IHG One Rewards Premier Credit Card review: Valuable benefits for IHG loyalists

Editor’s note: This is a recurring post, regularly updated with new information and offers.

IHG One Rewards Premier Credit Card overview

The IHG One Rewards Premier Credit Card offers many beneficial perks for frequent IHG travelers and a big welcome bonus. With an annual fee of $99, however, you may not get enough ongoing value from this card if IHG One Rewards isn’t your primary hotel loyalty program. Card Rating*: ⭐⭐⭐⭐

*Card Rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

The IHG One Rewards Premier Credit Card offers a lot of perks for travelers who frequently stay with IHG. For example, you’ll get automatic Platinum Elite status as long as you’re a cardholder. The card also offers a unique fourth-night-free reward perk that allows cardholders to pay zero points for every fourth night when redeeming points for award stays of four nights or longer.

With a solid return on IHG spending and plenty of perks, IHG One Rewards loyalists will benefit from this card. Even travelers who only stay with IHG several times a year may get ample value from the IHG Premier Card.

But, one perk alone — the anniversary-free night each year, valid for a night costing up to 40,000 points — can easily provide enough value for you to justify paying the IHG Premier’s annual fee each year. Premier cardmembers can also top off their award nights with points, allowing you to use the certificate to stay at higher-priced hotels like the Six Sense Laamu in the Maldives.

Note that the recommended credit score for this card is at least 670. Now, let’s look at whether the IHG Premier Card is a good choice for you.

IHG One Rewards Premier pros and cons

| Pros | Cons |

|

|

IHG One Rewards Premier welcome offer

The IHG One Premier Card is currently offering new cardholders a bonus of 5 Free Nights (each free night valued up to 60,000 points) after spending $4,000 on purchases in the first three months of account opening. TPG’s July 2024 valuations peg IHG points at 0.05 cents each, making this bonus worth $1,500.

This is the best offer we have seen on this card, and it should be highly considered if you’ve been thinking about opening it.

Note that you won’t be eligible for this card (or its bonus) if you currently have any IHG personal credit card or have earned a welcome bonus on another IHG personal credit card within the last 24 months. However, this rule doesn’t apply to holding the IHG One Rewards Premier Business Credit Card or bonuses earned on that card.

Related: The best time to apply for these popular Chase credit cards based on offer history

IHG One Rewards Premier benefits

The IHG One Premier Card carries a relatively modest $99 annual fee. However, the card’s actual value hinges on whether you’ll use the benefits frequently enough to justify that annual fee. Here’s an overview of the card’s main IHG-related perks:

Anniversary free night: Cardholders receive a reward night certificate valid for a one-night hotel stay at a property costing up to 40,000 points. This benefit is annual, starting on the first account anniversary. Although IHG uses dynamic award pricing, finding an appealing redemption option for your certificate isn’t difficult. For example, I’ve redeemed anniversary free night certificates for stays at the InterContinental Buenos Aires, InterContinental Madrid and Kimpton De Witt.

Note that you can use an unlimited number of points to top off this certificate and use it for higher-priced properties. For example, you can book a room priced at 55,000 points using the free night plus 15,000 points from your IHG One Rewards account.

Complimentary IHG Platinum Elite status: IHG One Rewards Platinum Elite members enjoy 60% bonus earnings on paid stays when booking directly with IHG One Rewards, room upgrades based on availability at check-in, a welcome amenity and several other perks. There is also a pathway to Diamond status.

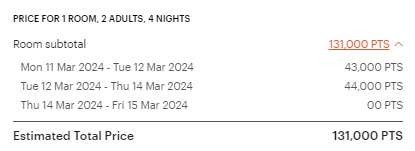

Fourth-night-free reward: When you redeem points for a stay of four nights or longer, you’ll pay zero points for every fourth night. If you can find four nights of consecutive award space at a property you like, this can be a great way to stretch your points even further. Of course, the value of this perk depends on how frequently you redeem IHG points for stays of four nights or more.

10,000 bonus points after spending $20,000: You’ll earn 10,000 bonus points and a $100 statement credit after spending $20,000 in a calendar year. Based on TPG’s July 2024 valuations, these bonus points are worth $50; combined with the statement credit, this bonus can be worth up to $150. However, consider whether you’ll realistically spend $20,000 on your card during your account anniversary year — especially if you can otherwise put those purchases on an everyday spending card with a better earning rate.

20% off when buying IHG points: Save 20% on your purchase of IHG points when you pay with your IHG Premier Card. However, this discount doesn’t stack with other discounts when IHG puts points on sale. Also, these points are considered non-qualifying and will not count toward elite qualification, so the value will be minimal for most cardholders.

Additionally, IHG Premier cardholders enjoy the following general perks when using their card:

- Application fee credit for Global Entry, TSA PreCheck or Nexus: You can get reimbursed up to $100 every four years when you charge a Global Entry, TSA PreCheck or Nexus application fee to your card.

- United TravelBank cash: You can get up to $50 of United TravelBank cash per calendar year.

- Travel and purchase protections: You’ll get perks like trip cancellation/interruption insurance and purchase protection.

