Some premium cards now require an ‘ultra-coupon’ mindset

Up to $50 Saks Fifth Avenue statement credit every six months (January-June and July-December; maximum $100 per calendar year). Up to $20 monthly Credit statement for digital entertainment (up to $240 per calendar year). Up to $300 annual Equinox statement credit every calendar year.

Additionally, up to $15 in Uber cash monthly on US purchases (but remember up to $20 bonus in December; up to $200 per calendar year).* Up to $200 statement credit per calendar year for fees incurred by the airline – but not plane tickets. Up to $200 statement credit per calendar year for stays booked through Amex Fine Hotels + Resorts Program. Registration is required to receive select benefits; Terms apply.

And all of that is just the beginning.

No, that’s not a list of options from a fancy coupon book. Those are some of the benefits for those earning $695 per year. American Express Platinum® Card (see exchange rates and fees).

While my brain almost loves finding and tracking deals and travel perks, I even get mentally tired of keeping up with all the mid-sized and Small variations are provided by the growing tag list.

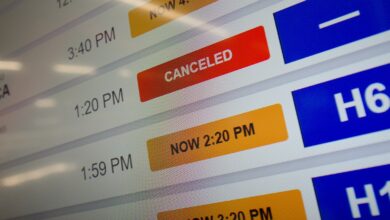

While in the past premium cards offered shorter lists of most important perks, they have now gone the route of longer perks lists, higher annual fees, and to move up ahead, you almost need to have thought about a coupon that is extremely focused on luxury.

*You must have downloaded the latest version of the Uber App and your eligible American Express Platinum Card must be the payment method in your Uber account. You must pay for your Uber ride with an Amex card to use Uber Cash.

The list of perks keeps getting longer – and more confusing

An issuer adding more card perks and benefits is generally a good thing. However, when you get to the stage where you need a spreadsheet to keep up with all the different benefits and whether you use them each month, it can be a sign that things have gone too far.

the Amex platinum itself currently has at least eight different built-in statement credits divided across time frames ranging from monthly to semi-annual, annual and quadrennial.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides and exclusive offers from TPG experts

And that’s not even mentioning the different category bonuses and the benefits and protections that come with including different fees on the card or the many different ways you can use the offer bonus Celebrate and continuously earn points with the card.

The credit alone is more than enough to offset the current $695 annual fee. But they’re only worth it if you use them – whether you get a $15 monthly Uber Cash credit, a $20 monthly statement credit for tech entertainment services eligible number (limited) and up to $50 Saks credit every six months?

the Reserve Chase Sapphire® There are fewer credits and periodic reporting categories. However, if you want to take full advantage of this feature, you will need to move Peloton monthly subscription through that card.

Then there is $300 annual travel creditLuckily, it’s quite easy to use.

But wait – there’s more. Holders of the co-branded American Express Hilton, Marriott and Delta cards will receive credits at U.S. restaurants and at select lodging establishments, depending on the card. These are even benefits that require monthly tracking and sometimes meticulous planning.

Simpler can be better

I personally went before card issuers rolled out all these different credits and perks. But I know I’m not a normal card user in that regard.

The less obsessed people I know, such as my husband, parents, and most friends, wouldn’t start switching the cards they use for this, that, and the other simply to Earn a few dollars in statement credits available here and there.

It may be “easy,” but it still takes up brain space, and that can be in short supply in an already stressful reality.

While not every card perk can fall into the category of a $300 annual travel credit, there’s something to be learned from the simplicity of that credit on Reserve sapphire. You can use it as quickly or slowly as you like during that year, and you can use it for many expenses that fall under “travel.”

the Amex Platinum The annual digital entertainment statement credit of up to $240 per calendar year is a good example of the opposite side of the simplicity fence.

This credit is divided into monthly installments of up to $20. It doesn’t match any old digital entertainment, only premium from select brands: Disney+, Hulu and ESPN+ – or Disney Bundle – Peacock, The New York Times and The Wall Street Journal.

