Toshiba faces uphill struggle to win over restive investors

An already romance-free honeymoon between Toshiba and its activist shareholders is liable to a full breakdown.

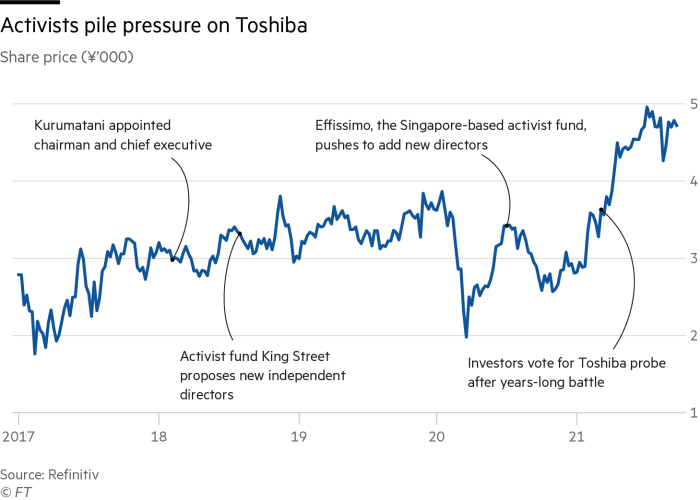

Japan’s oldest conglomerate is below strain from its largest buyers to tug off a radical restructuring or a non-public fairness deal and ship the 50 per cent share worth increase that activists consider will accurately worth the corporate.

Toshiba’s boardroom torment is centred on the necessity for a reputable plan to carry the inventory’s worth to the ¥7000 ($64) mark that at the least 5 of its 10 largest buyers consider it’s value. It’s the newest chapter in a saga that has plunged a Japanese market lengthy identified for its cosy relationships between shareholders and administration into uncharted territory.

Already this 12 months, Toshiba has endured defeat at a unprecedented common assembly after an explosive impartial report — pressured on the corporate by shareholders — alleged collusion between administration and Japan’s authorities to suppress activist buyers.

The revolt, led by Singapore-based fund Effissimo and backed by US-based Fallaron, ejected each Toshiba’s chief government and chair. Within the aftermath, Toshiba agreed to finish a strategic evaluate by the top of October.

Now, after a number of months of board deliberations and talks with the world’s largest non-public fairness companies, together with Bain Capital, KKR and Brookfield, the choices for the 146-year-old firm have narrowed to only three, based on individuals accustomed to the matter.

The primary can be to restructure and promote billions of {dollars} value of non-core property of a gaggle with operations spanning air con and lifts to defence and nuclear energy. The second can be to safe a bid from non-public fairness and delist the entire of the know-how conglomerate for as a lot because the $30bn some buyers consider it’s value.

A 3rd choice below dialogue by the board, the individuals say, can be a hybrid model of these, with a non-public fairness purchaser buying a stake giant sufficient to offer activist shareholders the choice of a swift worthwhile exit.

Buyers mentioned privately that, after their confrontation with Toshiba in June, they granted the brand new board a “honeymoon” interval to look at the corporate’s future, however on the understanding that it will discover all choices.

“I believe the arrogance that Toshiba was operating this course of truthfully was at all times very skinny. There are numerous rumours round that [the board] hasn’t been embracing the PE buyout choice,” mentioned one shareholder who has held Toshiba inventory since 2018. “If the strategic evaluate doesn’t provide you with a deal, there might be disappointment and the honeymoon might be instantly over.”

Having to hear

Toshiba’s vulnerability to investor strain is uncommon in Japan. However after its close to collapse in 2017 following an accounting scandal and the chapter of its US nuclear enterprise, Toshiba wanted nearly $6bn in money to shore up its stability sheet and keep away from delisting from the Tokyo Inventory Change.

With few selections accessible, it opted for an fairness increase that, at a stroke, packed its shareholder register with international activist funds whose mixed stakes of greater than 20 per cent have left them with highly effective leverage.

In latest weeks, the group’s strategic evaluate committee, which UBS is advising, has held talks with Bain, KKR, Brookfield and Japanese fund Integral, based on individuals with information of the discussions. All non-public fairness companies in discussions with Toshiba are certain by non-disclosure guidelines.

In an indication of the extraordinary nature of the method, nonetheless, talks over what may very well be a historic non-public fairness deal are unfolding with none point out of valuation and within the absence of a chief government and board chair who will execute the plan.

