The best credit cards for Cyber Monday shopping

Whether you’ve been pregaming for Cyber Monday by compiling a wish list of discounted items (guilty as charged) or are just browsing to see what strikes your fancy, you should consider putting your credit cards to work to help you maximize those purchases.

That includes adding on any extra discounts or rebates you can, earning extra rewards or cash back wherever possible and then paying with the right credit card.

This guide will help you strategize your credit card game to optimize your purchase power this Cyber Monday and score some killer deals.

Best cards for Cyber Monday shopping at major retailers

Where you’re shopping may dictate which credit card you should use. That’s because you could earn bonus rewards based on the type of store you’re shopping at and how it reports to your credit card. For details on that concept, see the following:

If you’re shopping at major retailers such as Target, Walmart, Best Buy or Amazon this Cyber Monday, here are the credit cards you should consider using to maximize your earnings on each dollar you spend.

Discover it Cash Back Credit Card

If rotating quarterly categories sounds like music to your ears, the Discover it® Cash Back Credit Card may just be for you.

Annual fee: $0

Current welcome bonus: None, but Discover will match the cash back you earn during your first cardmember year.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Earning structure: Earn 5% back on rotating categories each quarter, allowing you to earn 5% on up to $1,500 spent at the changing list of merchants (you’ll need to enroll to activate your bonus earnings each quarter). During the fourth quarter of 2024, the bonus categories are Amazon.com and Target.

Why we like it: Being able to earn 5% back on Cyber Monday purchases is fantastic. But this gets even better if you’re a new cardholder this year. Discover will match the cash back you earn at the end of your first year — not bad at all for a no-annual-fee credit card.

The information about the Discover it® Cash Back card has been collected independently by TPG. The card details on this page have not been provided by or reviewed by the issuer.

Learn more: Discover it® Cash Back

Chase Freedom Flex

The Chase Freedom Flex® is a fantastic card for those new to the credit card world.

Annual fee: $0

Current welcome bonus: Earn a $200 bonus after spending $500 on purchases within three months from account opening.

Earning structure: Earn 5% back on rotating quarterly categories (up to $1,500 in combined spending each quarter; activation required), 5% back on travel purchased through Chase Travel℠, 5% back on Lyft (through March 2025), 3% back on dining at restaurants (including takeout and eligible delivery services), 3% back on drugstore purchases and 1% back on other purchases.

Why we like it: Like the Discover it® Cash Back card, the Chase Freedom Flex earns 5% back on rotating categories each quarter (on up to $1,500 in combined spending, then 1% back after that; activation is required to activate the bonus earnings). From October to December 2024, those categories include PayPal, McDonald’s, pet stores/veterinary services and select charity services.

PayPal is an especially useful bonus category for Cyber Monday because millions of retailers accept PayPal at online checkout — just make sure your PayPal account has your Chase Freedom Flex set as the default payment method.

The real power of this card comes when you hold another credit card that earns Chase Ultimate Rewards points, as you would be able to combine your cash-back earnings with points and double their value according to TPG’s November 2024 valuations.

To learn more, see our full review of the Chase Freedom Flex.

Apply here: Chase Freedom Flex

Prime Visa

If you have a Prime membership, you need to consider the Prime Visa this holiday season.

Annual fee: $0, but a Prime membership is required

Current welcome bonus: Get a $200 Amazon gift card instantly upon account approval, exclusively for Prime members.

Earning structure: Earn 5% cash back on Amazon and Whole Foods purchases. Cardholders also earn 2% back at restaurants, gas stations and transit (including ride-hailing) and 1% back on all other eligible purchases. Additionally, earn 10% back or more on a rotating selection of items and categories on Amazon.com. Note that these earning rates require an eligible Amazon Prime membership.

Why we like it: It’s hard to beat the Amazon Prime Visa Card when you’re shopping at Amazon. If you’re planning on spending most of your Cyber Monday budget with the e-retailer, this is a great card to use to maximize those purchases.

To learn more, see our full review of the Prime Visa.

Apply here: Prime Visa

Target Circle Card

Target is a popular retailer at any time of the year, let alone Black Friday and Cyber Monday. If you’re a Target fan, consider the Target Circle™ Mastercard.

Annual fee: $0

Current welcome bonus: Get $50 off a future qualifying purchase from Target when that purchase is $50 or more. This offer is valid as soon as your account is approved.

Earning rates: Get a 5% discount on all eligible Target purchases in-store and online.

Why we like it: Unlike other cards on this list, this card offers an immediate discount on your purchases. Getting a 5% discount on Target purchases, both in-store and online, can save you a pretty penny. Plus, cardholders get 5% off at Starbucks locations inside Target.

Other benefits include 30 extra days for returns and free shipping on most Target online purchases without having to meet the usual $35 minimum. Keep in mind that this card is offered as either a debit or credit card. The debit version can often make more sense as it won’t add to your 5/24 count with Chase or create a hard pull on your credit report.

The information about the Target Circle Mastercard has been collected independently by TPG. The card details on this page have not been provided by or reviewed by the issuer.

Learn more: Target Circle Mastercard

Best cards for Cyber Monday shopping at smaller retailers

Smaller retailers and online boutiques may not fall into larger bonus categories, so flat-rate rewards credit cards tend to be the best options for these purchases. There is an exception, though, which we’ll highlight below.

The Platinum Card from American Express

If you’re in the market for a premium card with numerous benefits, consider The Platinum Card® from American Express.

Annual fee: $695 (see rates and fees)

Current welcome bonus: Earn 80,000 bonus points after spending $8,000 on purchases in the first six months of cardmembership.

TPG’s November 2024 valuations peg this bonus at a whopping $1,600. However, you may be eligible for an even higher welcome offer through the CardMatch tool. Offers can change at any time, and not everyone will be given the same offers.

Earning rates: Earn 5 points per dollar on flights booked directly with hotels or through American Express Travel (on up to $500,000 of these purchases per calendar year, then 1 point per dollar), 5 points per dollar on prepaid hotels booked through American Express Travel and 1 point per dollar on other purchases.

Why we like it: This luxury travel rewards card comes with a colossal annual fee to match the eye-popping number of benefits it offers, but this holiday shopping season may be the ideal time to apply for the Amex Platinum.

If you’re anticipating thousands of dollars in spending across Cyber Monday and through the end of the year, your holiday shopping could put a large dent into the spending requirement to earn the welcome bonus.

It’s also worth checking your Amex Offers to see if you’re targeted for any rebates or bonus points when shopping at small businesses.

To learn more, see our full review of the Amex Platinum Card.

Apply here: The Platinum Card from American Express

Chase Freedom Unlimited

The Chase Freedom Unlimited® is another popular product from Chase that’s worth your consideration for Cyber Monday.

Annual fee: $0

Current welcome bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year), worth up to $300 cash back.

Earning rates: Earn 5% back on travel purchased through Chase Travel℠, 5% back on Lyft (through March 2025), 3% back on drugstore purchases, 3% back on dining (including takeout and eligible delivery services) and 1.5% cash back on all purchases without any earning limits.

Why we like it: Some purchases don’t fall into bonus categories like grocery stores or gas stations. For all of these other purchases, you should use a card that earns well on everyday spending.

The Freedom Unlimited earns 1.5% back on all spending with these “other purchases.” As with the Freedom Flex covered above, the real power of this card comes when you hold another credit card that earns Chase Ultimate Rewards points, as you would be able to combine your cash-back earnings with points and double their value according to TPG’s November 2024 valuations.

To learn more, see our full review of the Chase Freedom Unlimited.

Apply here: Chase Freedom Unlimited

Capital One Venture Rewards Credit Card

If you’re looking for a solid mid-tier card, consider the Capital One Venture Rewards Credit Card.

Annual fee: $95 (see rates and fees)

Current welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months of account opening. TPG’s November 2024 valuations place this bonus at $1,338.

Earning rates: Earn 5 miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel and earn 2 miles per dollar on all other purchases.

Why we like it: You’ll earn 2 miles per dollar when shopping in stores or online during Black Friday and Cyber Monday, so this is probably one of your best credit cards for these purchases — no matter which store it is.

Capital One miles are worth 1.85 cents each based on TPG’s valuations, meaning you’ll earn a 3.7% return on spending. You can also look for Capital One Offers to provide additional cash back (more on that below).

To learn more, see our full review of the Capital One Venture Rewards card.

Apply here: Capital One Venture Rewards

Citi Double Cash Card

Those looking for a card with a very basic earnings structure will appreciate the Citi Double Cash® Card (see rates and fees).

Annual fee: $0

Current welcome bonus: Earn $200 cash back after spending $1,500 on purchases in the first six months of account opening.

Earning rates: Earn 2 points on every dollar spent, as follows: Earn 1% cash back when making your purchase, and an additional 1% when you pay your bill.

Why we like it: If you have the Citi Double Cash and no other Citi credit cards, you can redeem your rewards for travel or for cash back. The real power of this card comes when you have a ThankYou point-earning card like the Citi Strata Premier® Card (which has a $95 annual fee, see rates and fees) and can combine your rewards to access all of Citi’s hotel and airline partners for amazing redemption values.

To learn more, see our full review of the Citi Double Cash.

Apply here: Citi Double Cash Card

Best cards for Cyber Monday shopping if you’re booking future travel

Numerous airline and hotel brands offer Black Friday and Cyber Monday travel deals every year. If you decide to take advantage of any of these promotions, be sure to use the right travel credit card.

Capital One Venture X Rewards Credit Card

If a premium card sounds like a good fit for you but you don’t want to fork over several hundred dollars for one, consider the Capital One Venture X Rewards Credit Card.

Annual fee: $395 (see rates and fees)

Current welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases within three months of account opening. TPG’s November 2024 valuations peg this bonus at $1,388.

Earning rates: Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights and vacation rentals booked through Capital One Travel and 2 miles per dollar on all other purchases.

Why we like it: The earning rate of 2 miles per dollar on everyday purchases mirrors the earning rate of the Venture Rewards card discussed above. Where the Venture X card shines is when you’re booking through Capital One Travel.

If you find a great deal on a flight or hotel and book through this portal, you’ll earn extra rewards. Even better: cardholders receive $300 in credits annually for travel booked through Capital One Travel each year, which can go a long way toward covering your travel costs.

Cardholders also have access to Capital One Lounges, Plaza Premium lounges and Priority Pass lounges at numerous airports around the world and get 10,000 bonus miles on each account anniversary — plus numerous travel protections in case something goes wrong on your holiday.

To learn more, see our full review of the Capital One Venture X.

Apply here: Capital One Venture X Rewards Credit Card

Chase Sapphire Reserve

Rounding out the trio of top premium cards is the Chase Sapphire Reserve®.

Annual fee: $550

Current welcome bonus: Earn 60,000 points after spending $4,000 on purchases in the first three months from account opening.

Earning rates: Earn 10 points per dollar on hotels and car rentals purchased through Chase Travel℠ and 5 points per dollar on flights booked through this portal. You’ll also earn 10 points per dollar on Chase Dining and on Lyft rides (Lyft through March 2025).

Cardholders also earn 3 points per dollar on travel, 3 points per dollar on dining (including takeout and eligible delivery services) and 1 point per dollar on other purchases. Note that the bonus-earning rates on travel purchases don’t apply to purchases covered by your travel credit (see below).

Why we like it: What counts as travel on the Sapphire Reserve is defined very broadly, and cardholders have up to $300 in travel credits to use each year. This can be a great way to reduce or eliminate travel spending during Cyber Monday deals.

You’ll also enjoy perks with Lyft (through March 2025) and access to lounges from Chase Sapphire and Priority Pass once it’s time to take your trip. And if something goes wrong during your trip, you’ll have best-in-class travel protections.

To learn more, see our full review of the Chase Sapphire Reserve.

Apply here: Chase Sapphire Reserve

Cobranded airline and hotel cards

Consider using your cobranded cards when you book travel deals directly. Many airline and hotel credit cards offer best-in-class earning rates on brand purchases while offering perks like automatic elite status, free checked bags and more.

While we don’t suggest using your cobranded cards on everyday purchases from retailers like Target and Amazon, you can use your specific cobranded cards when you book deals to maximize Cyber Monday purchases with the associated airline or hotel group.

Related: When does it make sense to spend on a cobranded credit card?

Other tips for maximizing purchases

You can add even more rebates and rewards on top of using the best credit cards for Cyber Monday purchases. If you play your cards right (pun intended), you can triple-dip when shopping online.

Shopping portals

In addition to maximizing purchases on Cyber Monday by using the best credit cards for the merchants you shop with, make sure you’re also taking advantage of online shopping portals. When you use shopping portals for your Cyber Monday shopping, you can double- or even triple-dip your rewards earnings on top of what you’ll already save with Cyber Monday deals.

We especially love using the Rakuten Chrome extension and checking CashbackMonitor.com to see which portals give the best return at specific retailers. Plus, most of the major U.S. airlines have their own shopping portals where deals abound.

