Travel Mistakes to Avoid During Hurricane Season

Vacations…are they great? There’s nothing like heading to a beautiful tropical island in the Caribbean, Florida, or the Gulf Coast in the summer or fall. Vacations can be great—that is, until a seasonal tropical weather event or hurricane hits your destination. Then, your vacation can turn into a major headache, or worse.

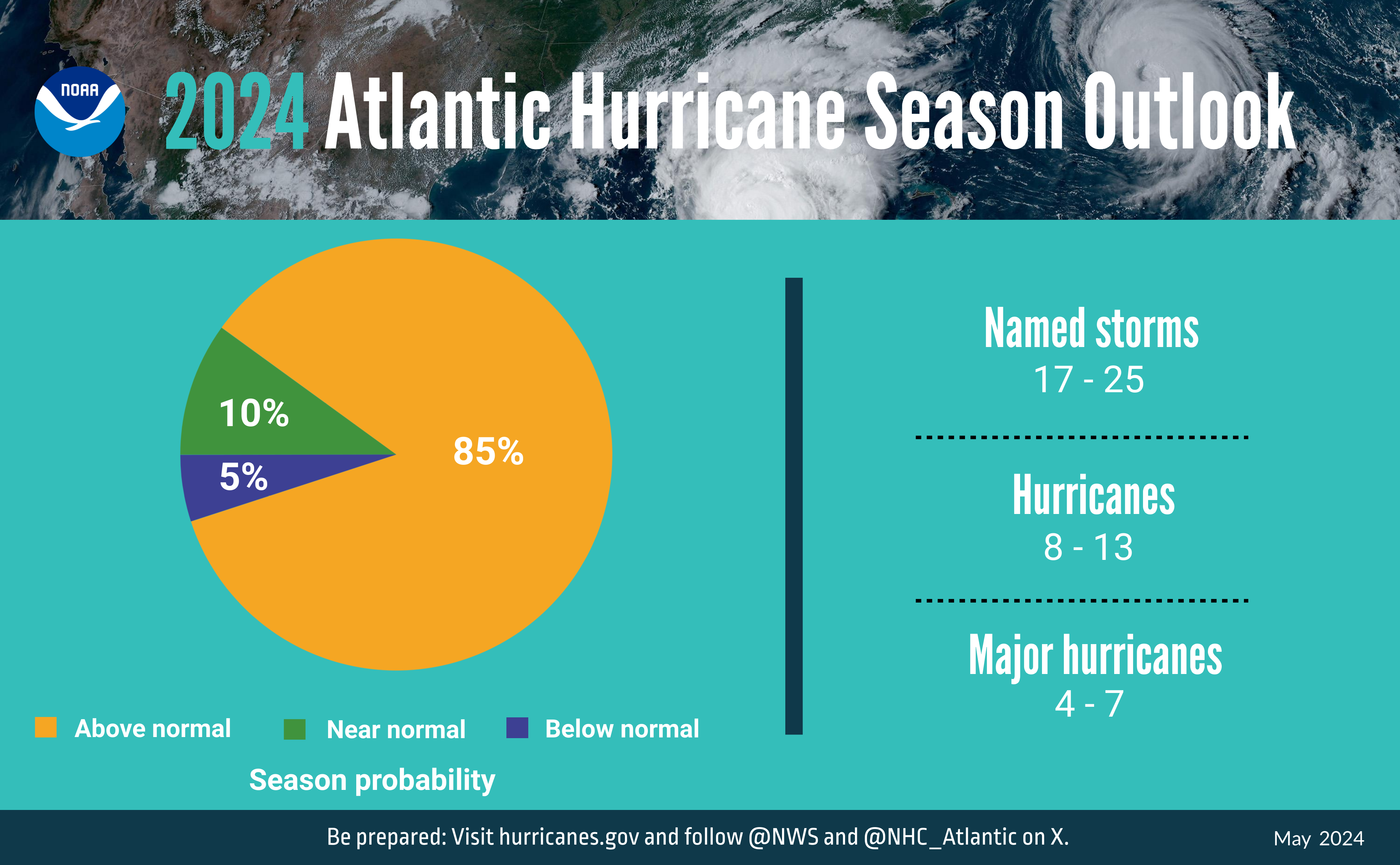

Since Hurricane season 2024 With Hurricane Katrina predicted to be one of the most active storms on record, it’s important to be prepared for travel during the main hurricane season. One thing that can help during a tropical weather event? Travel insurance.

“Travel insurance has become an essential part of travel plans for travelers vacationing in the Caribbean or Southeast during Atlantic hurricane season. [June through November]”, said Stan Sandberg, co-founder of TravelInsurance.com.

Related: Hurricane Season Is Here: TPG’s Hurricane Guide for Travelers

But even if you’ve purchased insurance or think your credit card travel insurance policy has you covered, there are still many unfortunate things that can happen.

Want to avoid hurricane headaches? Read on for travel mistakes to avoid during hurricane season.

Think hurricane season ends in early fall

“Some people don’t realize that hurricane season isn’t just limited to the summer months,” says Beth Godlin, president of Aon Affinity Travel Practice.

In fact, hurricane season lasts until November 30, according to Godlin, so you’ll want to keep an eye on the weather and your travel insurance through early December.

Don’t buy travel insurance before the storm

If there’s one thing you should remember to protect your vacation investment during hurricane season, it’s this: Once a storm has been named, it’s too late to buy travel insurance.

Daily News

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers to get the latest news, in-depth guides, and exclusive offers from TPG experts

There is an important reason behind this.

“Insurance covers the unexpected,” says Jenna Hummer, director of public relations for Squaremouth (a company that compares travel insurance from major providers in the US), “so once something is considered ‘foreseeable’ — in this case, when a tropical storm or hurricane is named — you’re no longer covered for that storm.”

Waiting to Buy Travel Insurance During Hurricane Season

It’s no surprise that every travel insurance expert I interviewed had the same advice if you’re planning to travel during a potential hurricane. They recommend purchasing insurance as soon as you book your trip.

If you see reports that a hurricane is about to hit your destination or that your home airport may be closed, you may have missed your chance to protect your trip.

Think you might cancel your trip because there’s a storm coming to your destination?

“A common misconception is that if a hurricane hits near your destination, you can cancel your vacation and be covered,” says Hummer.

But just because a hurricane has hit your planned vacation spot doesn’t necessarily mean you can cancel your trip and get a refund.

If your hotel is uninhabitable—meaning it’s not open or doesn’t have electricity or running water—you’re covered, Hummer says. But if the surrounding area is facing damage but the hotel remains open, “You have to pay for your stay.”

Not sure what your travel insurance will cover?

Most comprehensive travel insurance packages will include trip cancellation and interruption coverage, trip delay coverage, and baggage loss and delay coverage.

“Trip cancellation and trip interruption will reimburse you for any prepaid, non-refundable expenses that are lost or unused due to a storm that prevents you from reaching your destination,” Sandberg says. “Many plans will also provide coverage if there is a mandatory evacuation order at your destination. Some plans will even provide coverage if there is a NOAA hurricane warning at your destination on the day of your trip.”

Flight delay insurance will reimburse you for unexpected travel expenses such as food, transportation, internet services and accommodation when your flight is delayed for an extended period of time.

“Remember, however, that trip delay is typically not a covered reason for cancellation, and most policies will not reimburse you if you choose to cancel because of a trip delay,” says Godlin. “However, your benefits may include reimbursement for the portion of your trip you missed. For coverage to be effective, some trip delay policies require a minimum delay, which can range from four to 12 hours. Some policies may also only cover delays caused by specific named perils, such as a hurricane hitting your destination and forcing an early departure.”

Trust credit card policies to protect you

This is a difficult question, Hummer says, because many travelers carry credit cards with travel benefits, including trip delay insurance, and therefore think they’ll be covered in the event of a weather event like a hurricane.

“The problem with credit card insurance is that the coverage is very low, only about $5,000 for medical expenses,” she says.

This number is much lower than what you might need in a real emergency.

“Remember that your credit card won’t cover anything that wasn’t purchased with that card,” Hummer says. “So if you haven’t paid for the entire trip with that card, or other people in your group used a different payment method, you won’t be fully covered.”

Don’t buy insurance with 24 hour support

If there is a policy that costs less but doesn’t offer 24/7 support, skip it.

“Make sure you purchase a policy that has 24/7 support,” says Hummer.

She also adds that if you find yourself in a situation where the airport is closed due to a storm, “call your travel insurance company ahead of time; they may be able to cover hotel rooms and meals while you wait with the airline.”

Not getting enough protection

While you don’t have to pay a premium for travel insurance during hurricane season, you need enough coverage to get home and cover any emergencies.

According to Hummer, your insurance plan must include a minimum of $50,000 for medical expenses and $100,000 for medical evacuation costs.

Forgetting that a hurricane can happen at home too

Travel insurance can still be beneficial, even if you’re not going to the tropics.

“Let’s say you live in South Carolina, but you’re taking a cruise to Alaska,” Godlin says. “As you’re getting ready to embark on your dream vacation, a hurricane hits the coast and destroys your home. What can you do? If you have travel insurance and your home is uninhabitable, that may be a covered reason to cancel your trip.”

This is certainly a worst-case scenario, but it’s also a useful reminder that storms can happen at home or while you’re away, depending on where you’re coming from and where you’re going.

Paying too much for hurricane insurance

“Buy the cheapest insurance plan that has the coverage you need,” says Hummer.

She suggests using a comparison tool and knowing that “just because you pay more doesn’t mean you get more coverage.”

She explains that different travel insurance companies have different formulas and take into account a variety of factors, like age and destination—often the price changes while the coverage does not. Instead, make sure you get the coverage and support outlined above and choose the lowest-cost option.

Read more related: