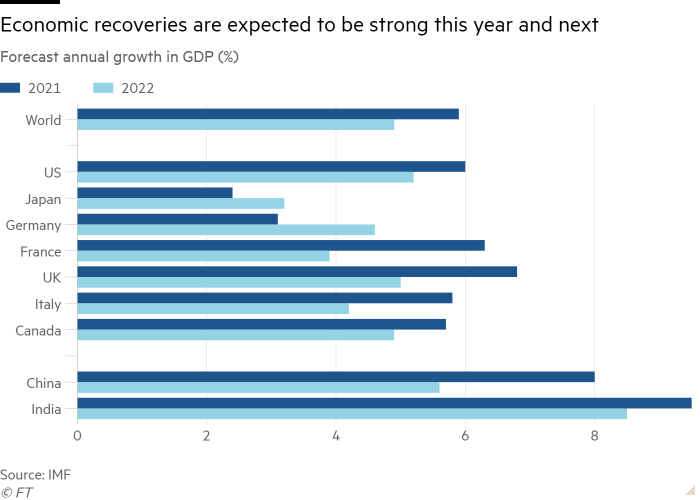

The funds’ forecasts had been little modified from these in April. The IMF expects the worldwide economic system to develop 5.9 per cent in 2021, reducing to 4.9 per cent subsequent yr.

Inflation in superior economies is anticipated to common 2.8 per cent this yr, after which fall to 2.3 per cent in 2022. Nevertheless, these inflation forecasts had been revised up by 1.2 proportion factors and 0.6 proportion factors respectively from April, indicating the dimensions of the brand new inflation risk.

The IMF additionally famous that even when the pandemic is over, rising economies and low-income international locations can be hit a lot more durable in the long run.

Not together with China’s, they’re doubtless in 2024 to be virtually 10 per cent smaller than anticipated earlier than the pandemic struck.