Capital One Venture Rewards vs. Capital One Venture X: Is it worth the extra $300 annual fee?

The Capital One Venture Rewards Credit Card offers great value for occasional travelers who want to maximize the miles they earn. This card has an annual fee of $95 (see prices and fees) and earn 2 miles per dollar on every purchase.

Its flashier sibling, the annual fee is $395. Capital One Venture X Rewards Credit Card (see prices and fees), offering an enhanced travel experience to compete with other premium products such as The Platinum Card® from American Express and Chase Sapphire Reserve®.

If you don’t carry any of these cards — Venture Rewards or Venture X — you might be wondering: Should you sign up? Venture Rewards is well established, crowd favorite or go premium with Venture X Luxury?

Let’s look at both cards to help you decide which one is better. Capital One Card is your best choice.

Compare Capital One Venture Rewards with Capital One Venture X

| Card | Capital One X Venture Fund | Capital One Venture Rewards |

|---|---|---|

| Annual fee | $395 (see prices and fees) | $95 (see prices and fees) |

| Welcome Welcome | Get 75,000 bonus miles after spending $4,000 in the first three months of account opening. | Get a $250 Capital One Travel Credit in your first year of card ownership. Plus, earn 75,000 bonus miles after spending $4,000 on purchases in the first three months of account opening. |

| Income ratio |

|

|

| Other benefits |

|

|

| Foreign transaction fees | No (see prices and fees) | No (see prices and fees) |

Capital One Venture Rewards vs. Capital One Venture X Welcome Offer

Venture Rewards is currently offering a $250 prize Capital One Travel credit for new applicants in their first year of cardholdership. Plus, earn 75,000 bonus miles after spending $4,000 on purchases in the first three months of account opening.

The Venture X card offers new cardholders 75,000 bonus miles after they spend $4,000 in the first three months of account opening.

Venture Rewards offer is worth $1,638, based on TPG’s July 2024 report valuationwhen adding up the total value of the award miles and Capital One Travel credit.

Meanwhile, the Venture X offer is worth $1,388 based on TPG’s valuations, so you’ll get incredible value from the rewards no matter which card you choose.

Winner: Venture Rewards. Travel credit offer with the same spend requirement as Venture X makes the welcome offer more valuable.

Daily News

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides, and exclusive offers from TPG experts

Related: How to Redeem 75,000 Capital One Miles for Maximum Value

Benefits of Capital One Venture Rewards vs. Capital One Venture X

With Venture Rewards, you’ll get up to a $100 credit for TSA PreCheck or Global Entry one time, as well as rental car and travel accident insurance, extended warranty protection, and access to Capital One Lifestyle Collection of the hotel and Capital One Entertainment.

Venture X, on the other hand, has a more attractive benefits list that completely justifies the higher annual fee if you can maximize them.

