How to maximize your earnings with Amex Business Platinum

No need to wonder, American Express Business Platinum® Card is the card you’ll want if you own a business. It combines everything we loved from the consumer version (American Express Platinum® Card) with higher earning rates and an increased welcome offer of up to 150,000 bonus points – worth $3,000, according to TPG’s valuation.

In this guide, we’ll show how business owners can maximize their earning potential with strategies that will help you earn thousands of points each year on Amex Business Platinum.

Register here: Amex Business Platinum with 150,000 bonus points after you spend $20,000 in the first three months of card membership.

Overview of Amex Business Platinum benefits

Before we get started, let’s review the outstanding benefits of Amex Business Platinum, with an annual fee of $695 (see exchange rates and fees):

- Income rate: Earn 5 points per dollar on prepaid flights and hotels through Amex Travel. Earn 1.5 points per dollar on qualifying purchases in key business categories, as well as on every purchase of $5,000 or more everywhere else, with up to $2 million in these purchases per calendar year (1 point thereafter). Earn 1 point per dollar on all other qualifying purchases.

- Pay with discount points: When you exchange points for airline tickets Amex Pay with Points for a business or first class ticket on any airline or class on your selected eligible airline through Amex Travel and you’ll get 35% points refunded to your account – use fewer points and get more money back — up to 1,000,000 points back per calendar year.

- Lounge access: Get access to American Express Global Lounge Collectioninclude captain, Priority card, Delta Sky Club (when flying same day as Delta; limited to 10 annual visits starting February 1, 2025), lounges and more.*

- Annual reporting credits: Get up to $400 Credit Dell Technology (up to $200 January through June and up to $200 July through December)*, up to $360 in Indeed credits (up to $90 quarterly)*, up to $200 airline fee credit for charges incurred by the airline of your choice, up to $189 Clear Plus membership credit (subject to automatic renewal), up to $150 Adobe credit* and up to $120 US wireless phone service credit (divided into $10 per month)*. Note that Dell, Indeed, and Adobe credits are scheduled to end on December 31.

- Global Entry/TSA PreCheck Refund: Every four years (or 4.5 years for TSA PreCheck) get a refund of up to $100 for your application Global entry or TSA pre-checkThis will speed up your airport experience.

- Hotel elite status: Get automatic Gold status on both Hilton Title And Marriott Bonvoy for room upgrades (subject to availability), bonus points for stays, and more.*

- Elite car rental incentives: Get elite car rental privileges with Avis preferred, Hertz Gold Plus*** And National Emerald Club for vehicle upgrades (subject to availability), discounts and more.*

- Amex Fine Hotels + Resorts Program: When you book a hotel through Amex FHR Programyou’ll get elite perks like daily breakfast for two, room upgrades and early check-in (subject to availability), guaranteed 4pm check-out, amenity credit worth 100 USD and more.

- Platinum Concierge for Businesses: For everything from meal arrangements and travel plans to finding concert tickets, you can call Platinum concierge for businesses for assistance.

- Travel protection: When you book travel with a card, you will receive one many measures to protect tourism.

- Mobile phone protection: Pay your monthly cell phone bill with your card and receive up to $800 per claim (with a $50 deductible) with a limit of two claims in a 12-month period.** This will help Useful if you your phone is broken or your screen is broken.

*Registration required for select benefits, terms apply.

**Conditions and benefit levels vary by card. Terms, conditions and limitations apply. Visit Americanexpress.com/benefitsguide for details. Insurance policies are underwritten by New Hampshire Insurance Company, an AIG Company.

***Enrollment in the Hertz Gold Plus Rewards Program is required.

With the Amex Business Platinum, you can think of the card as an incredible resource for everything travel-related. You’ll earn reward points when paying cash for flights, travel report credits to improve your overall experience, airport lounge access worldwide, and more.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Plus, remember that the card has your back when things go wrong, whether on travel or with your cell phone – making the Amex Business Platinum a form of insurance and a way to insure peace of mind, something we all need more of these days.

While there are plenty of great benefits to discuss, we’ll focus on how you can earn more points each year with your Amex Business Platinum for the things we love most at TPG, such as as travel prizes.

Related: Is Amex Business Platinum worth the annual fee?

Strategies to maximize Amex Business Platinum

Let’s learn how to maximize the earning potential of this card. You must spend a minimum of $20,000 in the first three months of account opening to receive the welcome offer. Also, how can you strategize your earnings on this card?

For starters, we know that the Amex Business Platinum probably won’t be the only rewards card you have in your wallet. Chances are you also have a personal credit card that helps you earn points and miles on personal purchases, whether eat and drink, grocery or gas.

However, when it comes to business travel and significant business expenses, the Amex Business Platinum is king. Here are some examples that demonstrate why:

Use your Amex Business Platinum to pay for flights

The Amex Business Platinum is the perfect card to use to purchase any flight as you’ll earn 5 points per dollar on flights booked through Amex Travel. Based our pricing Membership bonus points, i.e. 10% profit.

Unlike the personal version of this card, which has a $500,000 annual limit on this earning rate, there’s no limit to the number of points you can earn on flights with the Amex Business Platinum. So if your company spends a lot on air travel, you could earn 5 points per dollar for the number of flights you need to purchase.

If you want, you can also redeem your Membership Rewards points for flights through Pay with Points sale off at the rate of 1 cent each.

Use your Amex Business Platinum to pay for hotels

Likewise, the card offers a strong return of 5 points per dollar on prepaid hotels booked through Amex Travel. This is also a 10% profit based on our pricingand the flexibility to book a variety of different hotel brands and get this great rewards rate is a huge selling point of the card.

Use your Amex Business Platinum to pay for large purchases and work expenses

This card also has bonus categories to encourage businesses with high operating costs. You’ll earn 1.5 points per dollar on purchases of $5,000 or more, as well as on select business categories, including:

- American electronics retailer

- American software

- US cloud service provider

- Construction materials and hardware supplies from the United States

- US shipping provider

Cumulatively, you’ll earn this rate on purchases up to $2 million per calendar year and 1 point per dollar after that.

Use Amex Business Platinum for your monthly cell phone bill

Cardholders will get up to $10 off US wireless cell phone service each month for up to $120 per calendar year, so you’ll want to pay your cell phone bill every month. month with your Amex Business Platinum. Registration is required.

Don’t forget that the Amex Business Platinum is one of the few cards that offers one mobile phone protection. When you pay your monthly cell phone bill with your card, you’re eligible to receive up to $800 per claim (with a $50 deductible) with a limit of two claims in a 12-month period. month.

