5 steps to take when your personal information is compromised

Nowadays, most of us know a thing or two about Avoid scams. We scoff at emails from foreign princes requesting Western Union money transfers – if the messages even get past our spam filters, of course – and even our phones can detect if an incoming call from an unknown number is likely to be spam, telemarketing or a scam call.

However, schemes and scams have also become more sophisticated — and they is increasing. A few years ago, it took me a few minutes to realize the Chinese-speaking caller on the other end of the line wasn’t actually calling from FedEx with a package from my mother in Taiwan. And when I Google “pay car registration online,” the first few links don’t lead to my county tax office website; They all went to third party agents hoping to “help” me pay my dues for a generous fee.

If you’ve recently fallen victim to a scam, don’t be embarrassed: You’re not alone.

“Identity theft isn’t one of those things that ‘happens to other people,’” Michael Bruemmer, Experian’s VP of consumer protection, told TPG.

the Federal Trade Commission received more than 2.6 million fraud reports in 2023 alone. According to the FTC, impersonation scams top the list of fraud reports, accounting for more than $2.7 billion stolen from consumers .

One scheme in particular aimed at tourists is Global entry Admissions scam. The Better Business Bureau reported The agency’s ScamTracker website has received multiple accounts of “misleading websites that trick people into transferring money and sensitive personal information.”

Related: There’s a new way to skip waiting for your Global Entry interview

How the Global Entry scam works

You search for the Global Entry application online, according to BBBand official US Customs and Border Protection website appeared — as well as another website built specifically to mimic the official site.

If you follow that impersonated link, you will be taken to a third-party company that offers to complete all the necessary paperwork on your behalf – just provide your personal information, e.g. such as full name, passport number and home address. You will be prompted to pay the standard government fee of $120, plus additional fees for the service.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

What just happened? According to the BBB, “fraudsters have tricked you into paying extra money to complete a form on an official government website. Additionally, they now have access to your personal information and credit card details.” Friend.”

