A Gamble on Alaska Miles — Why I Signed Up for 2 Hawaiian Airlines Cards on the Same Day

I’m probably one of the most credit-card-dependent members of the TPG team. I have more credit cards than most people can keep track of, which has led me to use a spreadsheet to keep track of all my benefits. In fact, at last count, I had over 20 open cards.

With the number of cards I have now, I really have no need to buy more cards… until Alaska Airlines announces plans to buy Hawaiian Airlines return in December 2023.

Alaska said it will continue to operate Hawaiian Airlines as a separate brand but will combine Alaska Airlines Mileage Plan And HawaiianMiles into a loyalty program. That opens up the possibility that HawaiianMiles could eventually become valuable Mileage Plan miles… or something like that. That makes me want to accumulate some HawaiianMiles ASAP.

The proposed merger passed a major milestone in August 2024 when the Justice Department announced will not move to block the deal. It still needs approval from the Department of Transportation. In a statement, Alaska Airlines wrote of the merger, “…remains subject to the U.S. Department of Transportation’s (DOT) approval of its application for a temporary waiver for the transfer of international route management authorities.” The DOT has not provided a timetable for its decision.

However, DOT approval is seen as the smaller of two major hurdles to the deal’s approval.

Anyway, I decided on my credit card strategy late last year, before the management process began.

Admittedly, opening two credit cards based on a hypothetical situation is a very speculative move on my part. However, I value Alaska miles very much and feel confident that there is a good chance that this hypothetical merger will come to fruition.

So I decided to take action.

Daily News

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides, and exclusive offers from TPG experts

I’ve taken a lot of trips to Hawaii in recent years, so when I knew I was ready to consider adding a Hawaiian Airlines credit card to my wallet, I opened my desk drawer to see what flight attendant card applications I had saved.

Related: Why the merger between Alaska and Hawaii could benefit frequent fliers

I decided the old adage “in for a penny, in for a pound” was relevant here, so I signed up for both the personal and business versions of the Hawaiian Airlines card. That way, I could really maximize the sign-up bonuses, which could eventually go away (or at least grow from their current state) if the loyalty programs eventually merge into one.