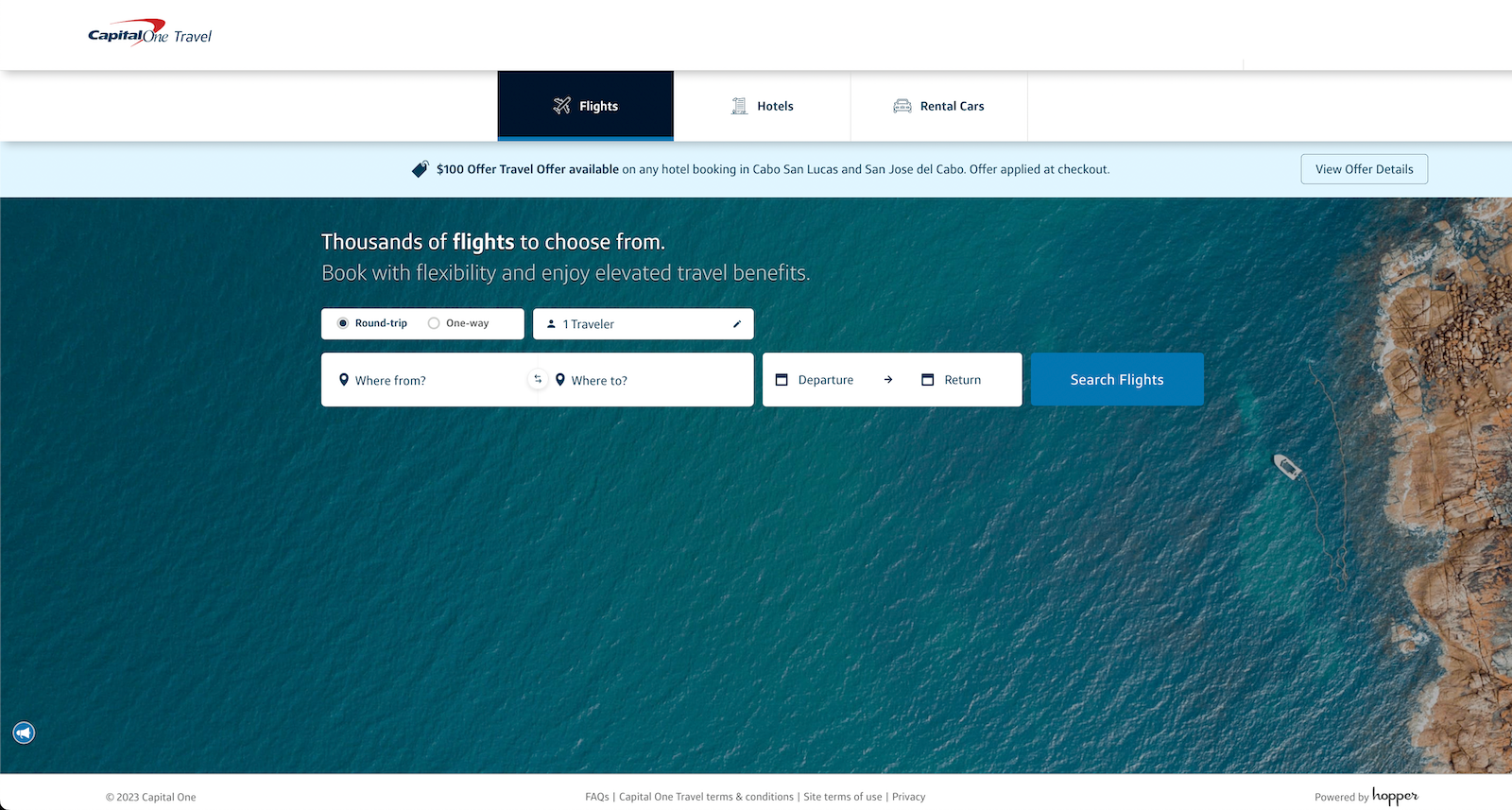

As a cardholder, you will receive $300 Annual Credit for bookings made through Capital One Travel and complimentary access to Capital One And High-class Plaza lounge for you and up to two guests. You’ll also get Priority card Lounge memberships at over 1,300 locations for you and unlimited guests (subject to capacity).

You’ll also get 10,000 bonus miles, worth $185 according to TPG Valuationon every cardholder anniversary, along with access to the Capital One Lifestyle Collection and luxury Premier Collection hotel protection, travel protection, extended warranty protection and cell phone protection.

An added benefit of Venture X is that you can add a limited number of authorized user no additional charge (see prices and fees). These authorized users enjoy the same airport lounge access as the primary cardholder, including complimentary access for themselves and guests.

Winner: Venture X. As a higher-end card, this card has a much more extensive list of benefits than Venture Rewards.

Related: Is Venture X worth the annual fee?

Earn Miles on Capital One Venture Rewards vs. Capital One Venture X

Both Venture Rewards and Venture X earn bonus miles on travel booked through Capital One Travel and 2 miles per dollar on all other purchases. Both cards also earn 5 miles per dollar on Capital One Entertainment purchases through December 31, 2025.

With Venture Rewards, you’ll earn 5 miles for every dollar spent. many hotels and rental cars booked through Capital One Travel. However, if you have the Venture X, you’ll earn 10 miles per dollar when you book hotels and rental cars through Capital One Travel and 5 miles per dollar when you book flights through the same portal.

Winner: Venture X. It earns twice as many miles as Venture Rewards on hotels and rental cars booked through Capital One Travel. Venture X also earns bonus miles on flights booked through Capital One Travel, while Venture Rewards does not.

Related: 6 Easy Strategies I Use to Earn Over 500,000 Points and Miles Every Year

Redeem Miles on Capital One Venture Rewards vs. Capital One Venture X

Both Venture Rewards and Venture X earn Capital One miles and give you the same redemption options.

You’ll get the most value by transferring your miles to one of Capital One Travel Partnersbut you can also exchange them for one credit statement to pay for travel purchases or gift cards at a fixed rate of one cent per mile.

Both cards allow you to redeem miles for cash, but you’ll get a much lower rate of 0.5 cents per mile, so we recommend avoiding this option whenever possible.

Winner: Tie. Both cards give you the same options for redeeming airline miles.

Related: Should you redeem miles directly for travel or transfer them to a partner?

Transfer Miles with Capital One Venture Rewards vs. Capital One Venture X

One of the great things about both Venture Rewards and Venture X is that they allow you to transfer your miles to any of Capital One’s 15+ hotel and airline partners, including valuable options like Air France-KLM Fly Blue, British Airways Executive Club And Turkish Airlines Miles and Smiles.

And if you can take advantage of transfer bonuses, you’ll get more value from your miles. For example, TPG points and senior writer miles Ben Smithson Get good value from your miles by transferring them to Air Canada Aeroplan and Flying Blue.

Winner: Tie. Both Venture Rewards and Venture X go to the same partner at the same rate.

Related: How to Redeem Capital One Miles for Maximum Value

Should I get Capital One Venture Rewards or Capital One Venture X?

If you’re focused on keeping your annual fee low, go with Venture Rewards. You’ll get a high earning rate, access to Capital One’s transfer partners, and a number of travel benefits for just a $95 annual fee (see prices and fees). However, if you want to use airport lounges and can take full advantage of the $300 annual credit, the Venture X is the better choice.

Related: Who Should (and Shouldn’t) Buy Venture X

How to upgrade from Capital One Venture Rewards to Capital One Venture X

If you already have Venture Rewards and want to upgrade to Venture X, you can call the number on the back of your card and request a product change. You won’t be able to take advantage of the new card’s welcome offer this way, but it’s a good way to get more benefits without worrying about eligibility.

Related: Venture X Helped Me Save Over $6,000 on a Summer Trip to France

Last line

Both Venture Rewards and Venture X are great travel rewards cards, earning bonus points on Capital One Travel purchases and 2 miles per dollar on other purchases.

The Venture X is a great card for those who can take advantage of airport lounge access and annual credit, while the Venture Rewards is better suited for anyone who wants to keep their annual fee low. Regardless of which card you choose, you’ll get solid travel benefits and earn valuable transferable rewards.

To learn more, read our full review of Adventure Reward And Joint Venture X.

Find out more: Capital One Venture Fund

Find out more: Capital One X Venture Fund

Related: How to Choose the Right Travel Credit Card for You

For Capital One products listed on this page, some benefits may be offered by Visa® or Mastercard® and may vary by product. See the respective Benefits Guide for details, as terms and exclusions apply.