What to do if your credit card is overdue – and how to prevent it from happening

Sometimes life happens and it can throw you off track financially.

You can have a complete financial plan, budget and savings. However, that may not be enough for you to avoid missing payments and letting your account become delinquent.

Credit card delinquency is nothing new, so let’s take a closer look at exactly what it is – and how you can avoid it.

What are credit card payment restrictions?

in one 2023 FICO Report11% of US adults admit to missing a credit card payment. These late or missed bill payments begin the process of delinquent credit card payments.

Delinquent does not mean you have not paid your balance in full; it simply means you didn’t make the required minimum payment. However, at TPG we always recommend paying in full to avoid interest on your balance. This is one of the TPGs commandments about credit card rewards.

ONE Philadelphia Federal Reserve 2023 Report shows that credit card delinquency rates are at an all-time high.

Rising rates could indicate credit card companies are working with riskier borrowers – and that was even before the coronavirus pandemic. So some banks may reduce the credit limit for cardholders and be cautious when accepting new cardholders.

Failure in work pay bills on time may result in credit card suspension, revocation, or even charges; Additionally, you may be charged penalties and late fees for delinquent accounts.

Let’s look at what it all means by looking at the days and months following a missed payment.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Early stages of card crime

If you miss your payment deadline, which is usually within 30 days, very little will happen to your account. Your credit card company may issue it late payment feebut if you are able to update your account within this time period, this negative mark won’t even show up on your credit report. Additionally, if you’re not a repeat offender of missing payments, your bank may waive late payment fees if you ask nicely.

After 30 days of non-payment, your account will likely be reported to everyone three credit bureaus like committing a crime. This means it usually takes two payments in a row for delinquency to start to seriously affect you. Consumers get a bit of a buffer before facing significant consequences.

The creditor may also temporarily suspend or suspend your account and stop allowing purchases for payment.

The middle stage of card crime

After several months of default (usually three to four months late), credit card companies may suspend your account completely and require certain actions to clear your account. cancel the pause.

If you are facing extenuating circumstances such as job loss or other financial hardship, you can contact your card issuer about Potential custom return options. Banks can more willing to work with youespecially if you are going through difficult economic times.

Besides working directly with the issuer, you can also work with a nonprofit credit counselor who can help create a debt management plan. Remember that the counselor must work with you and the creditor and have the consent of both parties.

Later stages of card crime

Eventually, your card will be revoked and you can never use it again, even if you pay it in full. This usually happens around 4 to 5 months.

If you have not yet proceeded to update your account, then credit card issuer “debt forgiveness” can be carried out as the final stage of the crime. This usually happens after six months of delinquency.

From an accounting perspective, this simply means that the issuer has reclassified the liability from an asset to a loss. However, charging a fee has a serious impact on your credit, and you’ll still need to pay your balance back in full.

Related: The complete guide to credit card debt

The impact of delinquency on your credit

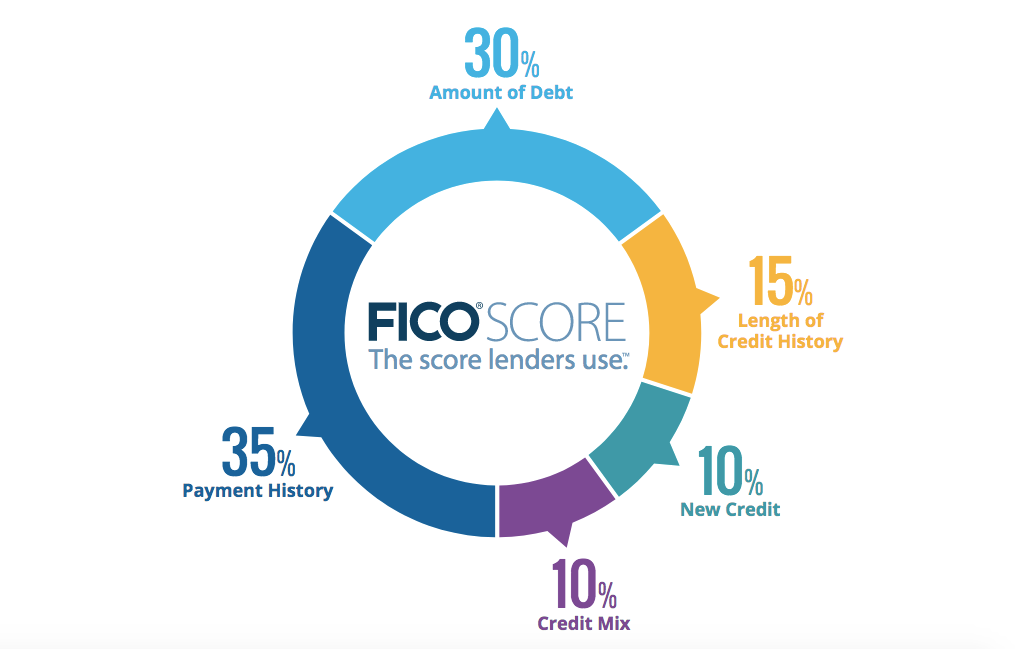

Now that we have discussed what delinquency is, how does it negatively affect your credit? the credit score factor Your payment history and amount owed are most affected when you miss payments.

Payment history

Not paying your bills on time will impact your payment history, accounting for 35% of your FICO score.

Amount owed

Next, a credit card revocation (this is when the issuer closes your account) can affect you negatively. credit utilization ratio. With less total available credit, your utilization ratio will increase. “Amount owed” makes up about 30% of your credit score, so this will also be negatively affected.

Discount

Finally, credit card debt will remain on your credit report for up to seven years. Exact impact on you credit score vary, but a price drop has the potential to seriously impact your financial future.

How to Avoid Being Late on Your Credit Card (and Being Charged)

Make all payments on time. Paying at least the minimum payment on your card bill each month will prevent delinquency. One strategy to do this is setup automatic payment. This will keep you from forgetting balance completely.

Don’t spend with your card. This may seem the most obvious, but if you’re at risk of missing your payment, don’t continue spending with the card.

Call your credit card company if you’re having trouble. Card companies may be willing to work with you on expanded payment options or other ways to help maintain your current balance.

Related: The biggest factors that affect your credit score

Bottom line

There’s a big difference between a payment that’s a few days late and an overdue account that hasn’t been paid for months. The good news is that there are ways to get back in good standing with your card issuer before things start to go awry.

Of course, it’s easy for late payments — plus interest on your revolving balance and other fees — to quickly add up. It can snowball out of control. That’s why it’s important to not only update your account as soon as possible, but also try to avoid getting into this situation in the first place.

However, sometimes it is unavoidable, especially for those who are facing financial difficulties. However, knowledge is power and with these tips you will know what to watch out for and what to do to avoid breaking the law.

Related: Credit Cards 101: A Beginner’s Guide