The birthplace of America’s oil boom a decade ago shows signs of decline

The Bakken field in North Dakota, the birthplace of the US oil boom a decade ago, is struggling to recover from last year’s market crash even as crude prices have rebounded to levels 80 USD/barrel.

It reflects a broad slowdown in growth from the US oil sector as companies continue to spend low in an effort to redirect cash flow from high prices back to shareholders. But analysts say Bakken faces a bleak future after years of exploratory drilling.

Clark Williams-Derry, an analyst at the Institute of Energy Economics and Financial Analysis, said oil producers in Bakken are now facing the “geological reality” that after a decade of rapid development “Most of the best wells have been drilled.” “It helps explain why the industry in Bakken is flat.”

The decreasing number of high-quality wells left to drill, said Mr. Williams-Derry, that can produce large volumes of oil at relatively low cost – making it difficult for Bakken producers to bring in large quantities of oil. output is back to pre-pandemic levels, Williams-Derry said.

Wells that compare favorably with today’s best drilling sites could start to dry up in as little as two years, and “things start to fall off the cliff” by the middle of the decade, he added.

Soaring oil production has transformed North Dakota over the past decade. As crude oil production surpassed many Opec members, billions of dollars were pumped into local government coffers and an army of oilfield workers from around the country were drawn into the crude oil rush. .

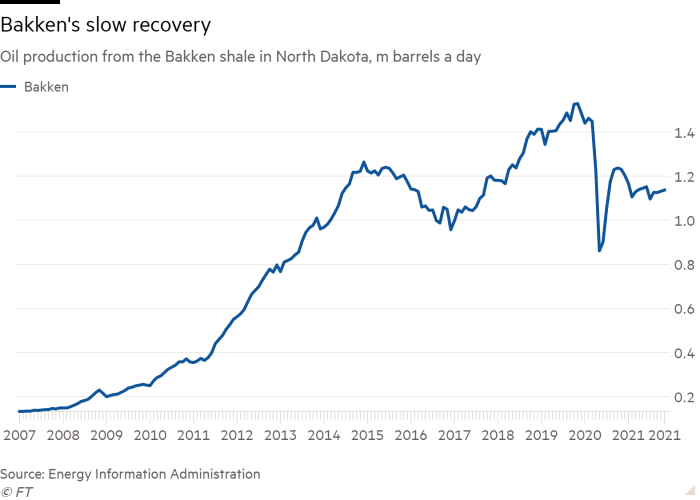

But last year’s oil market downturn hit Bakken particularly severely. About 40% of the field’s production had to be shut down as the pandemic hit and fuel demand evaporated. Oil flows quickly recovered as wells returned to production late last year as demand began to pick up again.

However, the recovery has been slow this year, with production not reaching a rapid pace even as crude oil prices have risen past $80 per barrel, high enough to make most wells profitable.

There were about half of the rigs drilling for oil in 2019, and production hovered around 1.1 million b/d, well below the pre-pandemic peak of 1.5mb/d.

Bakken’s sluggish recovery has weighed on larger US output, which has remained around 2 million bpd below 2019’s 13 million bpd peak even as consumption has rebounded to levels before the crisis. It has helped fuel the global rise in crude oil prices.

“No one sees Bakken as an engine of growth anymore,” said Steve Diederichs, vice president of Enverus, a consulting firm.

In addition to the prospect of dwindling high-quality wells, persistently high levels of flare-ups – when unsold natural gas is burned at well points – has also turned some operators away from pools.

“The easiest way to clean up your emissions record is to divest your dirtiest assets,” says Diederichs, citing an example for Norwegian oil and gas firm Equinor, which sold its business. His bakken earlier this year.

Rising oil prices prompted the Biden administration to call Opec +, a group of oil-producing countries and American companies to increase output to help lower the cost of gasoline. Pump prices are at their highest level since 2014 in the US and near record levels in other parts of the world.

Ron Ness, head of the North Dakota Petroleum Council, an industry group, said he “doubts we’ll see output start to pick up” as early as 2022, in part due to higher prices.

Tony Barrett, vice president of exploration at Continental Resources, Bakken’s largest producer, said the region is still in the “middle stage” of development and sees more scope for growth from area.

But there are warning signs for Bakken’s future as some of the region’s top investors have begun shifting resources to other oil fields.

Continental, owned by oil billionaires Harold Hamm, a senior supporter of former president Donald Trump, spent $3.25 billion this month acquiring lands from Pioneer Natural Resources in the Permian basin, which extends through Texas and New Mexico.

Twice weekly newsletter

Energy is the world’s indispensable business, and Energy Source is its newsletter. Every Tuesday and Thursday, straight to your inbox, The Energy brings you essential news, futurist analysis, and insider intelligence. Sign up here.

Barrett told the Financial Times it was “totally incorrect” for them to do the deal because of a lack of “inventory” in Bakken, adding that the company could expand for another decade without Permian assets.

However, the deal represents a broader shift in industry spending and activity away from aging shale regions like Bakken and towards the Permian, which is seen by investors as a viable growth engine. best for companies.

ConocoPhillips, another major Bakken producer, has spent nearly $20 billion over the past year building up its business in the Permian, including buying Royal Dutch Shell assets there for $9.5 billion. la. Timothy Leach, the company’s vice president, told analysts earlier this month that Bakken was at “optimal”.

“It doesn’t seem like the people who run Bakken have much faith in it,” Williams-Derry said. “The industry is focusing more on other parts of the United States, especially the Permian. Places that do not face imminent oil quality deterioration. “

Are you interested in energy stories? Our journalists want to find out what you like about our coverage and what you want to read more about. Let us know in this short survey. Thank you.