New to chasing the ultimate reward? Here are 3 easy ways to redeem 75,000 points

There has never been a better time to consider signing up for one Chase the Sapphire card, with both cards currently offering high welcome bonuses for a limited time only. These are the highest rewards we’ve seen on these two popular cards in more than a year.

The Chase Sapphire Preferred® Card currently offers 75,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening, as well as:

- 5 points per dollar spent on Lyft (through March 2025)

- 5 points per dollar spent on all travel purchased through Chase Travel℠

- 3 points per dollar spent eat and drinkIncludes eligible delivery, takeout and dining out services

- 3 points per dollar spent on select streaming services

- 3 points per dollar spent on online groceries (excluding Target, Walmart and wholesale clubs)

- 2 points per dollar spent on everything else tourism

- 1 point per dollar spent on all other purchases

Sapphire Preferred does There are no foreign transaction fees and have Many travel perksincluding baggage delay insurance, Trip interruption/cancellation insurance And Primary car rental insurance.

Meanwhile, Reserve Chase Sapphire® currently offers 75,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months of account opening and also earn:

- 10 points per dollar spent on Lyft (through March 2025)

- 10 points per dollar spent on Chase Dining booked through Ultimate Rewards

- 10 points per dollar spent on hotels and car rentals through Chase Travel

- 5 points per dollar spent on air travel booked through Chase Travel

- 3 points per dollar spent on travel not booked through Chase

- 3 points per dollar spent on other food purchases

- 1 point per dollar spent on all other qualifying purchases

Other perks include ease of use Annual travel credit valued at $300, a fee credit for Global entry or TSA Pre-Check (up to $100 every four years) and Select priority card the right to use the waiting room as well as the right to enter the waiting room growing list of new Sapphire lounges. Cardholders also receive primary car rental insurance, trip interruption/cancellation insurance, and other protective measures.

Pursuit points are really valuable because there are many ways you can use them. We generally recommend maximizing these points by transfer them to airline and hotel partner programs but be aware that this can be complicated to navigate if you’re a beginner.

If you are not familiar with it Chase card and haven’t earned your Ultimate Rewards yet, you might be daunted by the plethora of redemption options — but don’t worry. We’re looking at easy ways Chase Ultimate Rewards beginners can get real value from 75,000 points without much effort.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Related: Complete guide to Chase Ultimate Rewards

Book travel through Chase Travel

You can use your Ultimate Rewards points to easily reduce the cost of almost any airfare, hotel stay, car rental or experience when you book travel around the world through Chase travel portal. You don’t have to worry about airline partners, alliances, or award eligibility by using your Chase points this way.

As one Chase Sapphire preferred cardholders, when you redeem points for travel, each point is worth 1.25 cents. If you have Chase Sapphire Sanctuary, each of your points is worth 1.5 cents to redeem for travel points in the portal. This means the current 75,000-point welcome bonus would be worth $937.50 if you have the Preferred card, or $1,125 if you have the Reserve card.