As other cards drop shopping and travel protections, these benefits could be a serious factor when choosing a new credit card. However, as discussed in the next section, you won’t get a high return rate on most purchases with the IHG Premier Card.

Related: Register now: Complimentary IHG Platinum status for select United credit card holders

Earning points on the IHG One Rewards Premier

Hotel credit cards tend to be weak on the earning front, but this card’s earning rate at IHG hotels is pretty solid.

You’ll earn 10 points per dollar spent at IHG hotels and resorts. And, when you combine the 10 points per dollar spent by using your card with the points you’ll earn as an IHG Platinum Elite, you’ll earn 26 points per dollar spent on most IHG stays.

In addition, cardmembers earn 5 points per dollar spent on travel, dining and gas purchases, plus 3 points per dollar spent on all other purchases. This is a decent return for these bonus categories but is easily beaten by many other cards.

Related: 7 ways to earn IHG One Rewards points

Redeeming points on the IHG One Rewards Premier

IHG One Rewards does not have an award chart. Instead, it uses dynamic award pricing. IHG’s website states that nights start at 10,000 points, although we’ve seen nights priced as low as 5,000 points. And although there’s no stated maximum, the highest I’ve seen is 120,000 points per night (excluding Six Senses and Mr & Mrs Smith properties, which do frequently cost more).

But, even with IHG’s dynamic award pricing, it’s still possible to maximize IHG One Rewards redemptions. And, with a little bit of searching, you can often redeem IHG One Rewards points for a greater value than 0.5 cents per point.

You also can mix points and cash for your award stays. In some cases, this may provide good value. When you book this way, IHG sells you the extra points and then debits your account for the full number of points. In this example, you’d effectively purchase IHG points for 0.63 to 0.66 cents each. IHG frequently sells points at this price (or cheaper), which can be another way to top up your account.

It’s also worth mentioning the IHG Premier’s fourth-night-free reward perk again. When you book a reward night of four nights or longer, every fourth night of that stay will cost zero points. You can use this perk unlimited times each year, but points and cash stays are not eligible.

TPG credit cards editor Emily Thompson takes advantage of this perk as often as possible to maximize her IHG One Rewards points.

Finally, some travelers believe IHG’s policy on blackout dates makes it one of the weaker hotel programs for award night availability. The terms and conditions of the IHG One Rewards program note the following:

There are no blackout dates for Reward Nights; however, room inventory is limited and subject to prior sale. In addition, Members may not be able to redeem Points for Reward Nights at InterContinental Residences, IHG Army Hotels, select Six Senses Hotels Resorts and Spas and select Mr & Mrs Smith hotels.

So, while there are no blackout dates per se, hotels can limit the number of rooms they make available for award bookings.

Related: How to redeem points with the IHG One Rewards program

Transferring points on the IHG One Rewards Premier

IHG One has over 40 airline transfer partners, but we don’t recommend using your points this way. Points transfer at a nearly 5:1 ratio, which is on the lower side. Plus, transfers from IHG have been known to take an extended period of time.

You can also transfer your points to other IHG One Rewards members, starting at $5 per 1,000 points. However, these transfers are free for Diamond and IHG Business Rewards Program members up to 500,000 points per calendar year.

Related: Now you can transfer IHG points to others for free: Here’s how

Which cards compete with the IHG One Rewards Premier?

If you’re loyal to IHG, a card from another hotel brand might not merit your consideration. However, another card might suit your needs better.

- If you prefer IHG perks with no annual fee: The IHG One Rewards Traveler Credit Card has no annual fee and earns 5 points per dollar at IHG hotels and resorts, 3 points per dollar at gas stations, utilities and restaurants and 2 points per dollar on other purchases. Benefits include automatic Silver status with IHG One Rewards, a 20% discount on IHG points purchases and a fourth night free on award stays. For more information, read our full review of the IHG One Rewards Traveler Credit Card.

- If you prefer more flexible rewards: The Chase Sapphire Preferred® Card has a $95 annual fee and allows for 1:1 points transfers from Chase Ultimate Rewards to IHG One Rewards as well as 13 other travel partners. For more information, read out full review of the Chase Sapphire Preferred card.

- If you prefer a business card: The IHG One Rewards Premier Business Credit Card has similar benefits to the IHG One Rewards Premier card, including the fourth night free and the free anniversary night perk, but it will not count toward Chase’s 5/24 rule. For more information, read our full review of the IHG One Rewards Premier Business card.

For additional options, check out our full list of the best hotel credit cards.

Related: The best credit card for IHG stays

Is the IHG One Rewards Premier worth it?

If you’re an IHG loyalist, you’ll easily get enough from this card’s benefits to justify the $99 annual fee. The anniversary night alone could cover the annual fee. However, those who only occasionally stay at IHG properties will likely prefer a card with different benefits.

Related: Why I often choose IHG and Choice hotels despite limited elite perks

Bottom line

If you’re a loyal IHG traveler looking to make the most of IHG One Rewards, having the IHG One Rewards Premier Credit Card makes sense. After all, the card provides perks like automatic Platinum Elite status, a fourth-night-free reward on award stays of four or more nights and a large bonus multiplier for IHG stays. Still, some might find this isn’t the one for their travel and spending habits.

Apply here: IHG One Rewards Premier Credit Card