How to Freeze Your Credit

If you’re taking stock of security measures in every area of your life, don’t overlook your credit.

With a recent alleged attack, it is possible that every American could be Social Security Numbers and Physical Addresses StolenIt is alleged that 2.9 billion records were stolen from National Public Data, a public records storage company, in April 2024.

Now more than ever, it is important to ensure that your credit profile is secure and that you are not vulnerable to your personal information falling into the wrong hands. We recommend that you check your credit profile immediately and look for any irregularities so that you can take the necessary precautions. You should also update the passwords for any email accounts, bank accounts or services where your data may have been compromised.

Although it is nearly impossible to completely protect yourself from credit card fraud or identity theftThere are steps you can take, such as freezing your credit. But of course, freezing your credit comes with some inconveniences, like all security measures.

We’ll explain how and why you might want to freeze your credit.

What is a credit freeze?

A credit freeze prevents you or anyone else from opening an account in your name. It works by preventing creditors from accessing your credit file so that creditors and lenders cannot give you (or anyone pretending to be you) any type of credit.

Freezing is free, easy to request, and doesn’t affect you. credit score.

The problem is that before you can apply for a new credit card or loan, you first have to lift the credit freeze. Luckily, this is free, but it can be inconvenient if you frequently open new lines of credit.

Related: How to check your credit score for free

Daily News

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides, and exclusive offers from TPG experts

How can I freeze my credit?

To freeze your credit, you must request a freeze at all three credit bureaus. You can do this online or over the phone.

The agencies are required to freeze your credit report within one business day. After you request a freeze, each agency will provide you with a unique PIN or password. It is important that you keep your PIN or password in a safe place, as you will need it if you want to unlock your report (more on that later).

Before going online or calling, be prepared to provide personal information such as your name, address, date of birth, and Social Security number.

Freeze your online credit

You can complete the process online by visiting each credit company’s website:

Freeze your credit over the phone

You can also contact the companies by phone to request a freeze at the following numbers:

- Equifax: 888-298-0045

- Experian: 888-397-3742

- Trans Alliance: 888-909-8872

Please note that even after you freeze your credit, you will continue to receive pre-screened credit card offers unless you opt out by calling 888-567-8688.

Related: How to Protect Yourself from a Rewards Program Data Breach

Who can access a frozen credit report?

A credit freeze prevents new creditors from accessing your credit report. However, your credit remains available to certain entities, such as current creditors or debt collectors on their behalf. Additionally, government agencies may have access to it in response to a court or administrative order, subpoena, or search warrant.

When should I freeze my credit?

You should initiate a credit freeze if you believe your personal information has been compromised. Here are just a few situations that may warrant a credit freeze:

- Your wallet was stolen and contained personal identification information such as driver’s licenses, passports, Social Security cards, and credit cards.

- You fell victim to a scam

- Your information has been compromised in a data breach

- You notice a strange credit inquiry on your credit report.

In any of these cases, you should file a Report identity theft to the governmentgives you certain rights to erase any damaged credit that was not caused by you.

Related: How to Recognize and Prevent Credit Card Fraud

Does a credit freeze affect my credit score?

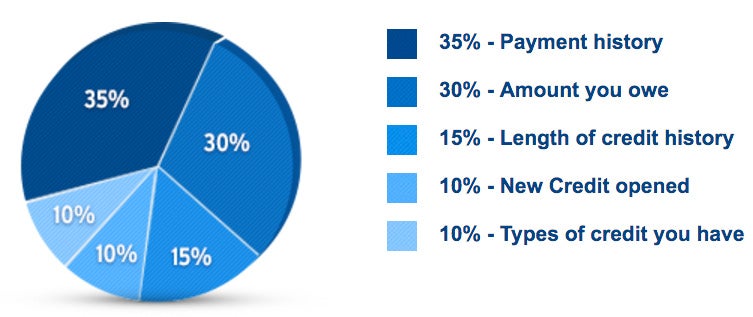

In short, no. Your credit score is used to determine your creditworthiness and is based on your credit history from the three major consumer credit bureaus. A credit freeze does not positively or negatively affect your credit score.

Related: How your credit score works

Pros and Cons of Credit Freeze

A credit freeze is the most effective way to prevent fraudulent accounts from being opened in your name — and since it’s free, there’s no reason not to do it if you think your information has been compromised.

However, a credit freeze also prevents you from opening a new account while it is still active. To open a new account, you will have to contact each agency separately to unfreeze your credit, which can be tedious. Additionally, a credit freeze will not prevent or alert you to fraud on any existing accounts.

Related: What is the difference between a credit freeze and a fraud alert?

How can I unlock my credit?

In some states, your credit freeze will automatically expire after seven years. However, in most cases, your freeze will remain in effect until you ask the credit reporting agency to remove it.

To unlock your report — for example, to apply for a new mortgage or credit card — you must contact each of these three agencies. Once you make your request, the agencies should unlock your report within an hour. Here are the links and phone numbers:

You will need the unique PIN or password provided during the initial credit freeze. When you temporarily unfreeze your report, be sure to give the agencies a specific time period or request that the unfreeze be for a specific party only.

For example, let’s say you want to open a new credit card. If possible, contact the issuer to find out which agency (or agencies) they get your credit information from. Ideally, you can then contact that credit agency (or agencies) and have your report unlocked for a period of time or just for the issuer to inquire about your credit file.

The last line

Freezing your credit can be a useful tool to help protect you from identity theft. It may be inconvenient, but many people find it worth the peace of mind, especially in light of recent data breaches.

Read more: