Oil prices climb and stockpiles fall on fears of Russia attack on Ukraine

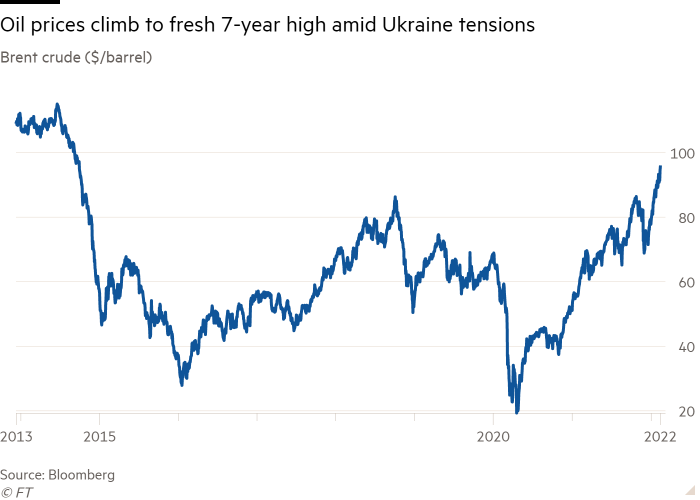

Oil prices rose to a seven-year high and European and Asian stock markets fell on Monday after US officials warned a Russian attack on Ukraine could be imminent.

The Stoxx Europe 600 regional index fell 1.9% in early trade, while Britain’s FTSE 100 fell 1.2%. Russia’s Moex share index fell 2.6% to its lowest level since late January.

The latest volatility in global equity markets, which has fallen this year as central banks tighten monetary policy, comes as German chancellor Olaf Scholz prepares to travel to Moscow to urge Vladimir Putin to launch an invasion of Ukraine.

According to the White House, US President Joe Biden on Sunday spoke with his Ukrainian counterpart and said Washington would respond “quickly and strongly” to any military action by Russia.

Scholz’s last attempt came as Western nations withdrew diplomatic and military personnel from Ukraine and several European nations braced for an influx of refugees in the event of military action.

Energy prices rose on Monday as investors focused on the latest developments in Ukraine. Brent crude, the international standard, rose 1.8% to $96.16 a barrel, marking a level highest level since September 2014 and reflects an annual increase of about 23%.

European natural gas contracts for delivery next month jumped 12% higher to €83.41/megawatt hour.

European bonds rallied as traders sought shelter in lower-risk assets.

Germany’s 10-year average yield, which has surged in recent weeks on the prospect of the European Central Bank pulling back on pandemic-era stimulus measures, fell 0.05 percentage points to 0.24%. The UK equivalent gilding yield fell 0.06 percentage points to 1.49 per cent.

“The whole situation remains fairly fluid,” said Marcella Chow, global market strategist at JPMorgan Asset Management in Hong Kong. Chow added that energy markets in particular are still competitive, with Russia responsible for a third European natural gas and 10% of global oil production.

“If there is any disruption or threat of outages, that will naturally push prices higher than the already high levels we have seen so far,” she said.

The drop in global stocks was caused by sell off for Wall Street on Friday, where the S&P 500 fell nearly 2%. In Asian equities, Hong Kong’s benchmark Hang Seng fell 1.4%, while Japan’s Topix and South Korea’s Kospi both closed 1.6% lower.

Unhedged – Markets, Finance and Strong Perspectives

Robert Armstrong analyzes the most important market trends and discusses how Wall Street’s best minds respond to them. Registration here to get newsletters delivered straight to your inbox every day of the week