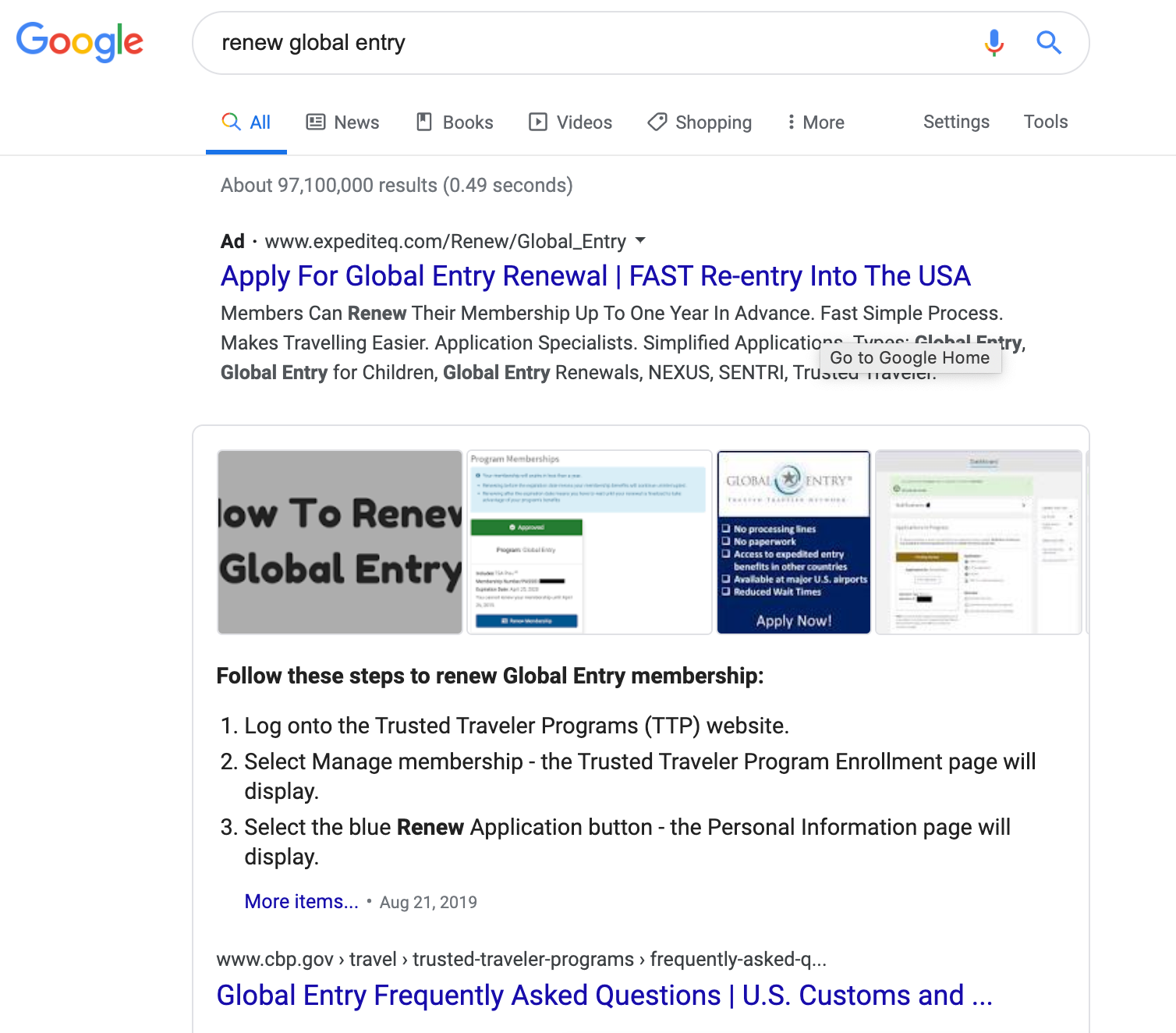

Curious, I tested this Google search myself. Here are my results for “Global entry extension“:

You’ll see the Google search box shows me a preview of the steps I need to take, right from the official CBP website. However, the first link at the top will lead to an advertisement for a third-party site with all the appropriate buzzwords.

