November home sales soared more than expected

Investors currently own more than 131,000 homes in the Las Vegas Valley.

Las Vegas Review Magazine | Tribune News Service | Getty Images

According to the National Association of Realtors, sales of previously owned homes rose 4.8% in November compared to October. That puts them at a seasonally adjusted, annual rate of 4.15 million. pcs.

Sales were 6.1% higher than in November 2023. This was the third-highest pace of the year and the largest annual increase in three years.

This number is based on closings, so contracts could be signed in September and October. Mortgage rates fell to an 18-month low in September but then spiked again in September. 10.

“Home sales momentum is building,” said Lawrence Yun, NAR’s chief economist. “More buyers have entered the market as the economy continues to add jobs, housing inventory increases from a year ago and consumers get used to new typical mortgage rates starting at 6%. to 7%.”

The supply of houses for sale at the end of October was 1.33 million units, an increase of 17.7% compared to November last year. At the current sales pace, that represents a 3.8-month supply. The six-month supply is considered balanced between buyers and sellers.

That tight supply continues to put pressure on prices. The average price in November was $406,100, up 4.7% year over year. That year-over-year comparison is growing again. Prices rose 4% year-on-year in October.

Price increases were strongest in the Northeast and Midwest, 9.9% and 7.3%, respectively. About 18% of homes were sold for more than the list price.

First-time home buyers gained ground, accounting for 30% of sales in November, up from 27% in October, but slightly lower than a year ago. Cash is still king at 25% of revenue. However, investors pulled out at just 13% of revenue, down from 18% last November.

“Is this a sign that investors or people who are more volume-minded think house prices are at their peak? Or is there another reason why rents are no longer increasing?” Yun asked.

The largest revenue growth continues to be at the higher end of the market. Sales of homes priced over $1 million increased 24.5% compared to November last year, while sales of homes priced under $100,000 decreased 24.1%.

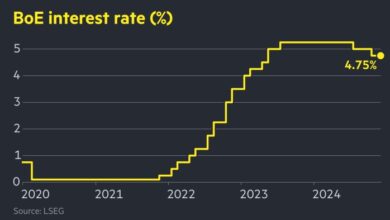

Mortgage rates are higher again today, with the average yield on the 30-year fixed note rising 21 basis points on Wednesday, following the latest rate Federal Reserve meeting. Fed rate cuts are expected to be fewer next year.