What is Venmo and how does it work?

Raise your hand if you always make your own decisions Reserve Chase Sapphire® and insist on paying for all of your friends’ dinners. It’s not that you’re rich – you just like earning 3 bonus points for every dollar spent on dining and knowing your friends will pay you back later.

This is where Venmo, a money transfer app, enters the conversation.

This service allows you and other Venmo users to send money to each other quickly and easily and is one of the most widely used mobile payment apps on the market.

If you’re new to Venmo — or you’ve heard of it and want to learn more before signing up — then you’ve come to the right place. Read on to discover how Venmo works, what fees are charged (depending on the transaction), how long transfers take, and more so you can navigate the system with ease.

What is Venmo?

As mentioned above, Venmo is a money transfer service, also known as a peer-to-peer (P2P) payment system. Originally operated by Braintree, PayPal acquired the company in 2013 and is still owned by PayPal.

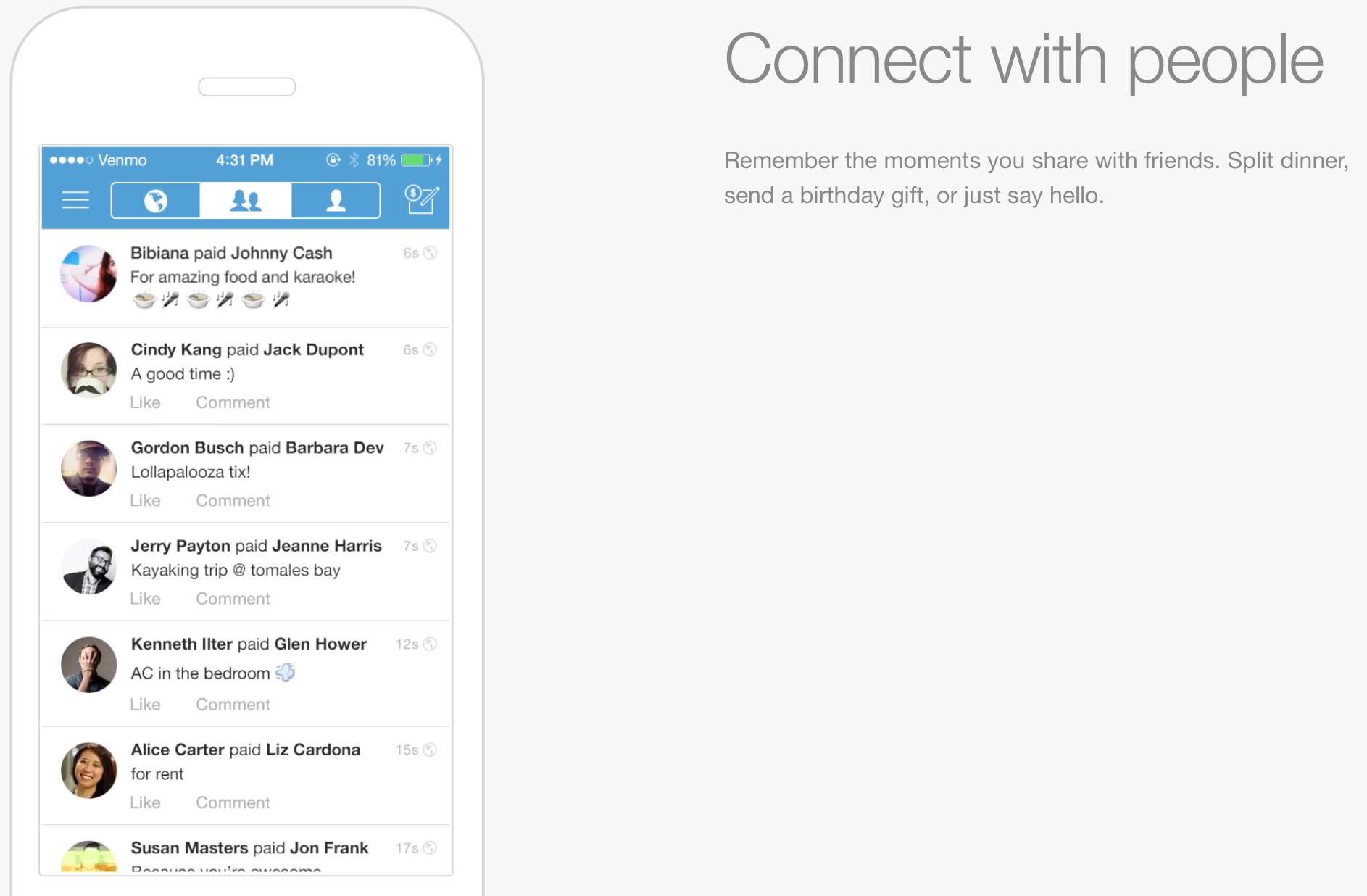

The key features that distinguish Venmo from other services are its mobile-first design (it has no web features) and a social network-like news feed that publicly displays the transactions you make (though although you can choose to make the transaction private). This means people you connect with can see transactions and comment or react to them.

How does Venmo work?