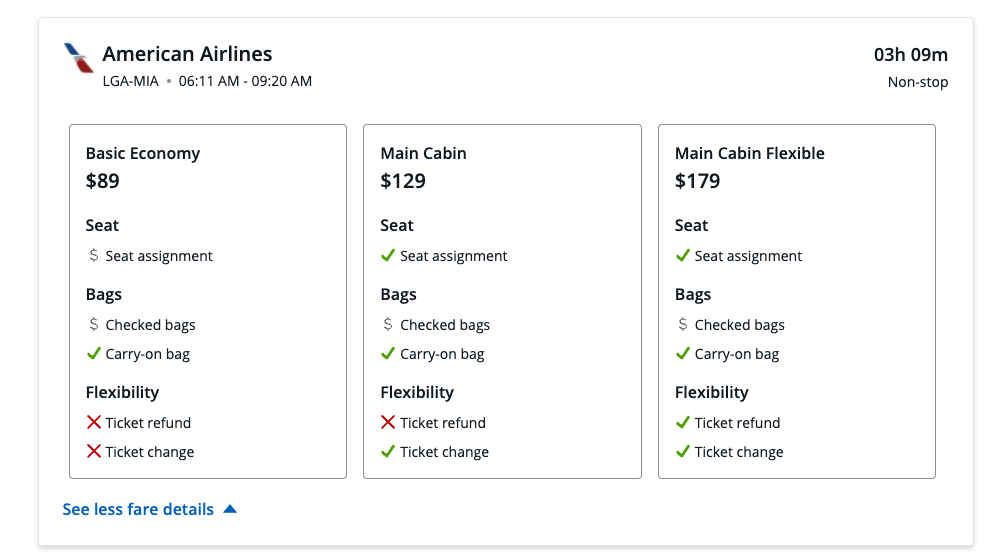

If you want to book a Main Cabin flight from New York’s LaGuardia Airport (LGA) to Miami International Airport (MIA) for $129 through Chase Travel, you can choose to reduce the price to $0 by redeeming Ultimate points Rewards.

If you have the Chase Sapphire Preferred, each of your points will be worth 1.25 cents, so you can use 10,320 Ultimate Rewards points to get the price down to zero (or a combination of cash and points, if you want ).

If you have a Chase Sapphire Reserve, each of your points will be worth 1.5 cents, so you can only use 8,600 Ultimate Rewards points to get the price down to zero. Another way to think about this is rewards Welcome 75,000 points on the Sapphire Reserve would be enough to take a family of four round-trip to Florida on American Airlines cash-free if redeemed for Ultimate Rewards through Chase Travel.

Get extra cash back on gas purchases, pets, and charitable donations

by Chase Give me my money back option allows cardholders to use points with the same redemption value for travel bookings. This typically doesn’t give you the maximum value for your Ultimate Rewards Points that you can get when using transfer partners strategically; however, it can be a good option if you’re looking for a simple refund or have a pile of points you don’t need to use right away.

You can redeem your Ultimate Rewards points at the above rate of 1.25 cents per point Chase Sapphire preferred or 1.5 cents above Chase Sapphire Sanctuary as statement credits for donations you make to the following charities through June 30:

- American Red Cross organization

- Equal Justice Initiative

- Feeding America

- GLEN

- Living environment for humanity

- International Medical Corps

- International Rescue Committee

- Leadership Conference Education Foundation

- Make-A-Wish America

- NAACP Legal Defense and Educational Fund

- National Urban League

- Advocates for a Fair & Equal Workplace

- SAGE

- Thurgood Marshall College Fund

- Negro United College Fund

- UNICEF USA

- unified way

- World Central Kitchen

If you have a Reserve card, you can use the Cash Back Yourself feature to redeem Ultimate Rewards points for 1.25 cents each on purchases at gas stations, stores and pet supplies, wholesale club and cardholder annual fees.

If you want, you can reduce the Reserve card’s annual fee to zero in the first year by redeeming 44,000 Ultimate Rewards points while still enjoying all the perks of the Reserve card.

Applying for credit through Chase’s Pay Yourself Back program is relatively simple. Log in to your eligible Chase account via the mobile or desktop app and select the “Pay Yourself Back” option in the redemption menu.

Next, you’ll see a list of purchases that are eligible to redeem points. Points can be redeemed for purchases within 90 days. You can offset the full purchase amount, assuming you have enough points to cover it, or you can redeem a smaller amount if you prefer.

From there, you can confirm the redemption value and required number of points and then choose to complete the transaction. Your statement credit will post within three business days.

Save money on all purchases

Another easy way to use your Ultimate Rewards is to earn statement credits on every purchase. You can redeem 1 Ultimate Rewards point to save 1 cent on any purchase you make on either card. This means 75,000 points can save you $750 on any purchase you like, even if you’re not traveling.

If you want to save money on everyday purchases, this can be an easy way to do it. When you receive your monthly credit card statement, you can apply as many Chase points as you like to reduce your balance.

Bottom line

While you’ll get the most value from your Ultimate Rewards by transferring them to airline and hotel partners in exchange for premium cabin flights and luxury hotel stays, But you might want a simpler way to save money on everyday purchases.

If you’re new to Ultimate Rewards, here are simple ways to save every day. Don’t miss the 75,000 Ultimate Bonus welcome bonus available on Chase Sapphire Preferred Card and Chase Sapphire Sanctuary.