Guide to foreign transaction fees: What you need to know

There are a few things we don’t like in TPG rather than unnecessary fees – including foreign transaction fees.

You may notice that when you use some credit cards abroad (or on a website that is not stored in the US), an additional fee is added to each purchase.

Discuss what those fees are and how you can avoid them in the future.

Related: The best card has no foreign transaction fees

What is the foreign transaction fee?

Foreign transaction fees are calculated on certain cards when you buy through banks abroad to handle transactions.

When you complete a transaction when traveling or through a foreign website, banks may have to convert buying transactions into US dollars. On some credit cards, the publishers will then transfer conversion costs to consumers.

Related: The best business credit card has no foreign transaction fees

What is the foreign transaction fee?

Visa and MasterCard Charge Banks a 1% fee for purchasing processed abroad, and many US publishers have reduced 1-2% of the fee. Standard foreign transaction fees tend to be about 3%. However, Capital And Detect is the only thing in having No foreign transaction fees On all their credit cards.

Which cards do not have foreign transaction fees?

Most of the Top travel credit card Do not charge foreign transaction fees. In fact, it is very rare for a card to provide rewards and privileges to calculate any foreign transaction fees.

Daily newsletter

Reward your inbox with the daily newsletter TPG

Join more than 700,000 readers for new news, in -depth instructions and exclusive transactions from TPG experts

Although some publishers calculate foreign transaction fees about 3% for some of their products, you should consider capital or discover cards because they do not charge foreign transaction fees on any of their cards. .

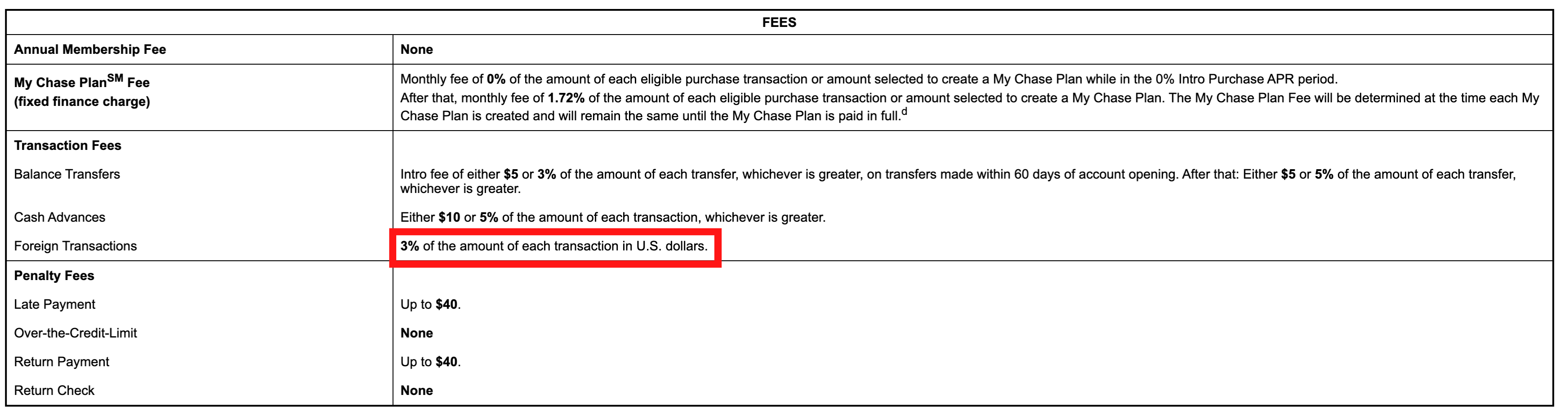

Card publishers are required to provide potential customers and existing customers to access prices and fees related to credit cards, including foreign transaction fees. Check the terms and conditions of your credit card to see if your card has (or the card you are considering registering) Foreign transaction fees.

When looking at the ratio and fees, foreign transaction fees are usually clearly listed according to the fee.

Related: How to choose a top -notch credit card

Foreign transaction fees compared to ATM fees

Another fee that you can hear when you travel is a foreign ATM fee. Although the two fees can be applied when traveling outside the United States, they are not synonymous.

A foreign ATM fee is calculated when you withdraw money from ATM overseas. Some banks give up this fee, especially if you use ATMs in a network of specific banks.

In addition, you may be on the hook to get extra charge when you use ATMs abroad, including a fixed fee from your bank because using ATMs is not associated with the bank (usually $ 5 La), foreign currency conversion fee (usually reduced in accordance with foreign transaction fees at 3%) and additional fees are calculated by the owner of the ATM specific you use.

This is a reason we recommend paying by credit card whenever possible. But in some places, cash is still the king and you will need a game plan to avoid these fees – or put them into your budget.

Related: How to save ATM withdrawal

How to avoid foreign transaction fees

Use cards without foreign transaction fees

The easiest way to avoid foreign transaction fees is to use the card without charge. TPG has a regular updated guide Top credit cards have no foreign transaction fees That can help you choose the best card for your trips.

Unfortunately, Cash card Such as Chase Freedom Unlimited® And Blue Cash Preferred® card from American Express (see ratio and fee) tend to calculate foreign transaction fees.

Related: The advantages and disadvantages of cash credit cards

Avoid ‘dynamic currency conversion’

When using a card terminal overseas, you can be reminded in local copper or US dollars. You should always choose local currency.

Dynamic currency conversion is a stealth way that banks encourage you to pay in family currencies (US dollars) when abroad. However, they will often give you a poor conversion rate, so it is best to pay for euros, peso or anything that is local.

Related: Why should you avoid dynamic currency conversion

Cash

Of course, you will also avoid foreign transaction fees by paying in cash.

However, those buying transactions will not earn your reward and withdrawing money abroad may be subject to troublesome fees.

Related: How to decide when to use cash or miles to buy air tickets

The key point

Good news is that foreign transaction fees are much less common Top credit card More than they used to. Hopefully, the entire industry is away from calculating customers with these fees. Until then, check the terms and conditions of your credit card to know if you are trapped at a fee when you travel – and plan your card use accordingly. .

To avoid foreign transaction fees, choose a top travel bonus card or one word or explore. In addition, always paid in local copper instead of US dollars to avoid poor conversion rate.

Related: Best travel reward card

For the price and fee of the cash priority, click This.