UPI transaction limits increased: RBI announces new limits for Lite and 123Pay wallets

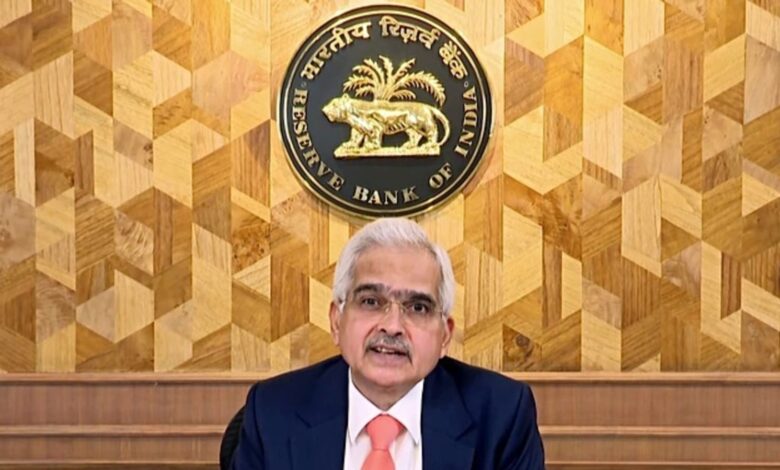

The Reserve Bank of India (RBI) has introduced new transaction limits for UPI Lite Wallet and UPI 123Pay, a major step towards strengthening the digital payments system in India. RBI Governor Shaktikanta Das shared these updates in his monetary policy statement on Wednesday. He highlighted the impact of Unified Payments Interface (UPI) in transforming India’s financial landscape by increasing accessibility and driving innovation.

RBI has decided to make the following changes:

1. Per transaction limit for UPI 123Pay will increase from Rs. 5,000 to Rs. 10,000.

2. UPI Lite wallet limit will increase from Rs. 2,000 to Rs. 5,000, while the limit per transaction will increase from Rs. 500 to Rs. 1,000.

Also read: Telegram rolls out phone number verification feature: Here’s how it works

Das stated that these changes are aimed at encouraging greater adoption of UPI and making it more inclusive for all users. He also proposed a new feature that would allow senders to verify the name of the account holder before completing a transfer through the Real-Time Gross Settlement System (RTGS) and the National Electronic Funds Transfer (NEFT) system. ). This proposal aims to reduce errors and fraud during payments by ensuring that funds reach the correct recipient.

Also read: Apple TV+ partners with Amazon Prime Video to expand streaming access for subscribers- Details

What are UPI Lite and UPI 123Pay Wallets

UPI Lite Wallet simplifies UPI transactions, allowing users to make payments without entering UPI PIN for amounts up to Rs. 500. The new limit will allow transactions up to Rs. 1,000 in the future, streamlining the payment process.

To use UPI Lite, users must first deposit money into their UPI Lite wallet. The previous maximum amount for this grant was Rs. 2,000; However, it has now increased to Rs. 5,000, allowing users more flexibility in managing their transactions.

Also read: X introduces a new payment model to increase premium user engagement and creator revenue

UPI 123Pay serves as an innovative solution for feature phone users, offering four different methods to support UPI payments:

1. Predefined number of interactive voice responses (IVR).

2. Missed call payment method

3. Payment system supports OEM

4. Audio-based payment technology

These options ensure that users without smartphones or internet access can still participate in the digital economy, increasing inclusivity and convenience for a wider audience. These changes reflect our commitment to improving financial services and encouraging a cashless economy in India.