Earn more rewards: How to use your points and miles better in 2025

At TPG, we try to cross off a few destinations from our annual travel wish list. However, finding the most economical way to get there and back is a challenge. Although many TPG readers and staff use credit card rewards When it comes to booking flights, you may not be sure whether you’re getting the best deal from your rewards.

To help with this, we’ve come up with a New Year’s resolution to help our readers understand How to maximize their points and miles. You can reduce travel costs and see more places by using your rewards more effectively.

Here are five easy tips to maximize your travel rewards in 2025.

Related: How to choose your best credit card strategy

Redeem Chase points when staying at Hyatt

There are many ways you can redeem Chase Ultimate Rewards points for hotels, experiences and sporting events to help reduce the cost of your vacation.

For example, you can use Chase Ultimate Rewards points to book a stay at Hyatt by transfer them to World of Hyatt. You can also transfer Chase Ultimate Rewards points IHG One Rewards And Marriott Bonvoybut Hyatt points are worth significantly more in December 2024 by TPG valuation.

For example, 21,000 World of Hyatt points is enough for a standard free night on an off-peak day at a Category 6 hotel like the Great Scotland Yard Hotel or Park Hyatt Chicago. Redeeming these points can get you into a room that costs more than $500 per night on most days. World of Hyatt is available to all members Complimentary resort stay when staying with the awardcan add to the savings.

Related: The best Hyatt hotel in the world

Here are some of the best cards for earning Ultimate Rewards points:

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

- Chase Sapphire Preferred® Card: Earn 60,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve®: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred® Credit Card: Earn 90,000 bonus points after you spend $8,000 on purchases in the first three months from account opening.

- Ink Business Cash® Credit Card: Earn $350 when you spend $3,000 on purchases in the first three months your account is open; Plus, earn an extra $400 when you spend $6,000 on purchases in the first six months after account opening.

- Ink Business Unlimited® Credit Card: Earn a $750 cash back bonus after you spend $6,000 on purchases in the first three months from account opening.

- Chasing Flex® Freedom: Earn a $200 bonus after spending $500 on purchases in the first three months of account opening.

- Pursue Unlimited Freedom®: Earn an extra 1.5% on everything you buy (on up to $20,000 in spending in the first year). This is worth up to $300 in cash.

The first three cards earn fully transferable Ultimate Rewards points, while the remaining four cards are technically billed as Cash back credit card.

However, if you also have a card that earns Ultimate Rewards points, you can convert your Chase cash back rewards into Ultimate Rewards points. For this reason, having more than one Chase card in the household can make sense to maximize your earning and redemption potential.

Learn how to transfer credit card rewards

You may consider using it Chasing the ultimate reward point to book travel directly in Chase Travel Portal℠but let’s see what that means for a one-way flight from Los Angeles International Airport (LAX) to Heathrow Airport (LHR) next summer.

