Nvidia is reportedly developing a new version of its Blackwell AI chip specifically for the Chinese market.

The biggest beneficiary of the AI boom is still trying to figure out how to sell chips to China without running afoul of Washington’s chip controls.

Nvidia is developing a new version of its flagship AI chip for the Chinese market, Reuters reported The US chip designer is said to be working with Inspur, one of its main distributors in China, to help launch and sell a China-specific version of the Blackwell chip, the sources said.

Neither Nvidia nor Inspur immediately responded to Fortune’s request for comment.

The US has controlled Nvidia’s AI chip sales to China since October 2022. Nvidia has tried to develop new chips that comply with US regulations, but violated Washington’s ban. tighten the screws further and Chinese customers beware a less powerful product.

Before the U.S. imposed chip export controls, China accounted for a quarter of Nvidia’s data center revenue. Data center revenue is in line with the company’s chip business. The company acknowledged in May that data center revenue in China has dropped significantly since Washington expanded its chip controls in October 2023.

Still Nvidia is on standby sold more than a million H20 chips, currently the most advanced chips on the Chinese market, this year, according to research firm SemiAnalysis. The firm expects H20 sales to generate $12 billion in revenue for the U.S. chip designer this year. (The company has $60.9 billion on revenue for the most recent fiscal year, ending January 2024.)

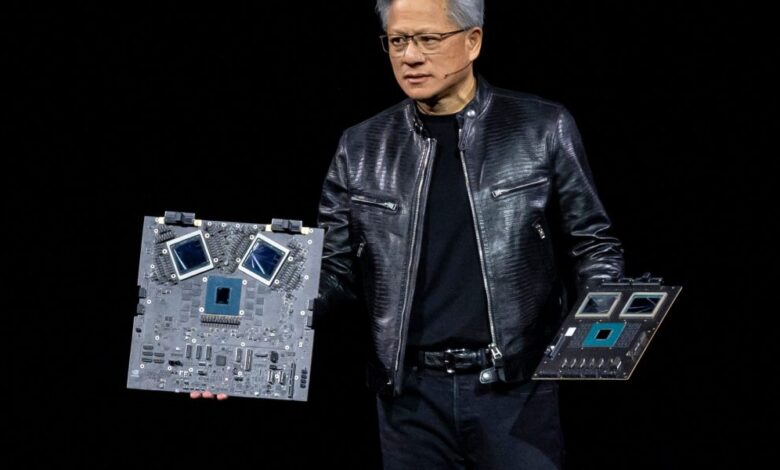

Nvidia launches Blackwell chip line Marchwith plans for mass production later this year. The company claims the new platform will allow users to run real-time generative AI applications at significantly lower costs than previous platforms.

The United States has shown no signs of easing pressure on export controls related to semiconductors.

Washington is reported pressure the Netherlands and Japan to further restrict access to Chinese chipmaking equipment, including considering adopting regulations that would give China jurisdiction over any products using US technology.

Nvidia shares rose about 1.5% in premarket trading on Monday. The company’s shares fell nearly 10% last week following reports of potential regulatory expansion, as well as former President Donald Trump comment that the island of Taiwan, a chip manufacturing hub, should pay for its own defense.

CEO Daily provides key context for the news leaders need to know from across the business world. Every weekday morning, more than 125,000 readers trust CEO Daily for insights from—and inside—the C-suite. Follow now.