US borrowers breach loan limit guidelines at record rate

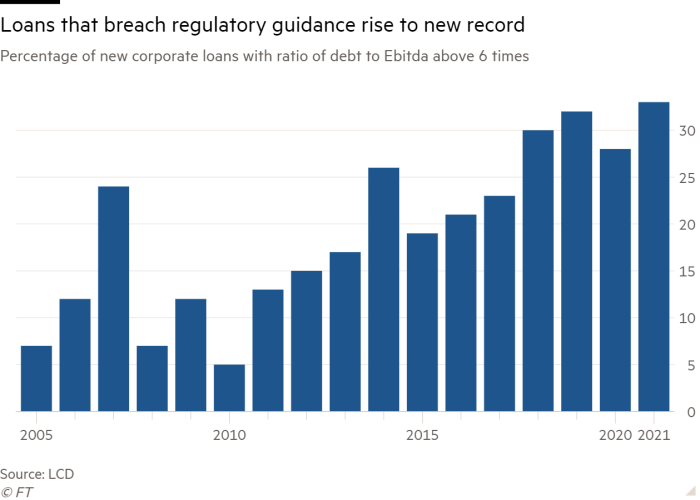

A record one-third of US loans sold to investors this year have come from companies borrowing more than recommended by financial watchdogs, raising concerns about day-to-day dependence. An increase in corporate credit could exacerbate the economic downturn.

By the end of November, 33% of the US 954 leveraged loans issued in 2021 to date have debt-to-earnings ratios in excess of six times, according to LCD data from 2005. These loans breached a threshold set by the Federal Reserve, Office of Corporations Federal Deposit Insurance. in 2013 has been adopted by the banking industry as an easing limit on leveraged lending.

The six times threshold is not a hard limit, and the guideline – unlike a more formal rule – is not enforceable. However, the guidance says that “generally,” debt in excess of six times earnings before interest, taxes, depreciation and amortization “causes concern for most industries.”

“There is a huge amount of leverage in the system,” said Dennis Kelleher, president of advocacy group Better Markets. “It created a positive ticking time bomb.”

It is feared that if U.S. economic growth weakens, or borrowing rates are higher, large amounts of debt could become unmanageable, accelerating the decline of heavily indebted companies and likely to happen economy. The data is also based on metrics that allow “add-ons” to increase Ebitda and reduce leverage to be calculated, meaning that the amount of leverage in some trades can be markedly higher.

Kelleher says historic Fed intervention last year to ease financial conditions after Disease has spurred a wave of corporate borrowing, facilitated by a flood of cash into the financial system that has brought standards in the lending market down.

The bankers acknowledged that some deals had gone wild, but said that the driver of the increase in leverage was not the result of poor underwriting but rather the changing nature of the firms. borrowers in this market. For example, high-growth technology companies may have negative cash flow as they expand, but high revenues and business value to support the debts they are carrying.

The computer and electronics sector with leveraged loans is currently the largest with more than 20% of the market, up from just over 13% when guidance was released in 2013. Services and rentals, are also considered to have high recurring revenue. , has also grown significantly.

Bankers pointed to where the guidance states that companies’ ability to repay 50% of total debt in seven years “provides evidence of an ability to repay in full,” even if they are leveraged above six times.

Overall leverage has increased this year to an average of 5.2 times debt on Ebitda, back to pre-pandemic peaks.

Along with rising valuations, private equity firms are also placing larger checks to buy companies, with money that will be at the mercy of investors in the event of bankruptcy. Bankers and investors also point out that low interest payments over the past decade have reduced costs for firms to support higher debt burdens.

Analysts at S&P Global say the current threat to debt markets is benign, with accommodative economic growth and monetary policy supporting companies at risk. The default value is said to remain low for now.

However, Ramki Muthukrishnan, head of leveraged finance at S&P, said there is reason to be concerned over the longer term.

“Clearly the fact that these companies have high leverage means that business conditions need to be extremely favorable for them to be able to pay off debt or refinance in the future,” he said.

Unhedged – Markets, Finance and Strong Perspectives

Robert Armstrong analyzes the most important market trends and discusses how Wall Street’s best minds respond to them. Registration here to receive newsletters delivered straight to your inbox every day of the week