It could be a much more user-friendly benefit if it were valid across a wider group of providers – such as for any streaming service.

Additionally, even if the list of providers is kept short or if the credit is only available for use on an annual basis rather than in monthly installments, it may be easier to take advantage because most listings Subscriptions are cheaper when paid annually instead of monthly or quarterly.

the American Express® Gold Card providing up to $20 in possible monthly stipends used for eating and drinking per calendar year, but one of the credits is up to $10 for Uber Cash in the US, while the other goes up to $10 Valid only at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and Five Guys.

You will receive up to $120 in dining credits annually and up to $120 in Uber Cash each year (You must have downloaded the latest version of the Uber App and your qualifying American Express Gold Card must be payment method in your Uber account. You must pay for your Uber ride with an Amex card to use your Uber Cash.). Registration is required for select benefits and terms apply.

Additionally, cardholders receive up to a $7 monthly credit at Dunkin’ (up to $84 per calendar year) and up to $100 per calendar year for Credit Resy. Resy credits are easier to use than you might think because any restaurant that signs up for Resy is eligible and no reservations are required. Resy credits are distributed periodically every six months in increments of up to $50.

All of these benefits come at a lower annual fee than the Amex Platinum at $325 per year (see exchange rates and fees).

I like the occasional free slice of cheesecake from The Cheesecake Factory as much as the next person, but the card wants to guide users to choose it for most dining charges by default. It would be significantly easier if it offered valid monthly dining credits at all dining locations. Registration is required for select benefits and terms apply.

Related: Is Amex Gold worth the annual fee?

How to come out ahead

I get more value in points, perks, and credits from each card in my wallet than I do from paying an annual fee. Otherwise, I will quickly throw that card away. But I’m willing to spend some mental energy to maximize most – though not all – of the perks my particular card offers.

You need to be very honest with yourself about what you’re willing and able to do to leverage value from your premium card. Certainly, Amex Platinum’s premium offers a variety of creditsBut which one will you actually use?

I can hardly use the Equinox credit of up to $300 per calendar year and have yet to figure out how I want to use the digital entertainment credit of up to $240 per calendar year.

You probably don’t care about the up to $50 Saks credit every six months, or probably won’t use up to $15 monthly in Uber Cash (with up to $20 added the following month). 12). That’s okay — you can skip some perks and still get stuck with that card, but be realistic about your situation from the beginning and at least before each account anniversary when you’ll again owe that annual fee.

But after you’ve calculated what you will and won’t actually benefit from, it’s helpful to have a tool that reminds you of different privileges. This is especially true if you have more than one or two cards in your wallet.

Maybe it’s a Google or Excel Sheet you set up that lists all the card credits you check monthly, or a sticky note on your computer or a label on a physical card in your wallet.

Whatever you need to do, remember to use Uber Cash monthly up to $15 (in the US) with Amex Platinum Card (up to $20 extra in December) or for use Amex Gold to pay for a monthly meal at Five Guys or Cheesecake Factory, having some sort of tracking system is the only way to really keep up with it all.

Choose the credits you’re most interested in, and at least have a list that you refer to monthly if you want to make sure you’re not leaving valuable ones behind Credit statement on the table.

Related: How the Amex Platinum Card Gave Me Access to Over $3,000 in Value This Year

Bottom line

It’s great that rewards credit cards have evolved with new lifestyles and everyday benefits that keep them relevant in a world where travel isn’t always at the top of everyone’s to-do list. However, this approach to evolution has put us in a position where we must adopt a couponer’s mindset to get real value from cards with annual fees of $500 or more.

Many of the new benefits require a penny-pinching approach to maxing out $10 and $20 statement credits that are typically only available at a niche list of retailers. You don’t have to use a monthly tracking spreadsheet to get fair value from a premium card. There are many ways to make premium cards fit into everyday life without overcomplicating the situation.

Related: Why Chase needs a competitor to Amex Gold

For rates and fees on the Amex Platinum card, click This.

For Amex Gold card rates and fees, click This.