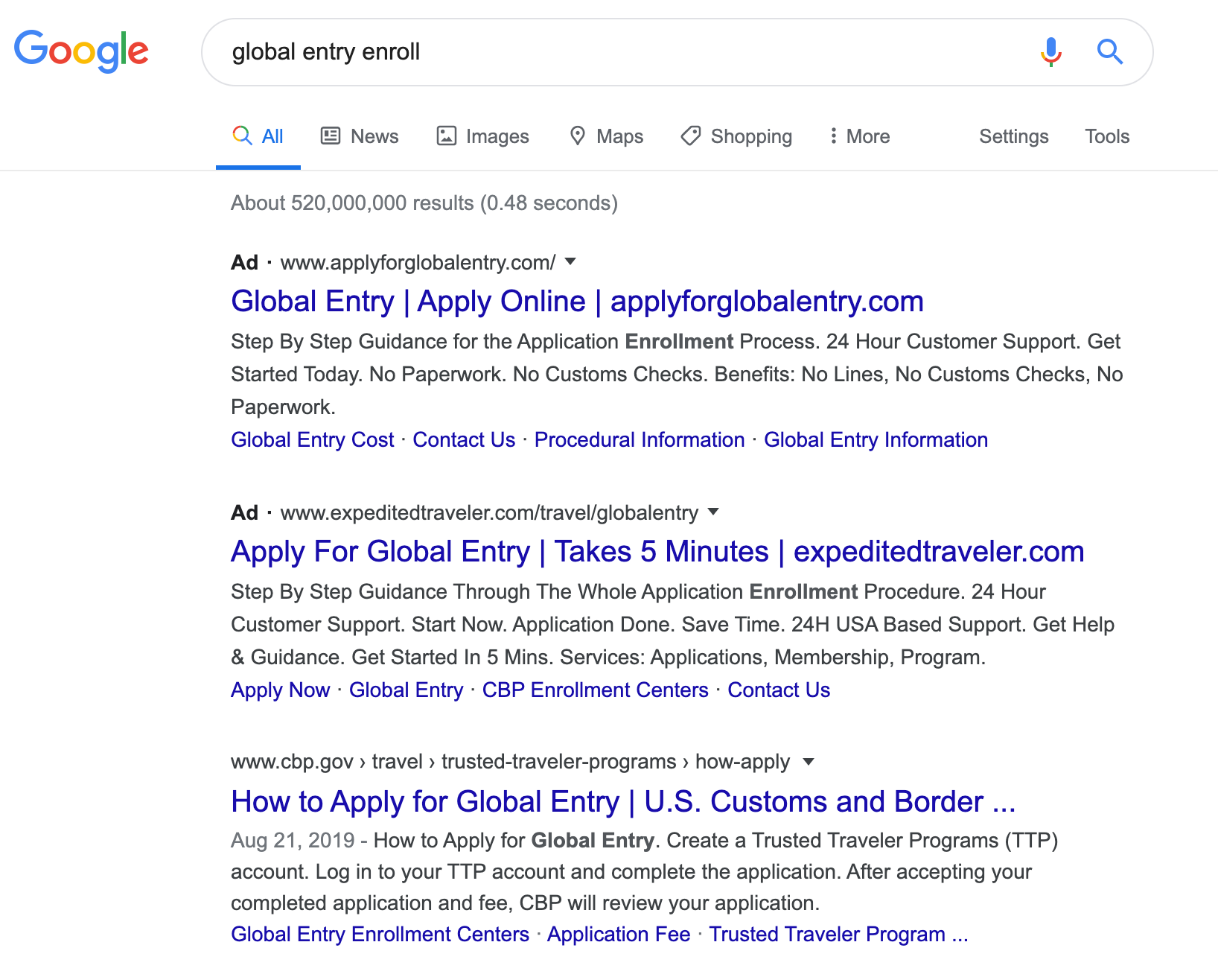

In incognito mode, not counting the hundreds of travel sites I search every day, the official CPB page in the “Global Sign Up” section even appears at the bottom of the page below two ads with The URL sounds very legit:

But none of these companies are approved by CBP.

Boarding group did a little investigating and discovered that the listed address of one of these so-called “promotion agencies” actually went to a shady-looking warehouse in Houstonaccording to Google Maps.

“Only a trusted Traveler Program website“A CBP spokesperson told TPG. “Third-party companies that charge fees to process Trusted Traveler Program applications are not endorsed by, affiliated or associated in any way with U.S. Customs and Border Protection or the U.S. government.”

