I was anti-Southwest until I got one of its credit cards — now I’m a convert

I’ve lived in the US for nearly a decade, and one of the strongest opinions I’ve encountered among travelers here is about Southwest Airlines. It seems like the only person more vocal than the people who hate this airline is Loyal fans.

I think there are valid arguments on both sides of the coin. And, actually, I was more of a Southwest hater for most of my time living here – until I got one of those. co-branded credit card.

At TPG, we don’t push credit cards just for fun; We promote those who offer best value to our readers. An airline credit card can make your travel more comfortable — and save you money in the process.

Currently, three airline personal cards – cards Southwest Rapid Rewards® Plus Credit Card, Southwest Premier Rapid Rewards® credit card And Southwest Rapid Rewards® Preferred Credit Card — is offering a high welcome bonus. If you sign up before June 26, you can earn 85,000 points after spending $3,000 in the first three months of opening your account.

So if you live near an airport with a Southwest presence, you should probably buy one of these. its credit card. Here’s how I became a Southwest convert after opening Southwest® Rapid Rewards® Performance Business Credit Card in 2023.

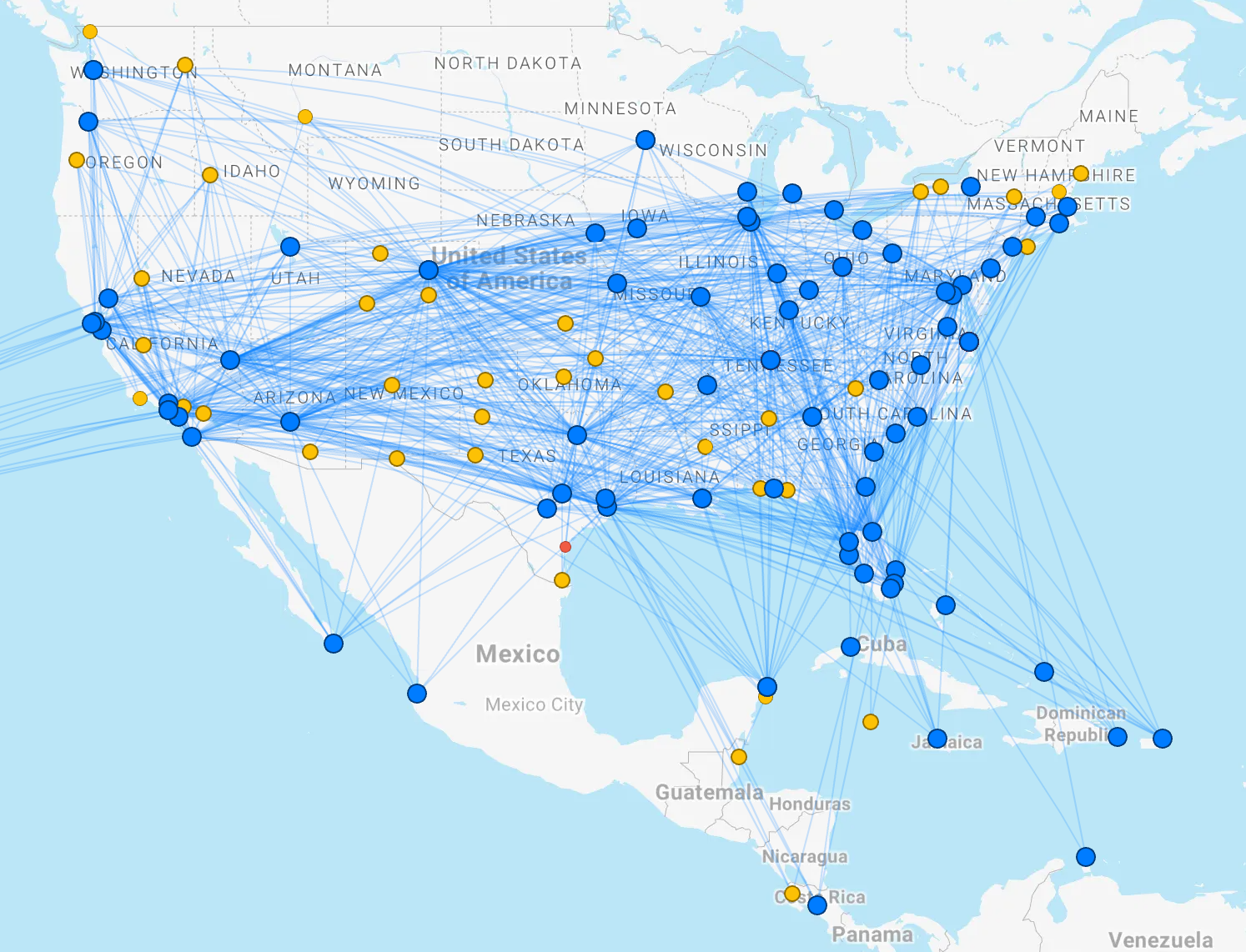

