Seven wild moments from its tumultuous history

Getty

GettyBitcoin price surpassed the $100,000 mark for the first time, reaching a new record high.

The value of the world’s largest cryptocurrency has been boosted by hopes that US President-elect Donald Trump will adopt crypto-friendly policies.

The milestone was reached hours after Trump said he would nominate former US Securities and Exchange Commission (SEC) commissioner Paul Atkins to run the Wall Street regulator.

Mr. Atkins is considered more pro-crypto than the current head of the SEC, Gary Gensler.

The $100,000 milestone has crypto fans around the world celebrating.

Bitcoin’s wildly fluctuating value always attracts interest, and its supporters react with glee when it has has surpassed the previous price threshold – and defiance during its decline.

But this particular milestone was especially anticipated. For weeks, charts, memes and predictions have spread across social media about when the price will hit what is considered one of the holy grails of the crypto world.

Millions of viewers even tuned in to watch parties online as prices hovered near $100k.

The value of one bitcoin is one of the measures of optimism in the cryptocurrency industry, which is currently estimated to be worth $3.3 trillion, according to analytics firm Coin Market Cap.

Trump’s election victory last month was the catalyst for the latest price increase.

The president-elect has vowed to make the United States the “crypto capital of the planet” – a notable move given his recent 2021 call for Bitcoin a “scam.”

What’s also notable is how much Bitcoin’s price has skyrocketed. The $100k valuation represents a 40% increase on election day in the US and is more than double the price at the start of the year.

Reuters

ReutersBut there’s more to Bitcoin than the rapid changes in its value.

From the mysterious inventor to the bringing down of the so-called King of Cryptocurrency, it’s a story with many twists and turns, which has seen the making – and loss – of huge fortunes.

So here’s the BBC’s list of seven of the craziest moments – so far – in Bitcoin’s tumultuous history.

1. The mysterious creator of Bitcoin

Despite its huge reputation, no one really knows for sure who invented Bitcoin. The idea for it was posted on internet forums in 2008 by someone calling himself Satoshi Nakamoto.

They explain how a peer-to-peer digital currency system could work to allow people to send virtual money over the internet, as easily as sending an email.

Satoshi created a complex computer system that could process transactions and create new coins using a huge network of self-appointed volunteers around the world who used Special software and powerful computer.

But he — or they — never revealed his identity, and the world never resolved it.

Retainer

RetainerIn 2014, Japanese-American man Dorian Nakamoto was chased by reporters who claimed he was the creator of the elusive Bitcoin, but that was proven false due to some mistranslations. .

Australian computer scientist Craig Wright said it was him in 2016 – but after years of legal battles, a Supreme Court judge concluded that he was not Satoshi.

Earlier this year, a Canadian Bitcoin expert named Peter Todd strongly denies being SatoshiWhile in London this month, a British man, Stephen Mollah, claimed that he had – but no one believes him.

2. Make history with pizza

Bitcoin is currently underpinning the two trillion dollar cryptocurrency industry – but the first recorded transaction using it was the purchase of pizza.

On May 22, 2010, Lazlo Hanyecz offered $41 worth of Bitcoin on a cryptocurrency forum in exchange for two pizzas.

A 19-year-old student did his duty and this day went down in history for fans of this currency as #BitcoinPizza day.

A source of memes for those in the crypto community, it also demonstrates the power of Bitcoin – a real internet currency that can buy items online.

Criminals must have been watching too because within a year the first darknet market was launched to sell drugs and other illegal goods in exchange for Bitcoin.

The current deal looks pretty bad for Lazlo. If he had kept those coins they would now be worth hundreds of millions of dollars!

3. Become legal tender

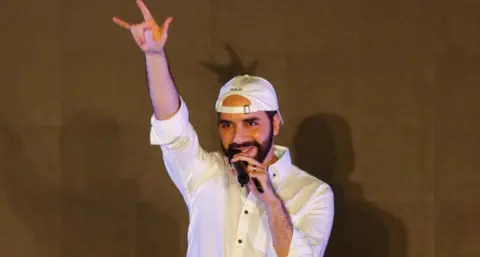

In September 2021, President Nayib Bukele of El Salvador, Central America, made Bitcoin legal.

