Samsung investors are looking for guidance on the plan for $100 billion in cash

Samsung’s most powerful executive is on a trip to the US that investors hope is a sign the company is looking to deploy $100 billion in cash.

Third-generation heir Lee Jae-yong is on his first overseas trip since South Korean President Moon Jae-in agreed in August. early release from prison on the grounds that it is in the national interest.

Corporate cash reserves, soaring while Lee behind bars for bribing Moon’s predecessor, which puts the potential capacity for megadeals on par with SoftBank’s original Vision Fund, the technology investment vehicle.

Samsung, which last made a significant acquisition in 2016 with its $8 billion acquisition of US automotive technology group Harman, has stayed out of the transaction boom that has reshaped. tech industry.

According to IC Insights, M&A in semiconductor companies totaled over $200 billion over the past four years, hitting a record $118 billion in 2020 – despite Nvidia’s 54 billion dollars The purchase of British chip designer Arm is now under threat from regulators.

“There have been a lot of mergers and acquisitions in the tech industry in recent years, but Samsung is not on the list,” said Kim Young-woo, an analyst at SK Securities. “This is something top management should deal with but Lee is busy dealing with his legal issues.”

Lee, who faces a separate trial over the alleged financial crimes, has met with executives from vaccine developer Moderna and US telecom operator Verizon and is expected to announced a US location for a new $17 billion semiconductor facility to further secure American business.

Shortly after its launch, Samsung announced a three-year $206 billion investment plan to expand its footprint in semiconductors, biopharmaceuticals, artificial intelligence, and robotics.

The world’s largest maker of memory chips and smartphones said it was optimistic it could reach a “meaningful size” deal within three years, and it was actively looking into development areas. Rapid developments include AI, 5G, and automotive.

Recent Samsung Acquisitions

August 2014

SmartThings

Internet of Things Platform Company

February 2015

LoopPay

Mobile payment solution company

November 2016

Harman

Solutions for connecting cars, infotainment and telecommunications

October 2018

Zhilabs

AI-based network and service analytics company

January 2019

Corephotonics

Camera solution and technology company

January 2020

TeleWorld Solutions

Network Service Provider

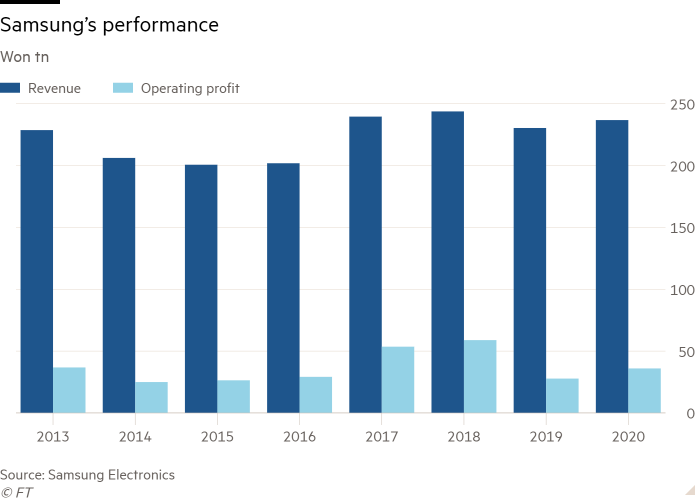

But investors fear the company has lost ground to rivals and lacks a clear growth strategy. Its cash flow reached $102 billion in the third quarter, outstripping US rival Intel at $7.9 billion and Taiwanese chip giant TSMC at $31 billion.

With a net cash flow of more than 100 billion won, shareholders want more money back from Samsung if they don’t use it to expand operations, said an industry official with knowledge of the company.

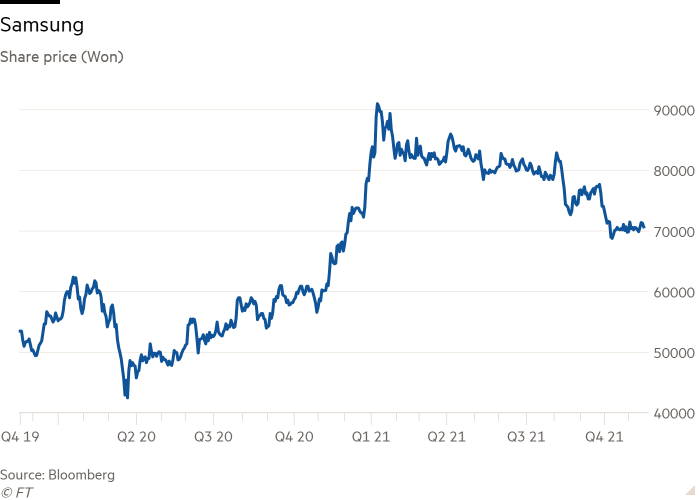

Shares of Samsung have fallen more than 10% this year due to concerns about its memory chips. “They have too much cash and are inefficiently allocating capital,” said James Lim, an analyst at US hedge fund Dalton Investments.

“There are concerns that Samsung may be falling behind in the memory race, while investors do not seem to believe it can become a leader in the non-memory sector,” he added. refers to the chips used to process data.

Samsung declined to comment. But a person familiar with the company’s thinking said the group is confident it has created ample shareholder value.

Samsung’s extremely cautious approach stems in part from Lee’s quest for steady management since he took control of the $357 billion company in 2014.

The company’s bitter experience with deals, as well as concerns about potential antitrust issues, also contributed to the company’s reluctance to take on major acquisitions.

Fund managers say executives were burned by their experience of Samsung’s takeover of AST in 1995, when the company lost local talent in its struggle to integrate the company. American computer into its own corporate culture. More recently, Samsung has struggled to improve Harman’s dwindling margins.

Analysts say Samsung needs to buy back in foundry, a lucrative market to make memory-free chips for other companies, where it lags far behind Taiwanese rival TSMC.

“The acquisition of a non-memory company is very important to Samsung. Paul Choi, head of research at brokerage CLSA in Seoul, said Samsung is the global leader in memory chips, but the non-memory market is much larger.

Investors are also concerned because advances made by Chinese companies in the field of memory chips, which Samsung has dominated for decades.

In the telecommunications and AI sectors, Samsung is likely to identify highly specialized tech companies that can help them develop wireless networks and interoperability of consumer electronics products, according to people familiar with the matter. with the company’s strategy.

But a Silicon Valley venture capital veteran who has advised on the sale of many tech businesses, told the FT that founders don’t want to integrate with companies with conservative reputations like Samsung , further complicating the ability to achieve transactions.

“For many founders, a company’s VC is seen as the bottom of the barrel, even if the company has a really big name in the tech space like Samsung,” he said.

“There’s always the fear that you won’t fit into the mothership and they haven’t really thought much about how they want to use your technology in their bigger picture.”

Weekly newsletter

Your ultimate guide to the billions of people created and lost in the world of Asia Tech. A curated menu of exclusive news, cutting-edge analysis, smart data, and the latest tech news from FT and Nikkei