Digital bank Revolut criticizes Meta for its deceptive approach

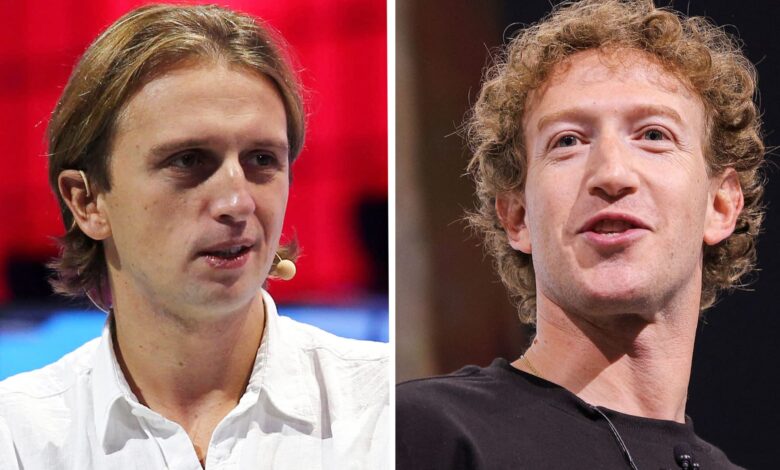

Revolut CEO Nikolay Storonsky (L) and Meta CEO Mark Zuckerberg.

Reuters

British financial technology company Revolut on Thursday criticized Facebook parent company Meta for its approach to tackling fraud, saying the US tech giant should directly compensate those who fall victim. of scams through its social media platforms.

One day later Meta announced cooperation with British banks NatWest and Metro Bank on a data sharing framework designed to help prevent customers falling victim to fraud schemes, Revolut said the pact “woefully falls short of what is needed to tackling fraud globally.”

In a statement, Woody Malouf, Revolut’s head of financial crime, said that Meta’s plans to tackle financial fraud on its platform were just “baby steps, when what the industry actually What is needed is giant leaps.”

“These platforms have no responsibility to reimburse victims and so they have no incentive to do anything about it,” Malouf added. Committing to data sharing, while necessary, is simply not good enough.”

CNBC has reached out to Meta for comment.

New reforms in the payments industry will come into force in the UK on October 7, requiring banks and payments firms to give victims of so-called authorized push payments (APP) fraud Maximum compensation is £85,000 ($111,000).

Britain’s payments regulator had previously proposed a maximum compensation of £415,000 for fraud victims, but rejected it after a backlash from banks and payments firms.

Revolut’s Malouf says that, while his company joins the steps the UK government is taking to combat fraud, Meta and other social media platforms should do their part to compensate financial main for people who become victims of fraud due to scams originating from their website.

Fintech company released a report on Thursday alleges that 62% of user-reported fraud on its online banking platform originated from Meta, down from 64% last year.

Facebook is the most common source of all scams reported by Revolut users, accounting for 39% of scams, while WhatsApp is the second highest source of scams at 18%, the bank said. said in the “Financial Crime and Consumer Security Report.”.“