Hairdressers, supermarkets and other stores must accept Bitcoin by law, along with the main currency, US dollars.

Many reporters and Bitcoin enthusiasts visited the area, quickly boosting tourism in the country.

Although President Bukele hoped the move would increase investment in his country and cut costs for people to exchange money, it has not become as popular as he expected.

He still hopes it will succeed but for now the US dollar is still king in the country.

Reuters

ReutersAs well as the huge amount of public money that President Bukele has spent trying to get people to embrace Bitcoin, he has also caused controversy by purchasing more than 6,000 bitcoins in the past few years.

The president has spent at least $120 million buying bitcoin at various prices in hopes of making a profit for his cash-strapped country.

It starting to look good for him in December 2023, when his stash soared in value for the first time.

A website built by Dutch software engineer Elias Zerrouq country’s Bitcoin tracker holdings and it is now estimated that the coins have increased 98% in value.

4. Kazakhstan’s Cryptocurrency Boom and Bust

In 2021, Kazakhstan became a hotspot for Bitcoin mining – the complex mathematical processing that underpins cryptocurrency transactions.

Today, there are warehouses full of the latest computers running day and night, but the reward is brand new bitcoins for the companies that participate.

Computer storage requires a lot of energy – and many businesses have moved to Kazakhstan, where electricity is abundant thanks to its huge coal reserves.

At first, the government welcomed them with open arms when they brought investment.

But too many miners arrived and put a huge strain on the power grid, leaving the country at risk of blackouts.

Within a year, Kazakhstan’s Bitcoin mining industry has grown from boom to bust as governments impose restrictions and raise taxes to curb growth.

Around the world, it is estimated that the Bitcoin network uses as much electricity as a small country, raising concerns about its environmental impact.

5. Bitcoin in landfill

Imagine having a crypto wallet worth over $100m (£78m) – and then accidentally thrown away a hard drive containing login information.

That’s what James Howells, from south Wales, says happened to him

The nature of cryptocurrency means recovery isn’t as easy as resetting your password. There is no bank involved – no customer support helpline.

James Howells

James HowellsUnfortunately for him, the local council in Newport refused him access to the landfill where he said the device ended up – even after he offered to donate 25% of his Bitcoins to local charities if they let him.

“It was the moment of dropping a penny and it felt like sinking,” he told the BBC.

6. Cryptocurrency King Scammer

No one has lost as much Bitcoin as former billionaire and cryptocurrency mogul, Sam Bankman-Fried. The founder of the giant cryptocurrency company FTX is known as the King of Cryptocurrency and is loved by the community.

FTX is a cryptocurrency exchange that allows people to trade regular money for cryptocurrencies like Bitcoin.

Reuters

ReutersHis empire was worth about $32 billion and he was flying high until everything fell apart in a matter of days.

Journalists discovered that Bankman-Fried’s company was in financial trouble and had illegally transferred FTX customers’ funds to support his other company, Alameda Research.

Just before his arrest at a luxury apartment complex in the Bahamas in December 2022, he spoke to reporters. He told the BBC: “I don’t think I committed fraud. I don’t want anything to happen. I’m definitely not as competent as I think I am.”

After being extradited to the US, he was convicted of fraud and money laundering. imprisoned for 25 years.

7. Investment banking boom

Despite all the volatility, Bitcoin continues to attract attention from investors and large companies.

In fact, in January 2024, some of the world’s largest financial companies added Bitcoin to their official asset list in the form of a spot Bitcoin ETF. They are like stocks and shares, linked to the value of Bitcoin but you don’t have to personally own any.

Customers have poured billions of dollars into these brand new products. Companies including Blackrock, Fidelity and GrayScale, have also Buy Bitcoin in thousandspushing its value to a record high.

It’s a major milestone for cryptocurrency as some fans believe Bitcoin is finally being taken as seriously as the mysterious Satoshi imagined.

However, few would object to wilder moments as the Bitcoin saga continues to unfold.