JPMorgan plots ‘incredible’ $12 billion tech spending to beat fintechs

JPMorgan Chase, the largest lender on Wall Street, said it plans to significantly increase spending on technology and talent to strengthen its competitive position, leaving investors worried about its earnings. US banks by 2022.

As it reported record With last year’s profit, JPMorgan stunned analysts by forecasting that expenses will rise 8% this year to about $77 billion, meaning it will likely miss its key profitability target in 2022 and maybe in 2023.

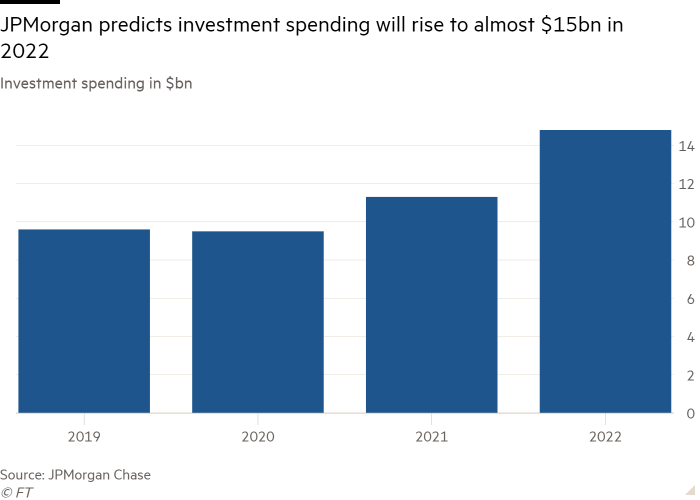

Part of the inflated costs are due to higher wages, with $2.5 billion earmarked for compensation and travel expenses. But JPMorgan also said it plans to increase new investments this year by $3.5 billion, or 30%, to nearly $15 billion. It said spending on technology in 2022 will reach $12 billion by 2022.

James Shanahan, an analyst with Edward Jones, said: “Global technology costs about 12 billion dollars, which is a staggering number. “That could blow away the cumulative dollar value of all the fintechs in the world trying to disrupt them.”

Shares of JPMorgan, which have nearly doubled from the depths of the pandemic, fell more than 6% on Friday. It also depressed shares of other major banks scheduled to report earnings next week, with Morgan Stanley falling 3.6%, Goldman Sachs 2.5% and Bank of America 1.7%.

Jamie Dimon, 65, who has gained a reputation for controlling costs as JPMorgan’s chief executive since 2005, told analysts the bank would need to “spend a few dollars” to beat competitors.

However, the spending plans have prompted Mike Mayo, a banking analyst at Wells Fargo who has recommended JPMorgan to clients for the past seven years, to downgrade the bank’s stock, without any indexes. Which performance is related to increased spending.

“Even Jamie Dimon, one of the best bankers of his generation, didn’t get a free card to increase his investment spending by a factor and a half in three years without giving more details on the benefits. expect,” Mayo said.

JPMorgan is ramping up spending as increased trading activity generating record investment banking revenue is starting to run out of steam. Investors had hoped that rising interest rates – and higher lending rates – would help offset, but most of this gain will now be channeled to funding new investments instead.

The large outlay reflects pressure on banks to compete with fintech companies such as payment processor Stripe, installment lender Affirm and challenger bank Chime.

Jeremy Barnum, JPMorgan’s chief financial officer, said the bank was in an “accelerating moment” in investment spending. “Part of the reason for that is due to the level of competition in the market,” Barnum said on a call with reporters, “especially from novelists new to fiction.”

JPMorgan is spending new capital on data centers and cloud computing, as well as expanding into new markets like the UK, and spending on marketing.

Executives say investing in technology today will eventually lead to lower operating costs. But it can take years to realize those savings, and the lack of specifics is a source of frustration for investors.

“You, as a shareholder, as an outsider, will never be able to tell the difference between investment spending and plain old spending until three years later. So you just have to have faith,” said Chris Kotowski, banking analyst at Oppenheimer & Co., said.

Following a fourth-quarter profit at Citigroup, which has spent heavily to bolster its technology under regulatory pressure following the bank’s mishaps, chief financial officer Mark Mason has called tech a “growth curve.” very important” in the bank’s cost base, without giving a specific forecast.

Shares of the bank closed down 1.25% on Friday.

Meanwhile, shares of Wells Fargo rose 2% after the bank reported a 12% increase in revenue in the fourth quarter as it sought to recover from the fake account scandal. The bank said its costs will likely be lower than in 2021 even as it plans to invest an additional $1.2 billion in technology and compensation.