Leonardo defense stocks rise to industry top, Bloom considers loser #1

Lubo Ivanko/iStock via Getty Images

SPDR industry selection industry (XLI) ended a two-week losing streak and ended the week ending December 23 in the green (+0.30%). XLI is among six, out of 11 S&P 500 week rounding sectors saw gains.

However, the SPDR S&P 500 Trust ETF (spy) reduction (-0.09%) third time week continuously when investor sentiment is still down. Money manager Sarat Sethi notes that a weak 2022 is likely to close with tax rounds sell and window decoration. Meanwhile, there have been some positive signs for the economy as Q3 GDP evolution was revised up to 3.2%, in part due to stronger consumer spending. YTD, SPY is -19.38% while XLI is -7.01%.

The top five gainers in the industrial sector (stocks with market capitalizations over $2 billion) all rose more than +6% every week. YTD, three of these five stocks are in the green.

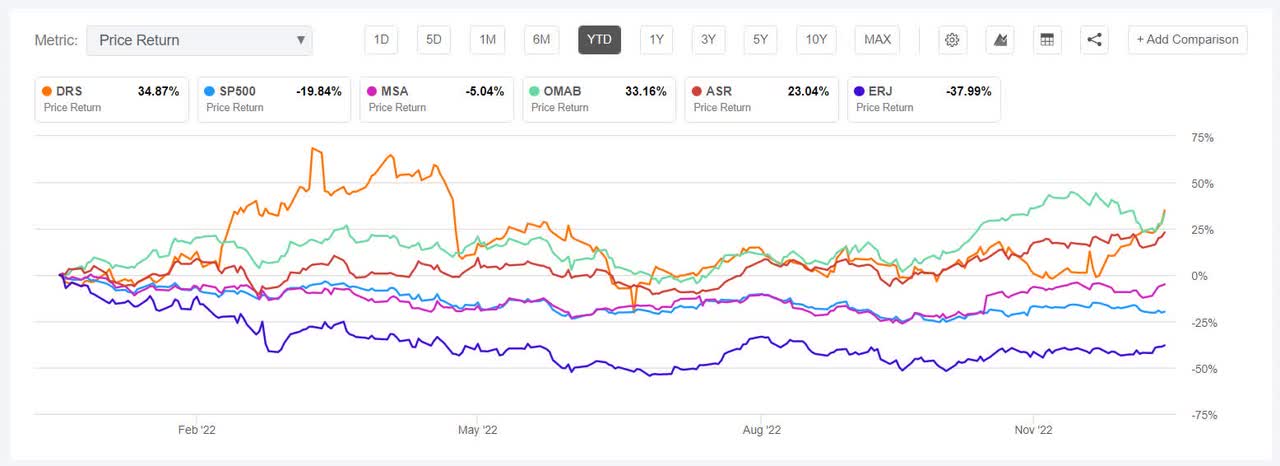

Leonardo DRS (NASDAQ:DRS) +8.95%. Defense products manufacturer based in Arlington, Va. was on the upswing and entered the gainers list for the third week in a row, this time at the top. YTD, the stock has risen +39.60%, the most among the top 5 gainers this week. The Only Wall Street Analyst Rating for DRS is Strong Buy.

Safety MSA (MSA) +8.27%. The safety product developer saw its stock rise throughout the week. The Pennsylvania-based company has an SA Quantitative Rating – which takes into account factors such as Momentum, Profitability, and Valuation among others – of Organization. The stock has a factor grade of B- for Profitability and D- for Growth. Wall Street analysts’ average ratings differ from Buying rating, of which 2 consider it a Hold and 1 rate it a Strong Buy. YTD, the stock has fallen -6.82%.

The chart below shows YTD return price Movements of the top 5 gainers and SP500:

Mexican airport service provider Grupo Aeroportuario del Centro Norte (OMAB) +8.05% and Grupo Aeroportuario del Sureste (ASR) +7.29% ranked third and fourth respectively on the leaderboard.

YTD, OMAB has skyrocketed +32.32% and has an SA Quantitative Rating of Strong buy, with a B for Valuation and a B+ for Momentum. Wall Street analysts’ average rating for the stock is Buyingwhere 3 out of 8 analysts consider the stock a Strong Buy.

Meanwhile, ASR has increased +24.53% YTD and also has an SA Quantitative Rating of Strong buy, with an A for Profitability and A- for Momentum. The average rating of Wall Street analysts is similar to that of OMAB and is one Buying for ASR, where 4 out of 10 analysts rate the stock as Strong Buy.