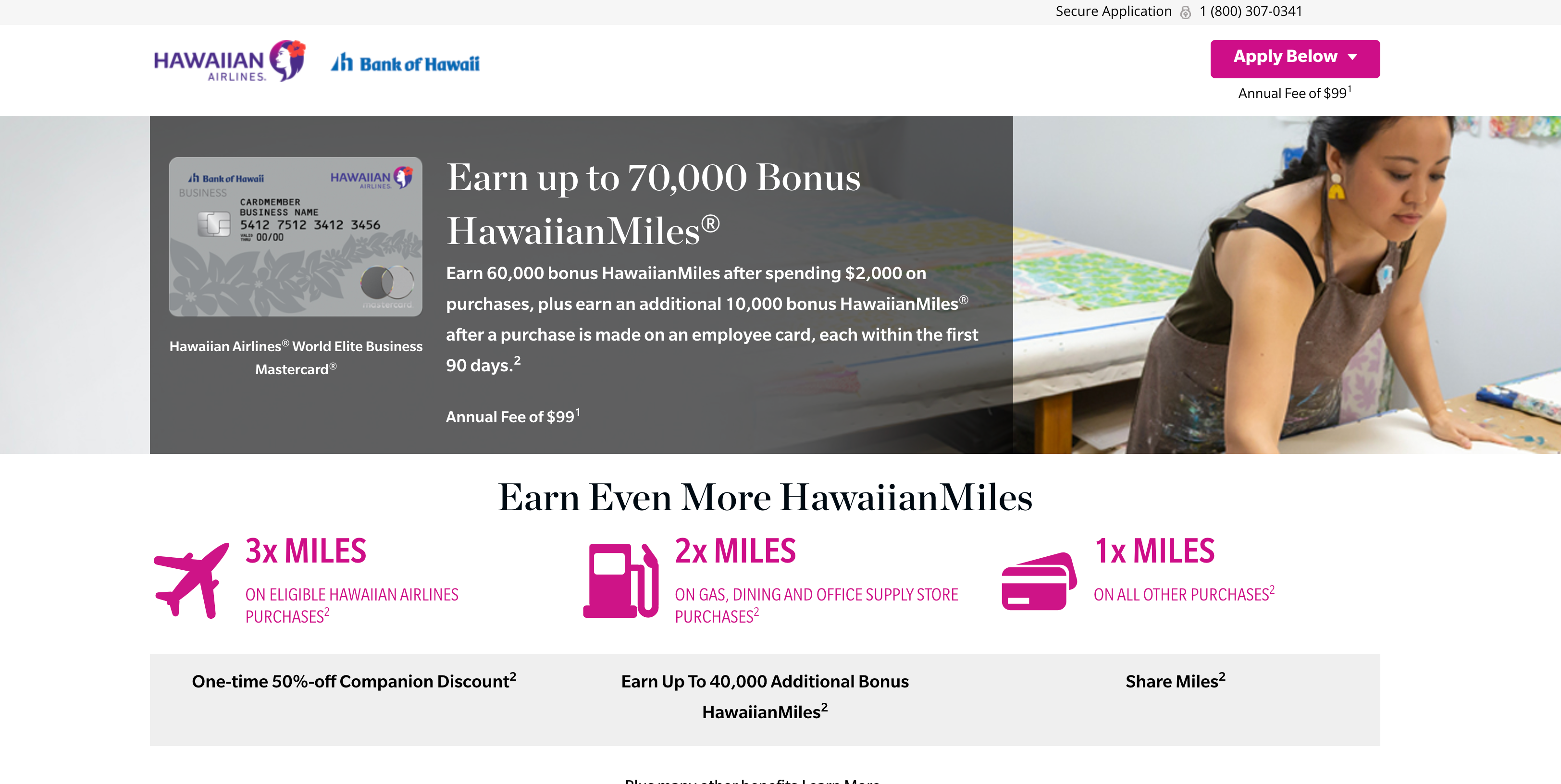

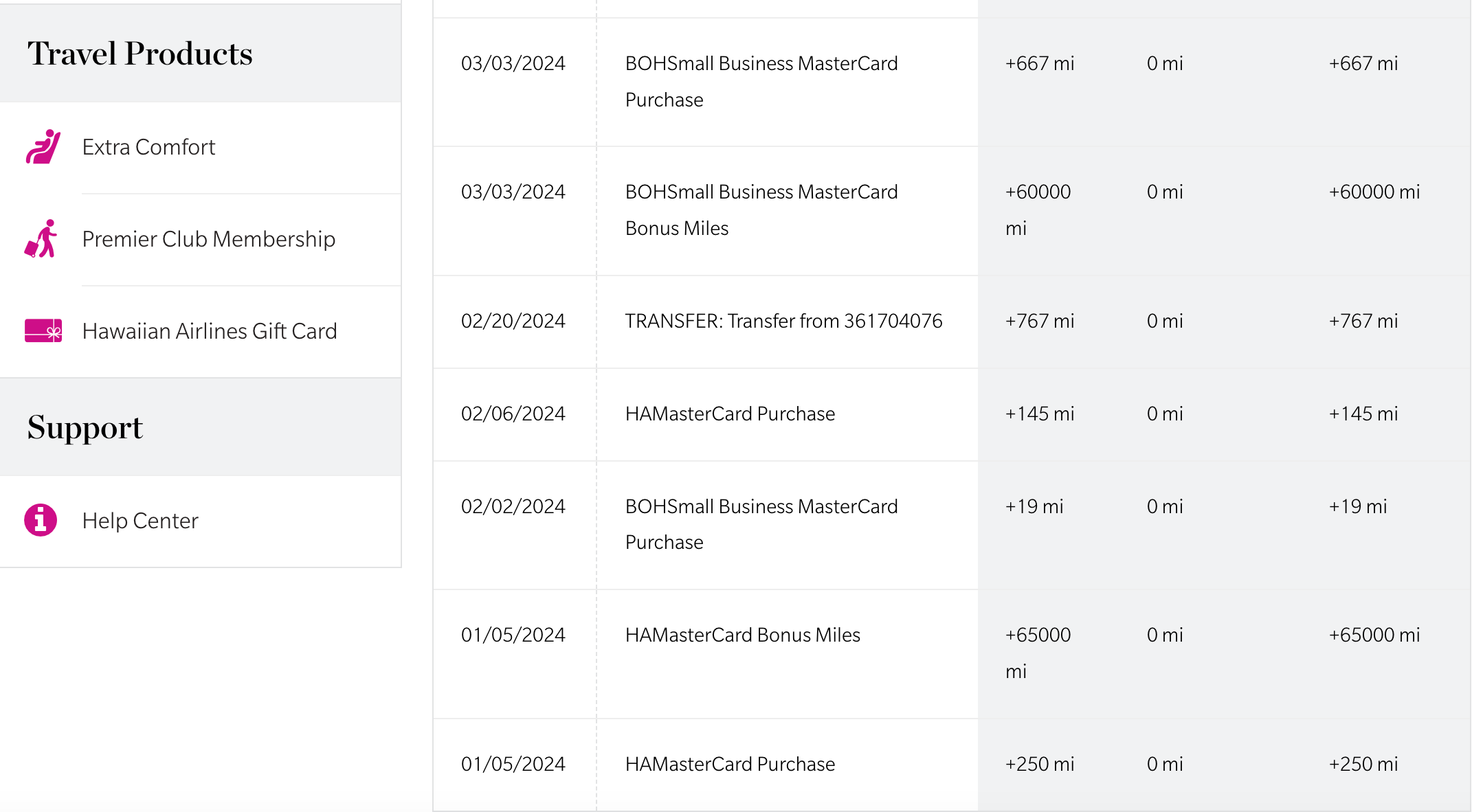

In my case, that means one offer is 65,000 HawaiianMiles after making a purchase within 90 days of opening my Hawaiian Airlines® World Elite Mastercard® account. The other offer is up to 60,000 HawaiianMiles after spending $2,000 and making a purchase with an employee card within the first 90 days of opening my Hawaiian Airlines® World Elite Business Mastercard® account.

The information about the Hawaiian Airlines® World Elite Mastercard® and Hawaiian Airlines® World Elite Business Mastercard® has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You don’t have to have a large business for this strategy to work, though. If you have any type of small business — even something as small as an eBay store — you can apply for a business credit card with your business name and your Social Security number instead of your name. employer identification number.

Related: Do I need to go through a business to get a corporate credit card?

While the personal card isn’t great for regular spending, it does award 3 miles per dollar spent on Hawaiian Airlines purchases and 2 miles per dollar spent on groceries, gas, and dining. It does come with a $99 fee, but in my opinion, that’s a small price to pay for all those miles.

The business version of the card has a similar earning rate. Like the personal card, it offers 3 miles per dollar spent on Hawaiian Airlines purchases and 2 miles per dollar spent on groceries, gas, and dining. It also comes with a $99 fee that’s not waived for the first year.

As can happen with many credit card applications, after I applied for two cards, I learned that I was not immediately approved. Both online applications were marked with a message that said, “Thank you for your interest. Your application is under review.”

Luckily, I received the first of two calls from Barclays just a few minutes later. After answering a few questions about my application, I was verbally approved for a new account over the phone. The same thing happened a short time later for another application.

