ECB lowers interest rates to 3% and opens the way for more cuts

Unlock Editor’s Digest for free

Roula Khalaf, FT Editor, picks her favorite stories in this weekly newsletter.

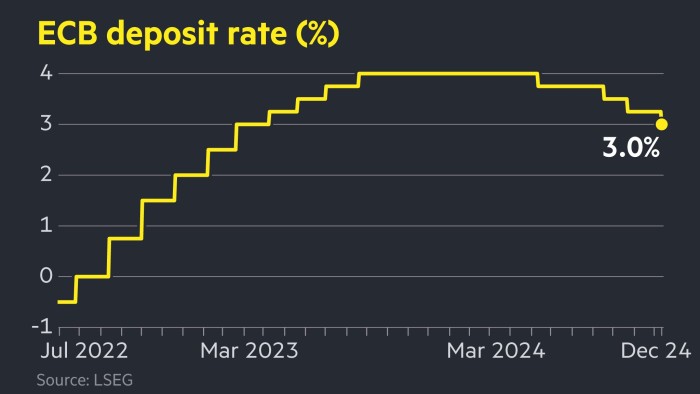

The European Central Bank cut interest rates by a quarter of a point to 3%, while toning down its hawkish language and warning that growth would be weaker than previously forecast.

The ECB’s cut – the fourth reduction in borrowing costs since June – takes the central bank’s benchmark deposit rate to its lowest since March 2023.

Christine Lagarde, president of the ECB, said some interest rate makers had proposed a larger cut of 50 basis points. But she added that support for the final quarter-point move was “unanimous.”

“The door has been opened more clearly for further cuts,” said Deutsche Bank economist Mark Wall.

The ECB’s dovish shift comes as the Eurozone and Germany, the region’s largest economy, grapple with weak growth and the threat of a global trade war after Donald Trump entered the White House. .

Thursday’s cuts came as the ECB warned that euro area economy will grow just 1.1% in 2025, down from an estimate of 1.3% in September.

The ECB also lowered its growth forecast for 2026 by 1 percentage point to 1.4% and was even more pessimistic for 2027, when it expected GDP growth of just 1.3%.

“What has changed is downside risks, especially downside risks to growth,” Lagarde said.

She added that Trump’s threats to impose blanket tariffs of up to 20% on all US imports – and hit growth – were “off base”.

That could imply that the export-heavy Eurozone economy will perform even worse than the central bank predicts if Trump introduces tariffs after he returns to office on January 20.

The euro was down 0.2% in late afternoon trading at $1.047.

The ECB has abandoned its commitment to “keep policy rates at sufficiently restrictive levels for as long as necessary” to reduce inflation to its 2% target. Instead, they emphasized that “the impact of restrictive monetary policy” will “gradually fade” over time.

“The current direction is very clear,” Lagarde told journalists.

suggests that the ECB will reduce interest rates further next year. However, she emphasized that the “pace” of cuts will be determined in a meeting-by-meeting approach.

She added that while the inflation “mission” remains unfinished, rate-setters now believe they are “really on track” to “sustainably” achieve the 2% target. .

The bank forecasts headline inflation of 2.1% in 2025, 1.9% in 2026 and 2.1% in 2027.

“The risks tilt towards the ECB doing more, not less, to support the economy in 2025,” said Dean Turner, chief euro zone economist at UBS Global Wealth Management.

But he warned that “this is more likely to lead to further cuts at the end of 2025 rather than bigger moves in the near term”.

Investors predict that ECB will cut interest rates more than the US Federal Reserve next year, as growth in the Eurozone is expected to lag that of the United States.

“Gradual easing is the message,” said Mariano Cena, senior European economist at Barclays.

Swaps traders largely kept their bets unchanged after the decision. Overall, they expect the ECB to make a further cut of 5 percentage points next September, which will bring deposit interest rates to 1.75%.

“If upcoming economic data weakens further, for example due to growing uncertainty over trade tariffs. . . then larger cuts would be feasible,” said Derek Halpenny, head of research at MUFG.

Swaps markets are pricing in around 0.75 percentage points of cuts from the US Federal Reserve over the same time period, which would bring the target range down to between 3.75 and 4%.

Earlier in the day, the Swiss National Bank halved its key policy rate to 0.5%, a larger-than-expected cut.