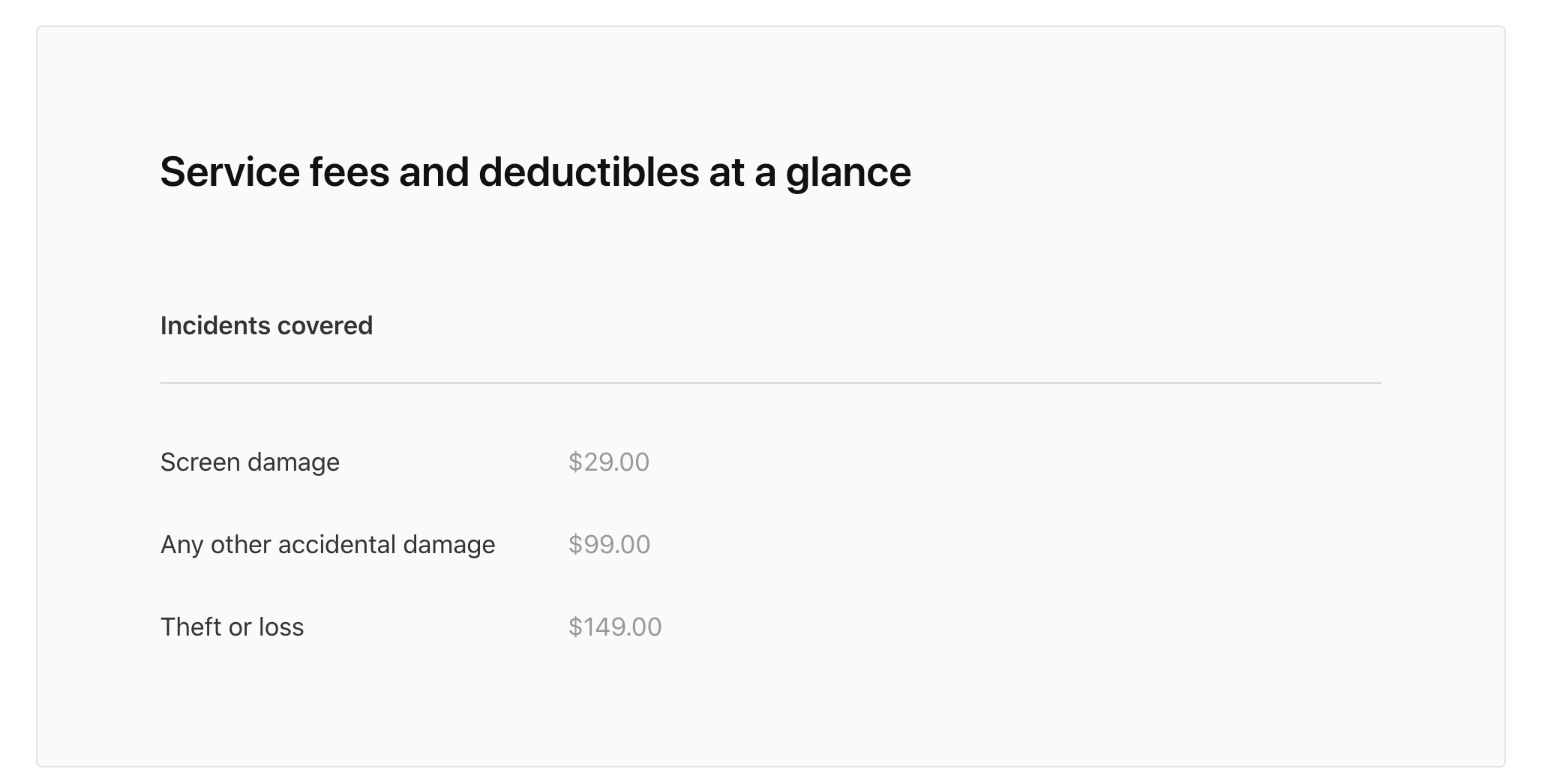

Let’s say you get a new iPhone and your carrier asks if you want to add Apple Care to your plan, which typically costs $9.99 per month. By opting out of Apple Care and paying your monthly bill with Amex Business Platinum, you’ll save about $120 per year. Additionally, Apple Care deductibles are much higher for other accidental damages (other than cracked screens) and theft or loss. Apple Care has the same limit as Amex Business Platinum of two claims every 12 months.

Save your time and money and count on the cell phone coverage that comes with your Business Platinum – it’s said to be as good as Apple Care.

Eligibility and benefits vary by card. Terms, conditions and limitations apply. Visit Americanexpress.com/benefitsguide for details. Insurance policies are underwritten by New Hampshire Insurance Company, an AIG Company.

When not to use Amex Business Platinum

While the Amex Business Platinum is a great card for the above situations, we know it’s not ideal for all purchases. Here are some situations where the Amex Business Platinum isn’t necessarily the best card to use:

Do not use your Amex Business Platinum for office supplies

While furnishing your office can be pricey (and can trigger the 1.5 points per dollar earning rate on purchases of $5,000 or more), smaller items such as stationery, office chairs or printer ink may not meet this limit. You’re better off using one card with office store or office supplies category rewards.

Do not use your Amex Business Platinum for company meals

Unless your tab costs $5,000 (or higher), you may want to avoid using the Amex Business Platinum for meals. Instead, many other rewards cards – both business and personal – offer them Great profit on restaurant purchases that makes a lot more sense than using your Business Platinum.

You can maximize your points with another card

If you want to continue earning and maximize Membership Rewards, consider signing up for a free annual subscription (see exchange rates and fees) Blue Business® Plus credit card from American Express. You’ll earn 2 points per dollar on the first $50,000 spent on purchases each year (after that 1 point per dollar), so if you max out those points, you’re looking at an additional 100,000 Membership Rewards points on purchases that leave your Amex Business Platinum short.

Bottom line

The Amex Business Platinum is one of the best business cards in the game, thanks to its huge earning potential and generous statement credits.

Now’s your chance to sign up for a card with a welcome bonus of up to 150,000 points.

For more details, see Full review of Amex Business Platinum.

Register here: Amex Business Platinum with a welcome offer of 150,000 points after spending $20,000 in the first three months.

For Amex Business Platinum rates and fees, click This.

For Blue Business Plus rates and fees, click This.