Extensive domestic flight network

First of all, Southwest has an extensive domestic flight network, making it easy to fly across the country.

The airline has a particularly strong presence in the eastern half of the United States, Texas and California, which includes a large portion of the country’s population. The airline also flies to Hawaii and several destinations in Mexico, the Caribbean and Central America.

Since I live in Austin, Southwest was an easy choice for me; it operates nearly 40% of the flights in and out of the airport. Plus, you’re just a short distance from Dallas Love Field (DAL) and Houston’s William P. Hobby Airport (HOU), Southwest’s fifth and seventh largest hubs, for easy one-stop connections across the service provider’s network.

Unparalleled versatility

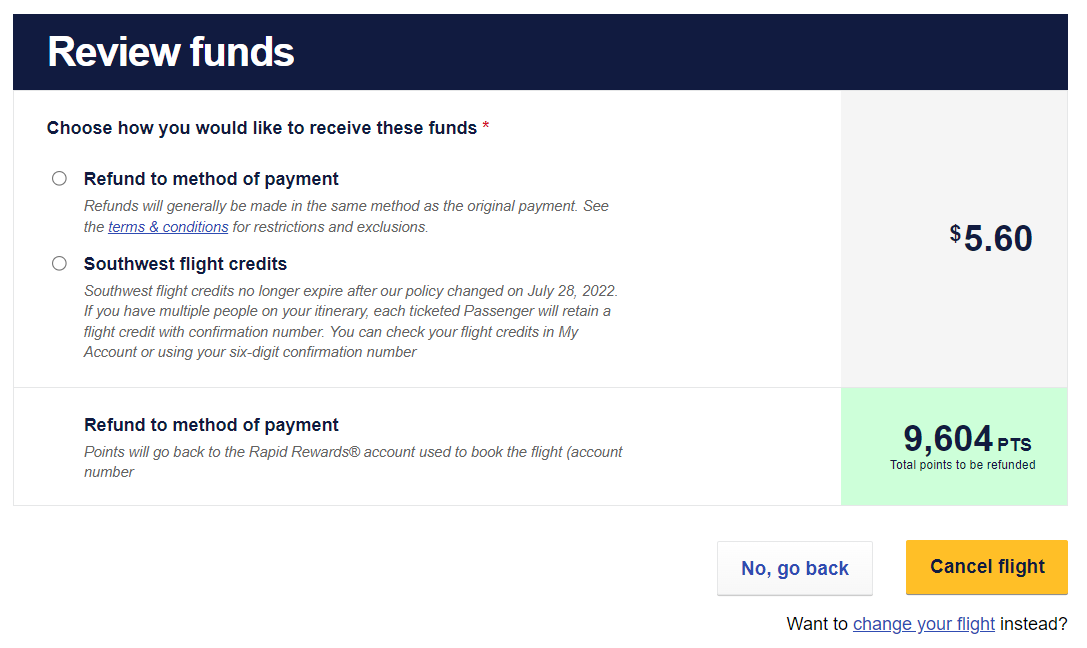

Southwest is proud to have it There are no cancellation or change feescan be useful for reward travelers and those who change plans at the last minute.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Case in point: This summer, I’m taking a break from the Texas heat to spend June in Chicago, July in Europe, and August somewhere else in the US. I wasn’t 100% sure where I wanted to spend my final month, so I booked some Southwest award flights to spend some time in Chicago or Portland, Maine.