Venmo works by linking your bank account, debit card, or credit card to your Venmo account. Once your information is saved to your account, you can send money to contacts and some businesses. You also don’t need to maintain a balance in your account. You can simply deposit money in one transaction and it will debit your linked cards accordingly.

It’s worth noting that you can deposit money from your bank account, balance (if you have one) or debit card for free. For credit cards, the standard fee is 3% per transaction.

Once you receive the money, you need to submit a transfer request directly to your bank account, and from there, you can withdraw the money or transfer it to another account if needed. To help reduce the risk of users being scammed, Venmo uses encryption for all of your transactions to keep your money safe. Remember to double check that when you send money, you send it to the correct account/phone number.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Can I have multiple Venmo accounts?

Venmo has a limit of two accounts per person under certain conditions. Two Venmo accounts must be opened with a single set of contact details — so each account will have a different email address and phone number.

To have another Venmo account, you must have a joint bank account or debit card with another Venmo user or own a business, in which case you open a Venmo Business account. However, you can only have one Venmo business account for your business.

How do I add money to Venmo?

In addition to linking your debit and credit cards to Venmo, you can also add money to your Venmo account. Funds can be added to your Venmo account using a debit card, check, or direct deposit.

For example, you can deposit your salary into your Venmo account or top up your account comfortably with a specific amount transferred from your debit card or bank account. The benefit of adding money to your Venmo account is that you only use your pre-loaded balance and reduce the risk of charges to your debit card or worse, an overdraft when paying directly with a debit card. debt for transactions.

Does Venmo charge a fee?

However, when using a credit card through Venmo, as mentioned earlier, you will incur a 3% fee whenever you do so. If you’re trying to score a sign-up bonus or other spend, this might work, but otherwise using a credit card might not be worth it.

It’s important to note that issuers may charge fees for using Venmo for P2P transactions. For example, in 2021, Chase has updated its definition of cash-like transactions to include P2P payments. Therefore, when making a Venmo payment with a Chase credit card like Chase Sapphire Sanctuary, Chase Sapphire Preferred® Cardor Pursue Unlimited Freedom®These transactions will be considered advances and are subject to transaction fees, higher interest rates, and no rewards.

Additionally, credit card cash advance limits are significantly lower than your regular credit limit and interest accrues from the first day the transaction occurs.

It’s a good idea to make a small transaction to check first to see if the purchase code is a cash advance with your specific credit card.

How do you get Venmo rewards?

There are a few different ways to earn Venmo rewards. The first is through a Venmo debit card, which is a Mastercard. You can use it just like a regular debit card, and Venmo will give you cash back at certain retailers.

You’ll find that some popular retailers like Target, Sephora, Chevron, and Sam’s Club offer cash back rewards when you use your Venmo card to make purchases. With cashback rates as high as 5%, this isn’t the worst way to maximize your spending, but there are a few. Better choice Earn even more money on specific purchases that are worth checking out.

Then there’s the Venmo Credit Card, which also earns Venmo rewards. Cardholders can earn rewards across eight categories, including travel, dining, gas, groceries, entertainment and more.

You automatically get 3% cash back in your top spending category, 2% in your next top spending category, and 1% cash back on all other qualifying purchases. There’s no limit to how much you can earn, and the card has no annual fee.

Venmo Debit Card and Venmo Credit Card information has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Is Venmo safe?

Venmo prides itself on its secure network and protection of customer data. As mentioned above, every transaction in the app is encrypted, so your linked card or financial institution information is secure regardless of whether you’re using Venmo to pay friends or family. retail.

You can secure the Venmo app by setting not only a password but also a biometric or PIN-based code for your account. You also have control over your privacy settings, meaning you can choose whether others see your transactions and activities.

Venmo vs. PayPal

Venmo and PayPal are both P2P payment tools that allow users to send and receive money. Although PayPal owns Venmo, each operates independently, and both have their pros and cons.

First, Venmo and PayPal have different fees they charge users. With Venmo, you can send money using a linked bank account or debit card with no fees, while using a credit card will incur a 3% fee.

Paypal only offers free transactions when sending money from a linked bank account or PayPal. On the other hand, debit or credit card transactions will be charged 2.90% plus a flat fee based on the currency used. With PayPal, you can also send money internationally to someone else’s PayPal account for a 5% fee plus a change fee.

Venmo and PayPal also have different transaction limits. Venmo allows a spending limit of $7,000 (for verified accounts), including Venmo debit cards and merchant payments, and $60,000 weekly for P2P payments. PayPal has fewer limits but requires single transactions not to exceed $60,000 and in some cases limits these transactions to $10,000.

Overall, Venmo is only for the US market, while PayPal is available in over 190 countries and supports 25 currencies.

Bottom line

Venmo is an easy-to-use service that caters to mobile users. Most transactions involving money transfers are free, however you will incur fees when using a credit card and incur additional fees if your issuer encodes P2P payments as peer-to-peer transactions. like cash.

It has a simple rewards program that offers cashback to participants and contributes to the security of your information. Overall, it’s a good choice for anyone.