The advances of Deepseek Sow of China are suspicious of whose spending

Informed with free updates

Simply register Equity Myft Digest – sent directly to your inbox.

Technology stocks decreased on Monday when the advances of Chinese artificial intelligence started Deepseek doubt whether the United States could maintain its leadership in AI or not by spending billions of dollars. La for the chip.

DeepSeeK Last week released its latest AI model, achieving the same performance as the American opponent of Openai, although the company previously announced the use of less NVIDIA chips.

The results sent a shockwave through the market on Monday, with NVIDIA lost more than $ 500 billion in market value, on the course for the largest daily reduction for any company, when Investors re -evaluate the future investment in AI hardware.

The venture investor Marc Andreessen called China’s new model as the time of whose Sputnik, made a comparison with the Soviet Union impressed the United States by putting the first satellite into orbit.

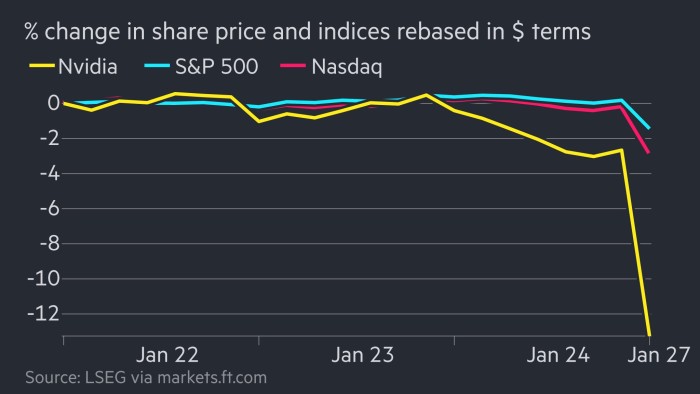

Stocks in Nvidia, one of the biggest winners from Who Revolution, has decreased by 16 %. The severe Nasdaq synthesis of technology lost 3.2 %, while the S&P 500 index decreased by 1.9 %. Microsoft has decreased by 3.6 %.

In Europe, the ASML chip equipment manufacturer has decreased by 7.5 %, while the Dutch semiconductor company ASM International has decreased by 12.5 %.

The habits are far beyond traditional technology names. Siemens Energy, which provides electricity hardware for AI infrastructure, has decreased by 20 %. Schneider Electric, a manufacturer of French electrical products, has invested a lot in services for data centers, has decreased by 9.2 %.

For some people, the sell -off in companies that make the options and shovels of the revolution AI repeated the collapse of Cisco’s stock prices when Dotcom Bubble broke.

NVIDIA, Broadcom and other chip manufacturers have benefited from the race of Silicon Valley to build larger chip clusters than ever, which people like the boss Xai Elon Musk and Sam Altman of Openai have argued that it is Needed to continue promoting whose ability.

CEO of NVIDIA, Jensen Huang and Broadcom’s Hock Tan have argued in recent weeks that they expect the crazy data center. Continue until the end of the decade.

Luca Paolini, the patriarchal strategist of the Pictet Asset Management, said that anyone’s trade is still vulnerable, like every transaction is a consensus and based on the assumption of a leading position without any position. ready.

But some Wall Street analysts and AI researchers have questioned the exaggeration surrounding Deepseek’s achievements. It seems that the mistake of classification that ‘China has duplicated Openai for $ 5 million’ and we don’t think it really discussed, the analysts wrote at Bernstein in one note for client.

Some researchers have even speculated that Deepseek was able to use shortcuts in their own training costs by taking advantage of the latest models from Openai, showing that while it could be possible. Regenerating the latest US developments forward.

AI investment of major US technology companies reached $ 224 billion last year, according to UBS, it is expected that a total of $ 280 billion in 2025. Openai and SoftBank announced it on the week of the week Before to invest $ 500 billion in the next four years In AI infrastructure.

Even after the latest release of Deepseek, director of Meta Mark Zuckerberg said in a Facebook post on Friday that he had planned to spend up to $ 65 billion for AI infrastructure this year.

Founded by the Liang Wenfeng Protection Fund manager, Deepseek last week released a detailed article explaining how to build a large language model that can automatically learn and improve itself.

It seems a bit realistic when China is not idle, even when these tariff restrictions and investments for technology companies have been strategic at BarClays.

The United States imposes strict limitations to the export of chips to China under former President Joe Biden, banning the sale of NVIDIA’s most advanced models to the country.

Some analysts argue that Deepseek’s advances will eventually prove the positive for AI chip manufacturers like NVIDIA.

Dylan Patel, chief analyst at the Consulting Semianalysis chip, said it is easier to cut down training costs and operate AI models that will help businesses and consumers more easily to apply the applications. AI.

Advances in training and deduction efficiency allows further expansion and proliferation of AI, Patel said. This phenomenon has occurred in the semiconductor industry for decades, where Moore’s law has reduced half of the costs every two years while the industry continues to develop and adds more capabilities to the chip.

Some Chinese technology stocks are advanced in the context of excitement for Deepseek, although the wider CSI index has been closed by 0.4 %. In Hong Kong Baidu closed 4 % and Alibaba increased by 3 %.