I can cancel any flight up to 10 minutes before departure, which is an extremely generous policy, giving me the right to adjust my flight once my plans have settled.

Easily change flight tickets

I aim to get at least 2 cents of value from each frequent flyer point or mile I redeem across different programs. This is approx the value we peg coins of major issuers, incl Chase the ultimate bonus score And Capital One Mile.

The reward is quick to the southwest a flat redemption value of points of 1.3-1.5 cents per point may not provide too much value because the redemption rate is tied to the cost of the revenue fare. Still, it’s easy to understand, and I appreciate knowing that I’ll almost always get the same value from my Southwest points, no matter which flight I use them on.

Priority boarding

One of the main problems travelers encounter when flying on Southwest is uncertainty about which seat they will sit in. The carrier has an open seating policy with no pre-assigned seats. However, each Southwest credit card allows you to board select flights early each year.

Lower tier Plus cards, Premier cards and The flagship Southwest® Rapid Rewards® business credit card Each person provides two Sign up for EarlyBird each year. This allows you to automatically book your boarding spot 36 hours before your flight. It also means you don’t have to remember to check in 24 hours before departure.

The Priority and Higher Level Performance business cards offer four boarding upgrade each year. I find this perk very valuable because even if I forget to check in just 24 hours before departure, I can still get a boarding spot on plane A1-A15 (if available), which increases my chances of Society received my ticket. Get one of the best seats on the plane.

Regular sales

Southwest is quite generous with flash sales on both cash and award airfares.

Most of the flights I booked with Southwest cost 10,000-15,000 points each. However, by monitoring Southwest’s website and app, as well as transaction announcement on TPGI can often get discounts on new flights — and even flights I’ve already booked.

For example, I originally booked one of the flights to Portland mentioned above for 8,021 points plus $5.60 in taxes. Then, a week later, Southwest announced it Birthday promotion 50% off. The route and dates I booked qualified for the discount, so I canceled my original flight and then immediately rebooked it at a lower price, saving myself nearly 4,000 points to use on a future flight.

Reward commemorative points

Aside from the big 80,000-point welcome bonus I got for opening my Performance Business card and meeting the minimum spending requirement, I think you should keep your Southwest card for years to come—if you fly Southwest at least at least a few times per year.

In addition to all the perks mentioned above, I also receive 9,000 anniversary bonus points each year I keep the card; Those points are worth $117, according to TPG June 2024 valuation. This covers more than half of the card’s $199 annual fee.

The remaining four cards offer 3,000-7,500 anniversary bonus points. According to our calculations, these bonus points make up 56%-79% of the annual fee, depending on the card you hold.

Related: How to decide if a credit card’s annual fee is worth paying

Bottom line

Sometimes it’s important to admit that you made a mistake and make amends. I’m glad I finally signed up for the Southwest credit card because it has proven to be very helpful in booking flexible flights and upgrading my travel experience with Southwest.

If you want to get one of the three personal Southwest cards, aim for a bonus of at least 75,000 points. If you want a Companion Pass, Best time to apply is in February-March, when issuers tend to offer bonus points plus temporary Companion Passes, or in the last quarter of the year, when you can your application period to maximize your points earned for next year’s Companion Pass. If you just want bonus points, mid-year (May-June) is the best time for you.

If you’re looking to sign up for a Southwest business card, the welcome bonus doesn’t change often. So I recommend applying if you can get 60,000 points in Premium Business or 80,000 points in Performance Business.

To learn more, read our full reviews of — in order of annual fees from lowest to highest — Southwest More, Prime minister, Priority, Leading enterprises And Business performance card.

Register here: Southwest Plus

Find out more: Prime Minister of the Southwest

Register here: Priority is given to the Southwest

Register here: Leading enterprise in the Southwest

Register here: Southwest Performance Business

Related: Compare Southwest Express Rewards Preferred, Premier, and Plus credit cards