Tesla’s deepening stock habit has wiped out half of 2020 meteoric gains

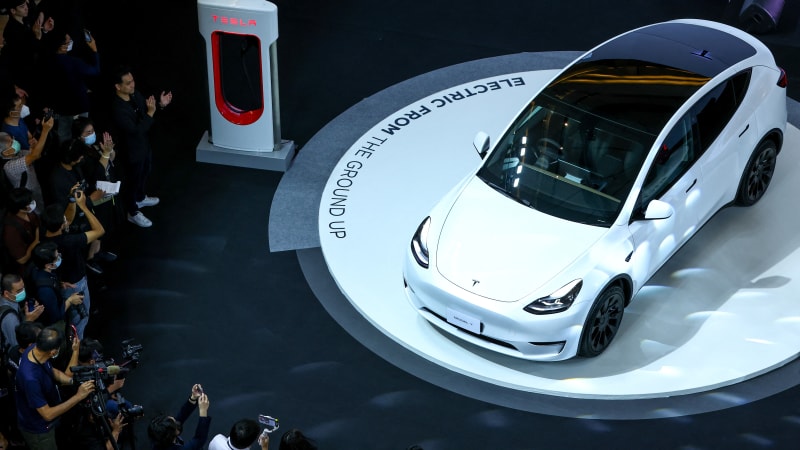

Reporters and guests surrounded Tesla Model Y in the official launch event of Tesla Thailand in Bangkok earlier this month. (Reuters)

Tesla’s decline accelerated on Tuesday as a report on plans to temporarily halt production at its China factory raised concerns about demand risk and sent the stock on a long bearish streak. the most since 2018.

Shares of the Elon Musk-led company fell about 8% to $113.13, marking a seventh straight day of declines. The electric vehicle maker’s market valuation has fallen to about $372 billion, lower than that of Walmart and JPMorgan Chase & Co. The latest sell-off will cause Tesla to lose its place among the top 10 most valuable companies in the S&P 500 Index, a distinction it has held since joining the benchmark in December 2020.

News of the production cut in Shanghai comes shortly after last week’s report that Tesla offered a $7,500 discount to US consumers to pick up the two biggest-volume models before the end of the year, which combined add to the increase. concerns that demand is falling. For Tesla, which is valued on its future growth prospects, these worries reflect a significant risk.

“Most of the weakness in equities this year is due to indicators that global demand is faltering,” said Craig Irwin, an analyst at Roth Capital Partners. Tesla’s estimated revenue growth is “still staggering, but not amazing given its $385 billion market valuation,” he said, referring to value last weekend.

Analysts expect average revenue to grow 54% in 2022 and 37% in 2023, data compiled by Bloomberg shows.

Hopefully Tesla will be the leading EV company in a future dominated by Electric Car drove the stock to a spectacular eightfold in 2020, earning its spot in the S&P 500 and at one point making it the fifth most valuable stock on the measure.

But this year the dismantling took place equally quickly. It has lost about two-thirds of its value amid Musk’s Twitter takeover and related distractions, investor worries about growth assets and, most recently, fears that high inflation and rising interest rates will reduce consumer enthusiasm for electric vehicles.

Wall Street analysts have already begun to warn about electric vehicle demand, with Tesla’s 12-month average price target down 10% this month alone. Meanwhile, median adjusted earnings estimates for 2022 have fallen more than 4% from just three months ago.

Still, analysts’ overall view of Tesla remains bullish, with buy-in or parity ratings the highest since early 2015.

“Despite the stock’s performance, Tesla’s innovation curve appears to be accelerating, in stark contrast to the big tech companies,” Canaccord Genuity analyst George Gianarikas wrote in a note last week. where incremental product updates appear to be the most sluggish.” He added that the “green shoots” of the recovery could emerge in 2023.