Toshiba’s board earlier this month mentioned it was chatting with potential buyers about “the feasibility of a privatisation” however acknowledged it has not settled on which path to take. “These discussions have been constructive,” it added.

Addressing why valuations weren’t being mentioned, the board mentioned “{that a} significant and knowledgeable dialogue on pricing can be most efficient as soon as discussions on enhancing worth have been accomplished to its satisfaction.”

The corporate declined to remark additional to the Monetary Occasions on the strategic evaluate.

Satoshi Tsunakawa, the corporate’s interim CEO, can be serving as a stopgap board chair till Toshiba can convene a unprecedented common assembly to nominate a brand new management crew. However it’s unlikely to be assembled by the point Toshiba releases the evaluate.

“Toshiba has modified to an organization that might want to extra significantly replicate the views of shareholders in its marketing strategy,” mentioned Citigroup analyst Kota Ezawa.

Amongst Toshiba’s shareholders, the extra aggressive funds have mentioned that they’ll reject any proposal if the evaluate comes again with out a delisting deal and a transparent worth.

The board’s worry, based on one other individual near the discussions, is that when a possible valuation is leaked, buyers will demand a better worth, extinguishing the possibility of any deal.

“No person desires to speak about it however the purpose why the discussions will not be transferring ahead can be as a result of there’s a hole between the committee and the non-public fairness on what the correct valuation needs to be,” the individual mentioned.

Carving up an icon

For buyout companies, Toshiba is a tantalising alternative in a market that has turn into fertile searching floor as Japanese firms face rising calls to restructure and sharpen their focus.

A $20bn takeover try by non-public fairness agency CVC collapsed earlier this 12 months, underlining the hurdles in capturing an organization that gives quantum computing, nuclear and defence applied sciences. Japan stays against breaking apart Toshiba, based on an individual near the federal government.

The sprawling group, nonetheless, is wealthy with different much less delicate companies that may be carved out with out triggering a political backlash, analysts say.

Topping the checklist is Toshiba Tec, which develops point-of-sale methods for retailers, whereas Toshiba Service, its air-conditioning three way partnership, is one other goal. The group additionally owns NuFlare, the semiconductor tools maker topic to a 2018 hostile takeover try by optical glass specialist Hoya.

“Buyers might be able to extract worth out of the corporate with out taking on the entire thing,” mentioned Macquarie analyst Damian Thong. “What might be left of Toshiba is probably not that fascinating, however will nonetheless have essential companies in infrastructure and industrial tools.”

Regardless of its latest miseries, Toshiba stays for a lot of Japanese the corporate most carefully related to the nation’s modernisation. It had a central function in electrifying each houses and public areas, and of making the white items which can be hallmarks of Japan’s large center class and financial growth.

In an extra signal of turmoil, the talk over Toshiba’s future and its applicable valuation has been difficult by the uncertainty surrounding Kioxia, the chipmaker by which it retains a 40 per cent stake after promoting the remaining to a Bain-led consortium in 2018.

Whereas Kioxia had been anticipated to checklist its shares in Tokyo this 12 months, it’s now in merger talks with its longtime US associate Western Digital, based on individuals accustomed to the matter. A possible deal would see Western Digital purchase Kioxia for about $20bn, with their new headquarters to be based mostly within the US, the individuals say. Western Digital declined to remark.

A mixture of the 2 would additional the ambitions of each the US and Japan to forge a semiconductor champion that reduces their reliance on Chinese language provide chains for chips, say analysts.

However a deal faces hurdles, with officers in Tokyo exhibiting preliminary resistance to a merged entity being based mostly within the US, based on an individual accustomed to the matter. A regulatory evaluate of any deal may take 18 months or longer, and danger being thwarted by Beijing.

Kioxia mentioned it was nonetheless contemplating itemizing its shares in Tokyo, whereas an individual accustomed to Bain’s considering mentioned that, for now at the least, “each these choices, or neither” have been below dialogue.

After a 12 months of tumult, buyers say Toshiba’s board might want to ship way over a box-ticking train when it presents the strategic evaluate.

“If we are able to really consider that there have been no non-public fairness bids accessible, then we’ll proceed to have interaction with the board,” mentioned one Toshiba shareholder. “We’re giving them the advantage of the doubt now, however there’s little or no credibility on what Toshiba administration say at this level.”