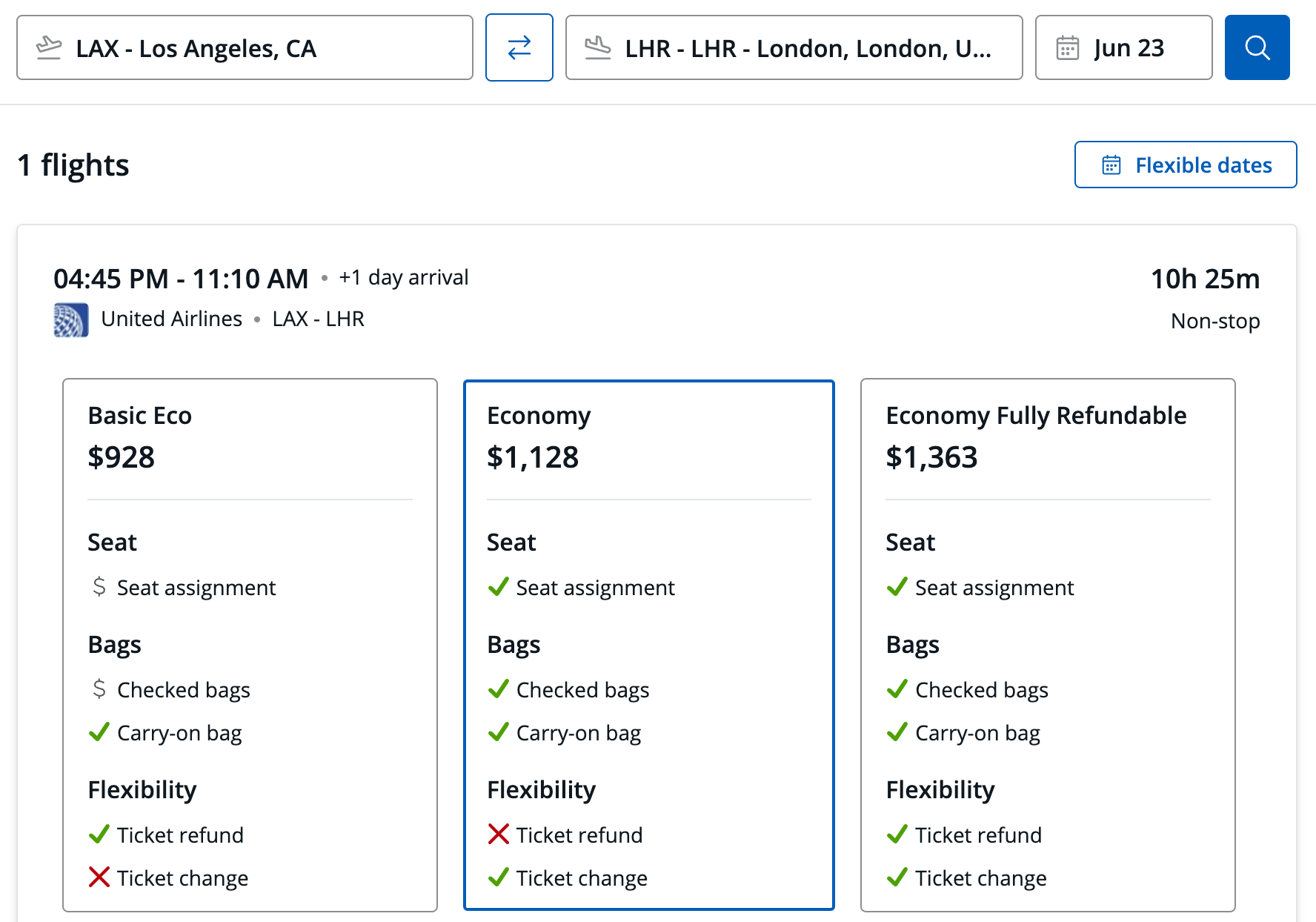

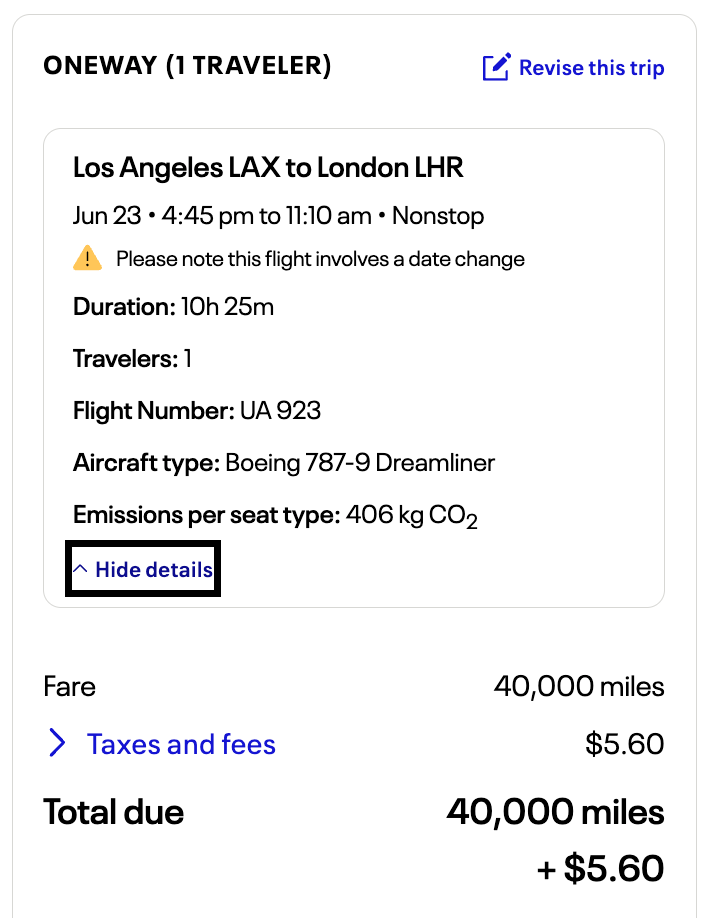

I chose a nonstop United Airlines sample flight that would have cost $1,128 in regular economy if I booked through Chase Travel.