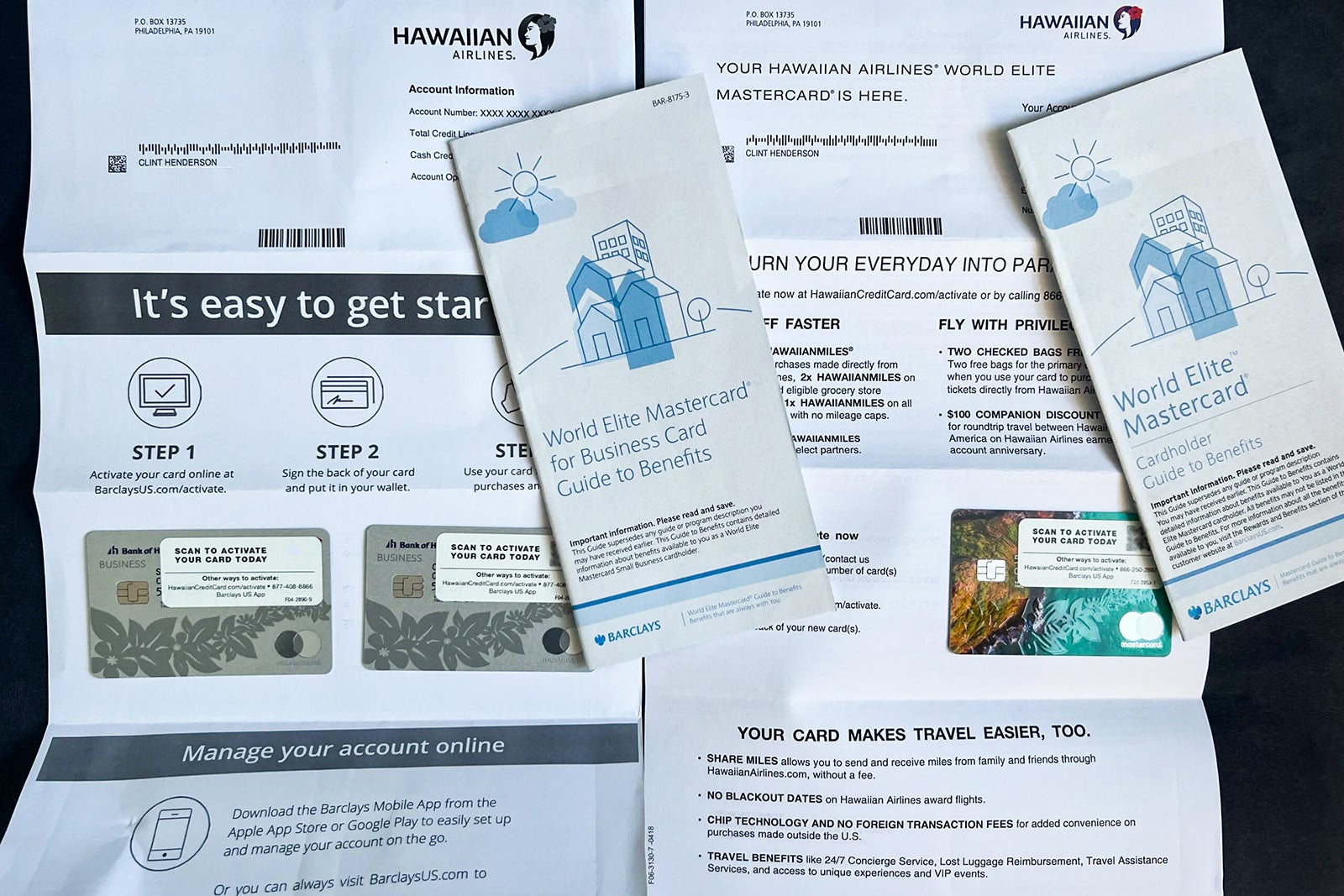

Within a week, two brand new Hawaiian Airlines credit cards arrived in my mailbox, ready to use.

TPG Managing Editor for Credit Cards Matt Moffitt also gambled, applying for a personal and business card on the same day in August 2024. He was immediately approved for a personal card with a $20,000 credit limit. However, his business card application is marked as ‘pending’.

So he called the Barclays reconsideration line and found out that he needed to transfer some of his credit from his personal card to his business card to get approved, splitting the $20,000 limit between the two. Like me, Matt received both cards in the mail a week later.

From opening these two credit cards, I’ve earned 138,000 HawaiianMiles. If they convert 1:1 to Mileage Plan miles at some point, as I hope, I’ll probably have enough miles to book a round-trip business class flight. similar to the one I brought to Taipei, Taiwan, with Starlux last year. However, that trip only cost me 120,000 miles under the Mileage Plan at the time. The prize ratio has increased since then..