Related: Simple steps to avoid credit card fraud

What to do if you get scammed

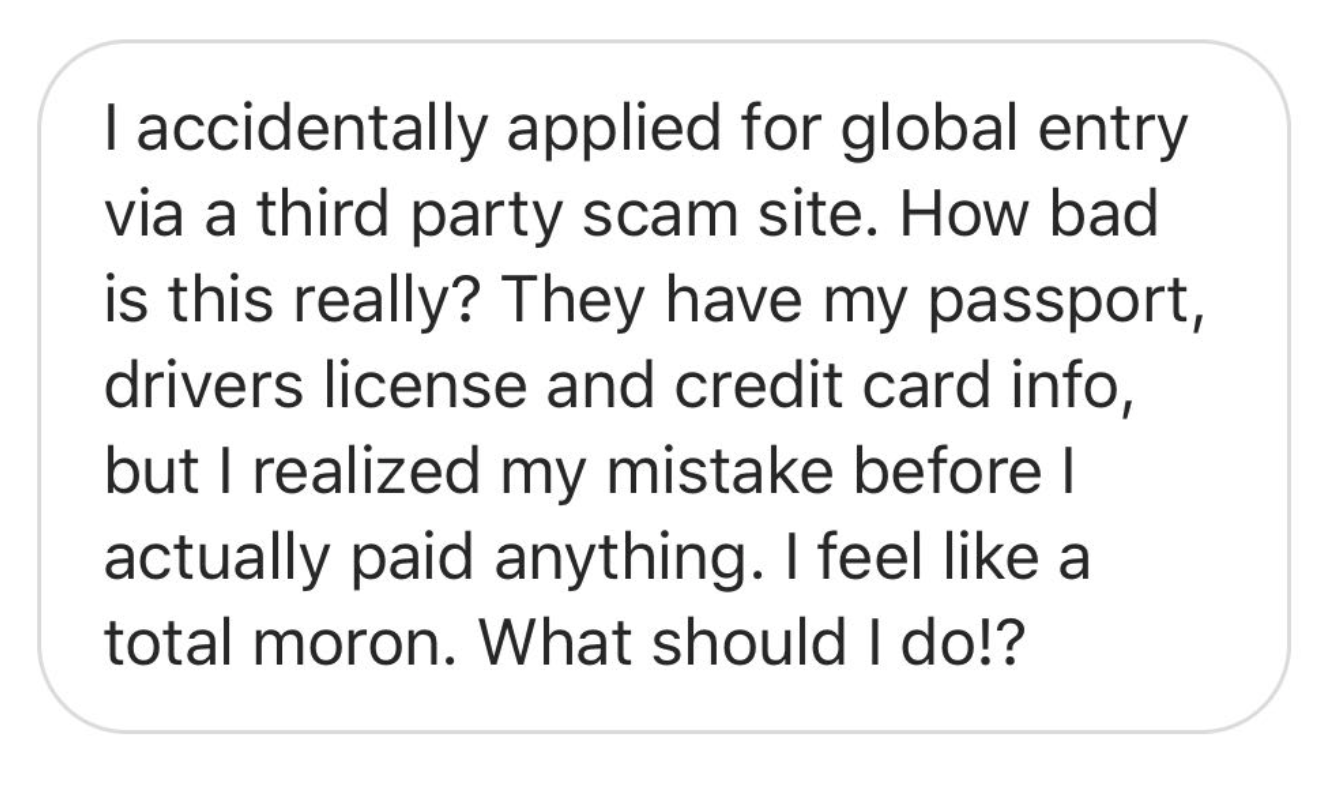

One reader contacted TPG for guidance after falling victim to one such site, wondering what next steps they should take to avoid further compromise of their personal and financial information.

“Seriously, how bad is this?” the reader asks, explaining how they do it registered to join Global through third party websites.

Unfortunately, it’s always bad news when you credit card detailsHome address and personal information such as full name, date of birth, driver’s license number and passport information were all compromised.

“You just opened the door to becoming a victim of identity crime,” said Eva Velasquez, president and CEO of the Identity Theft Resource Center. website.

Even if nothing happens to your data right away, it wouldn’t be fun to find out the hard way that unscrupulous strangers have extensive access to your personal information. . “Passports in the wrong hands can lead to various forms of fraud,” says security awareness expert and Safr.Me CEO Robert Siciliano told TPG.

And just because data breaches are widespread doesn’t mean the risks are mitigated in any way. “Recover from identity theft “Many people think it can only happen once or that the risk will fluctuate,” said Michael Bruemmer, Experian’s vice president of consumer protection. “In contrast, identity theft often carries consequences.” lifelong fruit.”

Good news? A few simple safety steps can reduce the risk of identity theft and help current victims track possible fraud. Victims can control the damage by reporting stolen financial and identity documents, closely monitoring their home’s physical security, and signing up for online data reports.

Security experts recommend taking several steps after your personal information has been compromised.

Report your credit card stolen

Block any further transactions and request a new card with a different number. (If you have a credit card with the “pause” buttonThis is a good time to use that feature.)

Lock your credit file

Secure your credit file with all three major consumer credit bureaus until your card is reissued. (Note that one credit lock not like one credit freezetakes longer to lift than a temporary lock.)

Sign up to receive online notifications

Sign up for text or email alerts so you’re alerted every time your credit card is used for a transaction. Monitor your credit report for suspicious activity and report anything unusual immediately. And if your home address is compromised, a good security system will give you peace of mind, especially if you use a system that syncs with your phone or sends digital alerts.

Monitor your emails

If your email address has been compromised, be alert to various forms of phishing emails and avoid clicking on any suspicious links.

Report the scam

After you take steps to secure and monitor your personal and financial information, report the fraudulent company to regulators. BBB Scam Tracker website and to FTC identity theft website.

Related: What is the difference between credit card fraud and identity theft?

Bottom line

If you feel unsure about managing the process on your own, you can call in the experts for help. Advisors at Identity Theft Resource Center offers free guidance over the phone, Velasquez says, “including who you need to call [and] what you need to say. [They] will help you create an action plan that works best for you.”

Ultimately, the best protection against future fraud is a strong, proactive approach.

“Consumers should be aware of the real risks, especially as they increase, and do what they can to minimize their vulnerability,” Bruemmer told TPG. “Taking steps to protect sensitive, personal information can protect against identity theft, and monitoring one’s financial accounts can reduce or even prevent fraud.”

According to Bruemmer, what is the one thing you don’t want to do? Get overwhelmed and pretend like nothing happened. “Doing nothing just makes it easier for thieves to catch more victims.”