If you have Chase Sapphire Sanctuaryyou can redeem Chase Ultimate Rewards points for gate moves for 1.5 cents each. So this flight would require 75,200 Ultimate Rewards points if you have a Chase Sapphire Reserve and redeemed for this flight through Chase’s travel portal. If you have Chase Sapphire preferredYour Ultimate Rewards points are worth slightly less at 1.25 cents each when redeemed through Chase Travel, so you’ll need 90,240 Ultimate Rewards points.

Alternatively, you can book this flight in economy for 40,000 MileagePlus miles and just $5.60 in taxes and fees. Remember, you can transfer Chase Ultimate Rewards points United MileagePlus with a ratio of 1:1.

When you transfer credit card rewards to a loyalty program, you typically won’t earn frequent flyer miles on your ticket (which you typically earn when booking through the Ultimate Rewards travel portal). However, you could potentially get a great return if you save tens of thousands of credit card points by transferring them to a partner airline’s program instead of redeeming them through a credit card travel portal .

Check rewards rates with transfer partners before redeeming rewards through your credit card issuer’s travel portal. Transferring awards to book award tickets or stays may make sense when award rates are high (like during peak summer days) or award rates are low.

Related: How (and why) you should earn transferable points

Track your points and miles

Using your points and miles properly will be difficult if you don’t track them accurately. Luckily, there are many ways to Track your points and miles.

Many of us are used to tracking our rewards manually in a Word or Excel document, but this is time-consuming and difficult to update. So you might want to use an automated tool. One option is TPG applicationTrack all your balances in one place, automatically calculate their value and notify you when they will expire.

The TPG app gives you a snapshot of your current situation and can help inform your travel plans. When you log in, you’ll see where you have the most rewards with the accounts you’ve synced (and their usage value). TPG monthly points and miles pricing).

Related: How to keep your points and miles from expiring

Sign up for all loyalty programs

Many people don’t sign up for every loyalty program because they think they’ll never actually fly JetBlue or stay at a Hilton hotel. But that mindset has cost travelers millions of points and miles.

Even if you’re not loyal to one airline or hotel chain, signing up for the program when you fly or stay means you’ll get more rewards added to your balance whenever you use it. reuse the program. You can even get additional perks, like free Wi-Fi during your hotel stay, just for becoming a member.

While you might not want to join every program now, consider making sure you have a loyalty number listed on every flight you take. Doing so will accumulate rewards in different programs that can eventually get you a free trip.

Related: These airline and hotel programs offer free points when you sign up

Use online shopping portals to accumulate reward points

You can earn more rewards when you make purchases for yourself or a loved one this holiday season through shopping portal. These portals are basically online shopping malls that cooperate with thousands of merchants. By starting at the portal instead of going directly to a retailer’s website, you can earn reward points or miles on thousands of items.

For example, let’s say you want to purchase a shuttle service or tour through Viator. If you go directly to the Viator website, you’ll only earn rewards on purchases made with your credit card. Instead, if you click through AAdvantage shopping portalFor example, before making a purchase, you can receive additional rewards.

If you want to earn cash back instead of points and miles, you can explore online shopping portals like Rakuten And Top cashback. We recommend using one Aggregate shopping portal every time you shop online to find the program that offers the best return for your seller.

Related: A beginner’s guide to airline shopping portals

Bottom line

With the start of a new year, there are plenty of possibilities to modify your strategy for earning and redeeming points and miles.

Following a simple strategy, such as ensuring you have a frequent flyer count associated with each flight you take, can bring you significant rewards.

We’re already dreaming of our next adventure using points and miles.