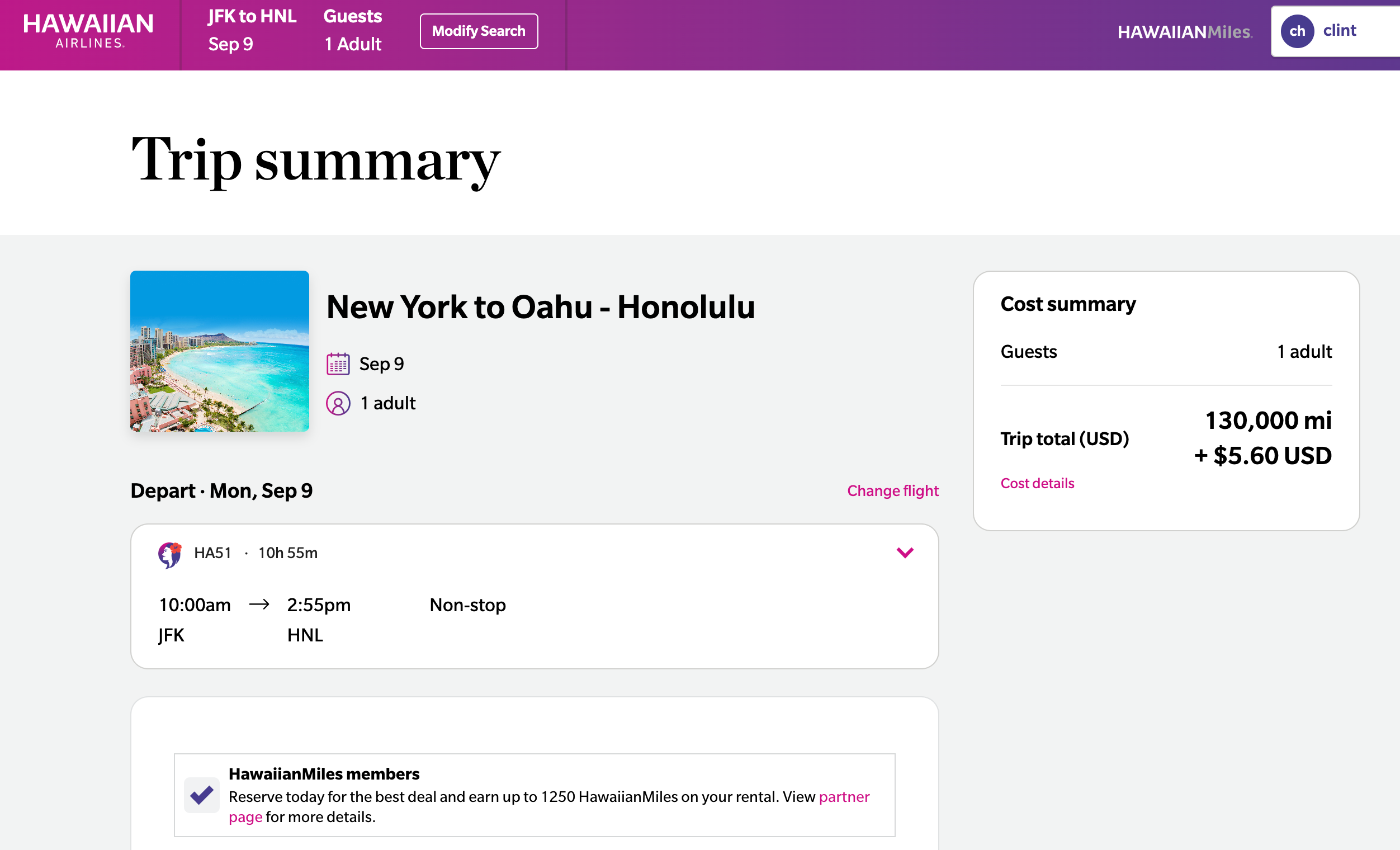

Even if the miles don’t transfer, either because the merger doesn’t go through or the conversion rates aren’t as favorable as I’d hoped, I can still find ways to use my HawaiianMiles. One redemption I’ve been eyeing is a business-class seat on a Hawaiian Airlines flight from New York’s John F. Kennedy International Airport (JFK) to Honolulu’s Daniel K. Inouye International Airport (HNL).

I’ve seen seats priced as low as 80,000 miles each way, although I can often find one-way first class awards for 130,000 miles for a nonstop flight from New York to Honolulu. The cash price for that ticket is over $2,000. I’ll definitely be able to use my HawaiianMiles… even if they don’t transfer to Alaska.

I look forward to seeing what happens with the proposed merger and the HawaiianMiles and Mileage Plan programs. There has been intense debate in The Points Guy newsroom about how the deal will play out for the loyalty program. While Alaska has not publicly announced how it will price Hawaiian rewards, The Beat of Hawaii reported Alaska told them in an email that the currency would be converted to the Alaska Mileage Plan at a 1:1 ratio. Some of my colleagues at TPG were skeptical about that conversion rate, but I believe that’s how it will happen.

To be clear, when Alaska acquired Virgin America 2016Old program miles transfer to Alaska at a rate of 1.3 miles under the Virgin America Elevate Mileage Plan for each point.

In the meantime, I’ll enjoy having an extra bank of air miles for rainy days.

Read more related: