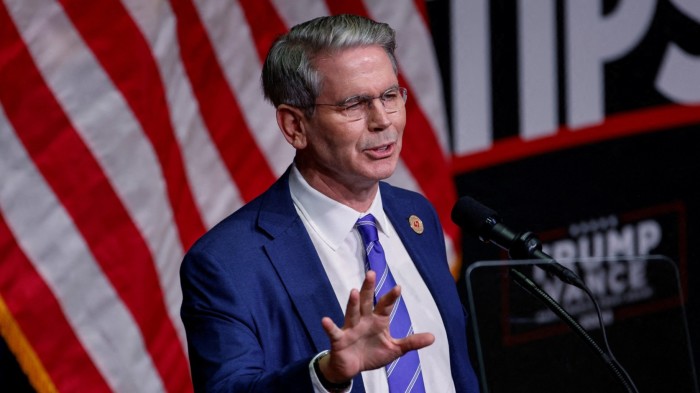

The dollar fell after Donald Trump appointed Scott Bessent to the Treasury role

Unlock Editor’s Digest for free

Roula Khalaf, FT Editor, picks her favorite stories in this weekly newsletter.

The U.S. dollar weakened and Treasuries rallied on Monday as the nomination of Scott Bessent as Treasury Secretary eased investor concerns about President-elect Donald Trump’s trade tariff plan .

The dollar index, which tracks a basket of currencies such as the yen and euro, fell 0.5%. The euro increased 0.6% against the US currency.

The index rose more than 7% from the start of last month through Friday, as a big beneficiary of the so-called Trump trade on expectations that his tariffs and tax cuts will boost inflation. inflation and put pressure on US interest rates. .

But the choice comes from Bessent, who last month described the tax as far-reaching “maximization” perspectiveis being seen by investors as a sign that the president-elect’s policies may be tempered.

Earlier this month, Bessent told CNBC that he would recommend introducing tariffs “gradually” to minimize the risk of a shock to the market.

“Having at least one significant supporter in the cabinet of the persistent trade tax debate is positive for markets,” said Paul Donovan, chief economist at UBS Global Wealth Management.

US Treasuries, which had been sold off on the prospect of inflationary pressures, have bounced back. US 10-year bond yields fell 0.06 percentage points to 4.35%. Yields move inversely to prices.

“Everyone has positioned themselves for ‘America First,’ but now I think you’re starting to understand that this is not a one-time decision,” said Hugh Gimber, global market strategist at JPMorgan Asset Management. afternoon”.

He added that the incoming administration is “talking about using the US dollar as a more strategic tool” to achieve its goals.

Nomination by Bessent Vincent Chaigneau, head of research at Generali Asset Management, said this is a sign that Trump may not “completely” implement the most inflationary policies, including tariffs.

Investors hope that hedge fund manager Bessent, who will be responsible for delivering Trump’s economic agenda, can also help limit the growing fiscal deficit.

Trump supporter Elon Musk previously objected to appointing a candidate he is described is the “business as usual choice”.

S&P 500 futures rose 0.4%. In Europe, the Stoxx Europe 600 was flat while Britain’s FTSE 100 rose 0.3%. European stocks have underestimated the US market because of tariff concerns.

America’s major Asian trading partners were delighted by news of the appointment. Japan’s export-heavy Nikkei 225 and South Korea’s Kospi both rose 1.3%.

Analysts at MUFG said Bessent “has previously indicated a possible more balanced approach in implementing trade tariffs.”

But they cautioned against reading too much into the nomination, saying the Treasury Secretary “is not someone who will design the finer details of a trade tariff implementation strategy.”