Embraer (ERJ) +6,90%. Brazilian plane maker may have risen this week but YTD has fallen -38.03%, the most among the top 5 gainers this week. The stock’s SA Quant Rating is Organizationas opposed to Wall Street Analysts’ Average Rating of Buying.

The top five losers this week among industrial stocks (market capitalization over $2 billion) all lost more than -7% every. YTD, all 5 stocks are in the red, of which 2 stocks fell ~50% during this period.

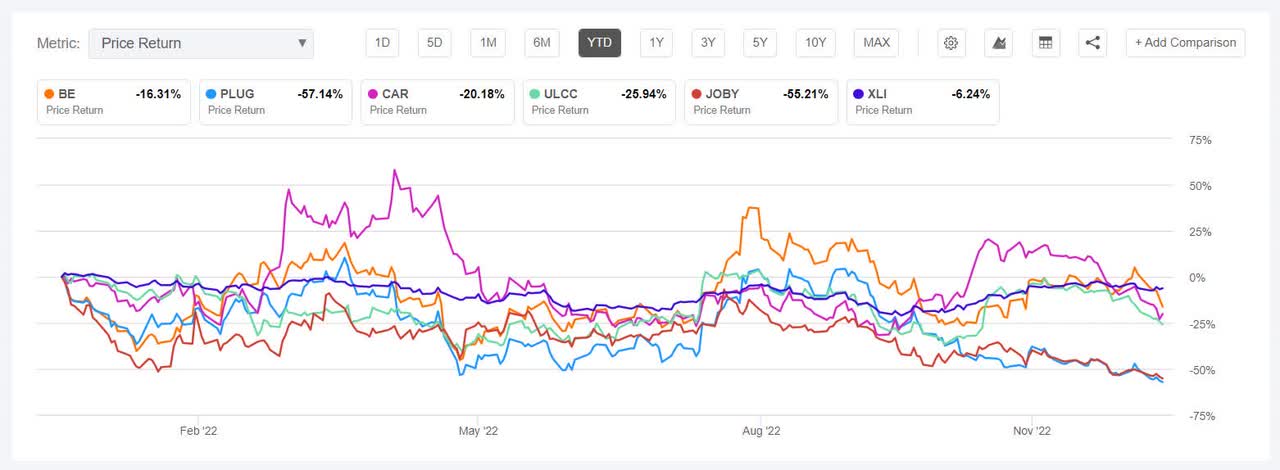

Flowering energy (NYSE:IT IS IN) -15.93%. The company is headquartered in San Jose, Calif. swapped positions from the bulls list last week to the top of the bearish chart as the stock fell throughout the week. The power generation platform provider has seen its stock drop -15.50% YTD. BE has an SA Quantitative Rating of Organization, with a factor score of A for Growth but D+ for Valuation. Wall Street analysts’ average ratings differ from Buying ratings, where 10 out of 23 analysts rate the stock as Strong Buy.

Plug in the power (PLUG) -11.98%. The Latham, New York-based company has been toggling between rising and falling stocks for the past three weeks. The stock is one of the top five riser last week but one of the worst year Performers two weeks ago. Stocks fell the most on Monday (-7.92%) this week.

YTD stocks have fallen -56.29%, the most of this week’s worst five. SA Quant rating on PLUG is Sell, with an F for Profitability and a D- for Momentum. The average rating of Wall Street analysts differs radically from one Buying ratings, where 16 out of 31 analysts consider the stock a Strong Buy.

The chart below shows YTD return price movements of the 5 worst losers and XLI:

Avis Budget (CAR) -8.83%. The Parsippany, NJ-based car rental company is back in business loser’ list after two weeks and YTD is gone -22.16%. CAR is top perform industrial stocks 2021 +455.95% (in this paragraph). SA Quant rating on CAR is Organization, with a score of A- for Valuation and C for Momentum. Average rating of Wall Street analysts agree with one Organization own ratings, where 3 out of 6 analysts view the stock as such.

Border group (ULCC) -8.25%. Denver-based airline has collapsed -22.99% YTD but has an SA Quantitative Rating of Buying, with a D+ for Profitability and a B- for Growth. Average rating of Wall Street analysts agree with Buying as well, where 7 out of 12 analysts consider the stock a Strong Buy.

Joby Aviation (JOB) -7.46%. The Santa Cruz, California-based electric flying taxi maker is also back among the weeklong discounters like Avis. YTD, the stock fell -54.11%. The SA Quantitative Rating for the stock is Organizationdiffers from Wall Street Analysts’ Average Rating of Buying.