Related: Your guide to maximizing shopping portals for your online purchases

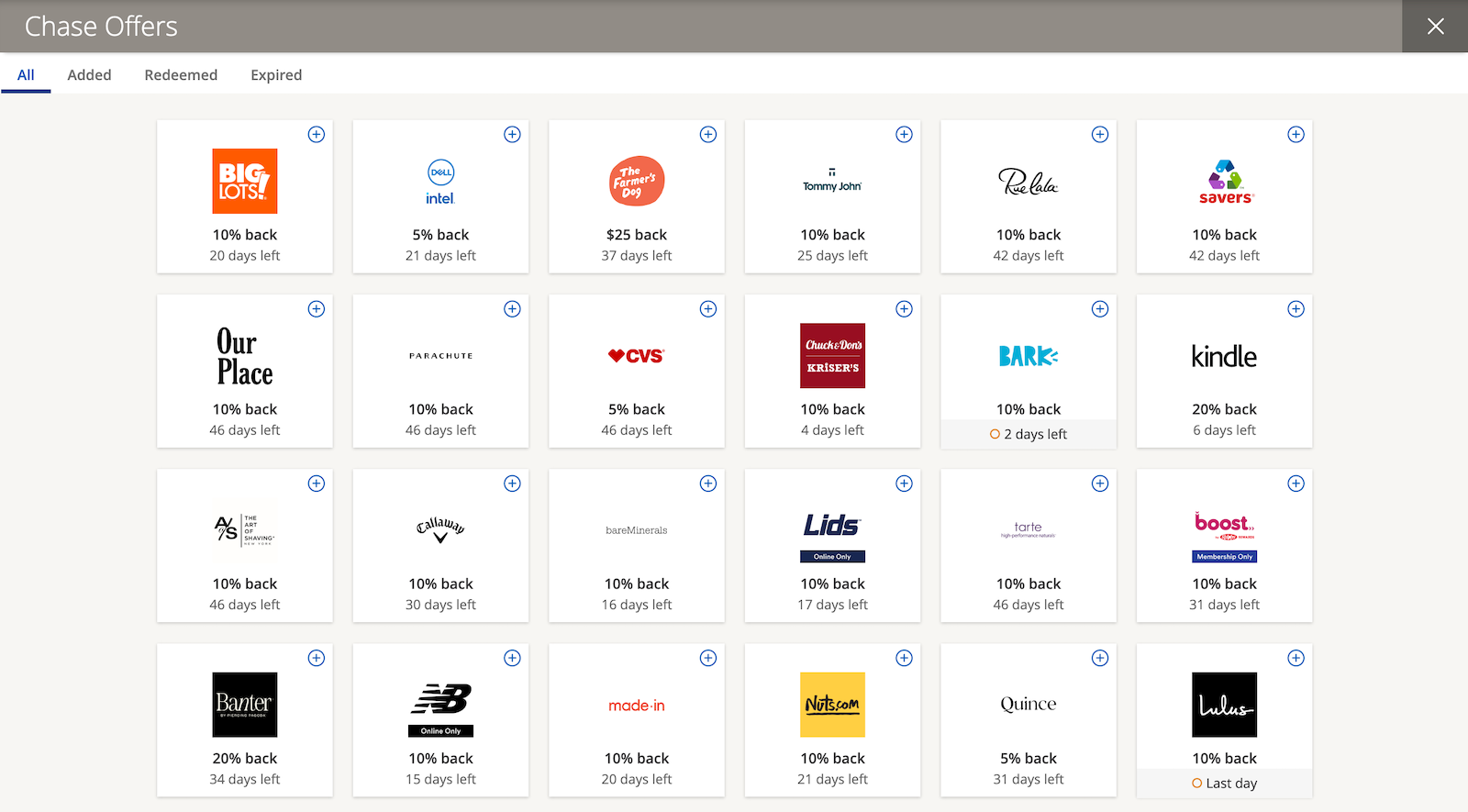

Offers from your credit card issuer

Your credit card issuer may offer a program with rebates that function like coupons or other offers to earn bonus rewards. These offers are targeted, meaning what you see on one credit card may be totally different from what’s available on another credit card.

However, you should definitely check your Amex Offers, BankAmeriDeals, Capital One Offers, Chase Offers and Citi Merchant Offers.

These offers are targeted and also change regularly, so it’s worth checking your offers regularly. A few extra clicks to use a portal or add an offer to your credit card before making a purchase can lead to big savings or a big pile of extra rewards.

Bottom line

To get the best deal possible this Cyber Monday, use the right credit card. With potentially hundreds (or thousands) of dollars in spending over the next month, you’ll want to make sure you earn those bonus points, miles and cash back that will help boost your balances as you head into 2025.

It could also be a great time to sign up for a new credit card and put your holiday shopping on that card so you can earn a great welcome bonus. See here for the best credit card bonus offers currently available.

Apply here: Chase Freedom Flex

Apply here: Amex Platinum Card

Apply here: Chase Freedom Unlimited

Apply here: Capital One Venture Rewards

Apply here: Citi Double Cash

Apply here: Capital One Venture X

Apply here: Chase Sapphire Reserve

Related: How to maximize shopping portals for Black Friday and holiday deals

For rates and fees of the Amex Platinum Card, click here.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.