What your credit card’s travel protection covers – and what it doesn’t

If something goes wrong while you’re traveling, you’ll be glad you booked your trip — and related expenses — with a card that features tourism protection. Thankfully, many credit card rewards suggestion Free protection as long as you pay prepaid, non-refundable travel expenses by card.

For example, Chase Sapphire Preferred® Card is a popular travel rewards card with a reasonable annual fee of $95. Among its wonderful travel benefits is trip cancellation and trip interruption insurance and Trip delay refund.

These protections provide a significant level of coverage that can prevent the need to purchase separate travel insurance. With the Sapphire Preferred, if your trip is delayed by 12 hours or more – or requires you to book overnight accommodations – you’ll be covered for related costs, up to $500 per ticket.

Check the coverage you get travel rewards cardUse the Sapphire Preferred benefits as a key example. Remember that protection levels and coverage vary from card to card, so carefully review the fine print for the specific cards you hold (or plan to apply for) before booking your adventure save next.

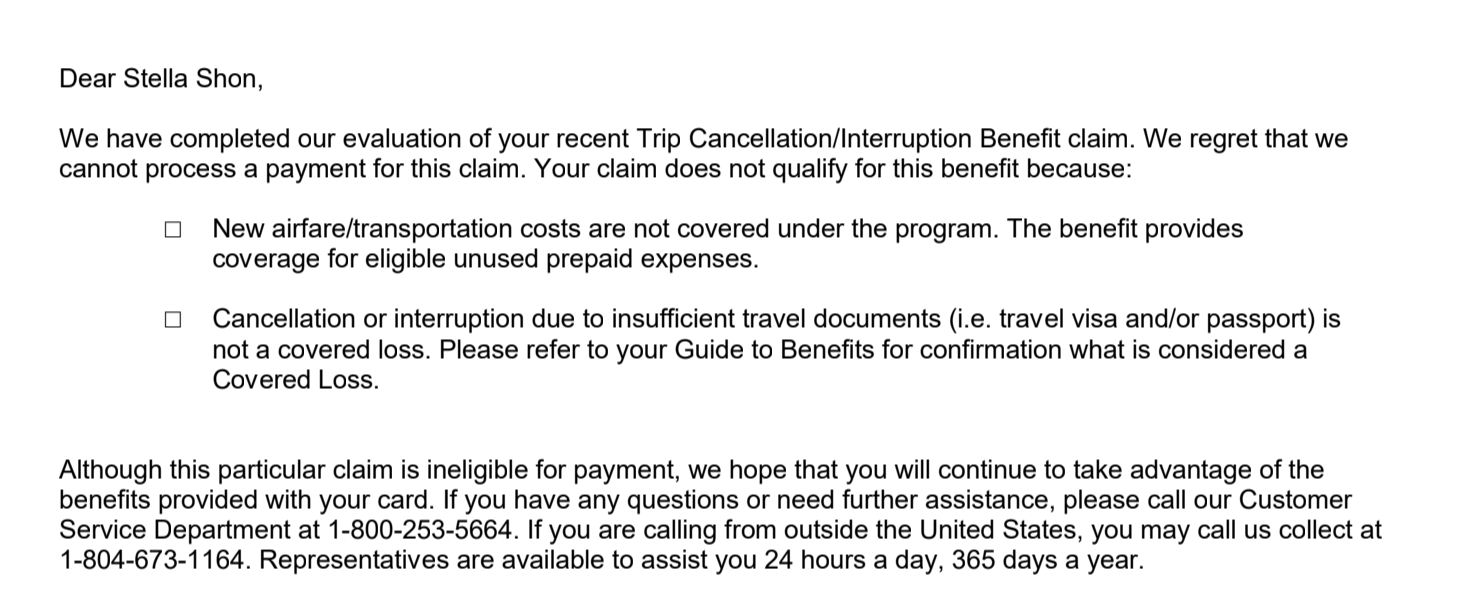

Trip cancellation and trip interruption insurance

First, let’s quickly learn about trip cancellation and trip interruption insurance above Sapphire preferredas outlined by Chase:

“If your trip is canceled or cut short due to illness, inclement weather, and other covered events, you may be reimbursed up to $10,000 per person and $20,000 per trip for travel expenses prepaid, non-refundable, includes passenger fares, tours and hotels.”

If the airline, hotel or tour operator won’t reimburse you for prepaid travel expenses, that’s when you can file a trip cancellation and trip interruption insurance claim for a refund. pay these costs.

Note that you will not be refunded for any new fees tourist accommodation made because of cancellation or interruption.

Related: The best travel insurance policies and providers

Trip delay refund

Same terms for travel delay reimbursement as above Sapphire preferred:

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides and exclusive offers from TPG experts

“If travel on your regular carrier is delayed more than 12 hours or requires an overnight stay, you and your family will be covered for non-reimbursed expenses, such as meals and lodging , up to 500 USD per ticket.”

Like trip cancellation and trip interruption insurance, a trip delay policy only provides reimbursement for specific expenses, stated as “reasonable additional expenses incurred for meals, lodging, Personal hygiene, medication and other personal items due to delays are covered”.

Therefore, you can expect to get refunds for essential items that you had to buy due to the delay. However, this doesn’t mean you can Book a new flight on another carrier and still got a refund.

Remember to keep in mind the $500 limit per ticket.

Related: Flight canceled or delayed? Here’s what to do next

Will travel insurance cover the cost of my new flight?

In short, the answer is no. Whether you file a claim under trip cancellation and trip interruption insurance or trip delay reimbursement, you will not be reimbursed for the new airfare.

That means if you buy a $100 Unified flight gets canceled (or delayed) and you end up having to buy another $300 flight on Delta, the cost of the new flight Delta airline tickets will not be covered for refund.

I learned this the hard way on a solo trip to Europe when my flight from Italy to Greece was cancelled. I rebooked my ticket and thus rerouted myself via an airport two hours away.

After purchasing a new flight, boarding the bus, and waiting patiently at the terminal for the next flight, I tried filing a claim with my Chase Sapphire Preferred.

This may seem annoying, but trip cancellation and trip interruption insurance will still reimburse you for prepaid, non-refundable costs.

Related: How to reach airline customer service quickly

Bottom line

It’s great that many travel credit cards come with benefits like trip cancellation and trip interruption insurance and refunds for trip delays, but it’s important to read the terms and conditions to know exactly what these benefits do and do not include.

While these protections may be enough for most travelers, those who want higher levels of coverage should seriously consider purchasing travel insurance with a higher level of protection or “cancel for any reason“coverage.

Related: New airline rules come into effect – here’s what you should know