Tesla fans keep buying, don’t succumb to the $720 billion write-off

Even the worst year for Tesla Shares Inc. hasn’t shaken individual investors’ confidence in the electric vehicle maker and its billionaire executives. Elon Musk.

Data from Vanda Research shows that such retail traders have continued to buy stocks. In fact, they have been strong daily buyers this month, driving their net buying to record highs in both December and the fourth quarter.

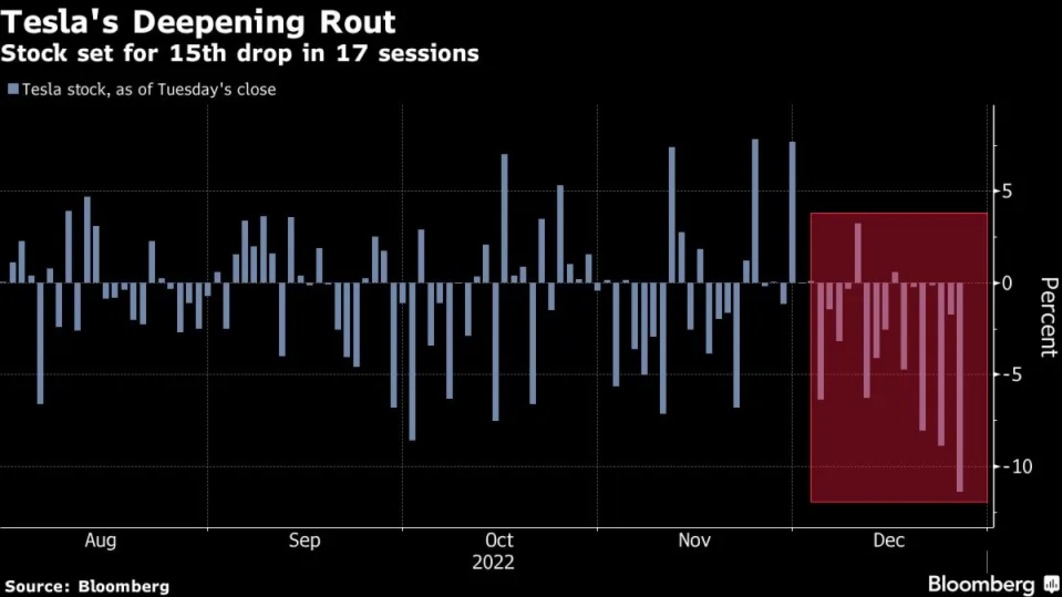

On Wednesday, they seemed poised to receive a small reward for their loyalty: Tesla rallied as much as 6.6% shortly after the market opened. But stocks returned almost all of those gains late in the morning, risking prolonging the seven-day bearish streak that has seen them drop 70% this year and take nearly $720 billion off the price. the company’s stock market capitalization.

The dullness has been fueled by rising interest rates that have disrupted growth stocks, concerns that demand will be eroded in the event of a recession, and concerns that Musk’s acquisition of Twitter will divert growth. his attention and increase sales of his Tesla stock to keep this social media company afloat. . The drop made it the third-worst performer in the S&P 500 Index this year.

Still, for Tesla’s diehard fans among retail investors, the risks to electric vehicle demand or Musk’s preoccupation with Twitter haven’t been enough to make them worry about a stock. The stock has become one of the highest priced stocks on Wall Street during the pandemic.

“Retail investors have bought more Tesla stock in the past six months than they have totaled in the previous 60 months,” said Viraj Patel, senior strategist at Vanda. “For institutional investors, it is a seller’s paradise when you have a buyer who is clearly not reading the fundamental signals.”

On Tuesday, Tesla was hit by an 11% drop due to renewed concerns about production shutdowns at its Shanghai factory and last week’s report that Tesla was offering US consumers huge discounts. $7,500 to receive the car before the end of the year.

That raised concerns about eroding demand ahead of fourth-quarter deliveries expected in early January. Estimates have dropped in recent weeks, and on Wednesday, Baird analyst Ben Kallo was the latest to lower his estimates, citing “potential weakness in demand”.

Growth stocks have generally taken a hit this year, with the Nasdaq 100 falling 33% as the Federal Reserve raised interest rates aggressively to tame inflation. Tesla is the second-biggest drag on the index after Amazon.com Inc., with this year’s decline marking a significant change from the company’s 1,163% gain in the previous two years. Musk’s Tesla stock sales and distraction from his Twitter takeover didn’t help either.

“It feels like the confidence has gone and the Tesla fairy tale has come to an abrupt end,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Investors are more eager to see how the impending recession will affect Tesla’s demand, how competition from other electric vehicle makers will affect Tesla’s market share. When and when will Elon Musk stop causing trouble elsewhere while Tesla is badly shaken.”

Related videos: