What credit score do you need to get the Chase Sapphire Reserve card?

At TPG, we spend a lot of time talking about How credit scores workways to your improvement and how can you keep it in shape. Although a good credit score may be enough to get you approved for many projects travel credit cardsome of the most rewarding premium card Top credit inquiries.

There’s no magic number that guarantees approval for a particular card, but we can analyze publicly available data points to gauge your odds.

Let’s talk about one of the best premium credit cards available on the market: Reserve Chase Sapphire® – and what the unpublished credit score requirement will be to get approved when you apply.

Chase Sapphire Sanctuary Overview

The Chase Sapphire Reserve has consistently been one of the best travel rewards credit cards since its launch in 2016. It offers a respectable 3 points per dollar spent for all tourism And eat and drinkand it comes with some of the most extensive features tourism protection Available on any credit card.

It has an annual fee of $550, but comes with benefits like a $300 annual travel credit, up to $5 in DoorDash credit monthly (until December 2024), Priority pass to airport lounges and a Global Entry/TSA PreCheck application fee credit helps offset it.

Additionally, new cardholders can earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months — worth $1,538, based on TPG valuation.

Related: Chase Sapphire Reserve credit card review

What credit score do you need to get the Chase Sapphire Reserve card?

Chase Sapphire Sanctuary has a bit Stricter approval requirements than its siblings, Chase Sapphire Preferred® Card. Reports show that you typically need to score at least 740 points to be approved for a card, although the average score will be slightly higher. People with scores under 700 have been approved for cards, but approval is often not immediate in those cases.

If your score is at the lower end of the range, remember that there are many other factors that affect eligibility, such as your income and the age of your credit accounts. In the context of Chase, another important factor is your relationship with the bank.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

If you are a long-time Chase customer and have other Chase cards To demonstrate that you can pay your bills on time or have a large balance in your bank account but a below-average credit history, you may have a higher approval rate.

Reports suggest that those with banking connections can also increase their odds by enrolling in a branch.

Another idea is to apply for the Chase Sapphire Preferred with a lower score requirement and then claim it product change to Chase Sapphire Sanctuary.

Related: What credit score do you need to get the Chase Sapphire Preferred card?

How many card accounts can I open?

The Chase Sapphire Reserve is subject to Chase’s unpublished regulations 24/5 rule. This means that if you have opened five or more personal credit cards with any issuer in the past 24 months, Chase will automatically deny your application for these cards, even if you have a good score. Perfect credit.

The 5/24 rule is hard-coded into Chase’s system and cannot be overridden manually, so if you’re on 5/24, there’s no benefit to taking the opportunity to sign up just to see what happens. What will happen?

You also won’t be approved if you currently hold the Chase Sapphire Preferred; Additionally, you need to wait at least 48 months from receiving the sign-up bonus on one card before you can earn that bonus on the other card.

Related: How to calculate your 24/5 location

How to check your credit score

It would be best if you never spent money on it Check your credit score. Most of The credit card comes with free FICO The score calculator makes it easy to see where your score falls on the scale from good to poor and stay up to date with your performance.

You can also easily open an account on sites like Credit karma or Credit sesame. These sites are free and can help you better track your score and its factors. You can also use these services to dispute any information about your scores that is inaccurate or appears fraudulent.

Sites like Credit Karma also provide regular, automatic updates when your score changes, as well as alerts whenever a new inquiry is added to your credit report. Because these sites work soft pullthey will not negatively impact your credit score.

Factors that affect your credit score

Before you start applying for any credit card, it’s important to understand the factors that make up your credit score, since applying for a new line of credit will change your score.

Related: 5 little-known things that affect your credit score

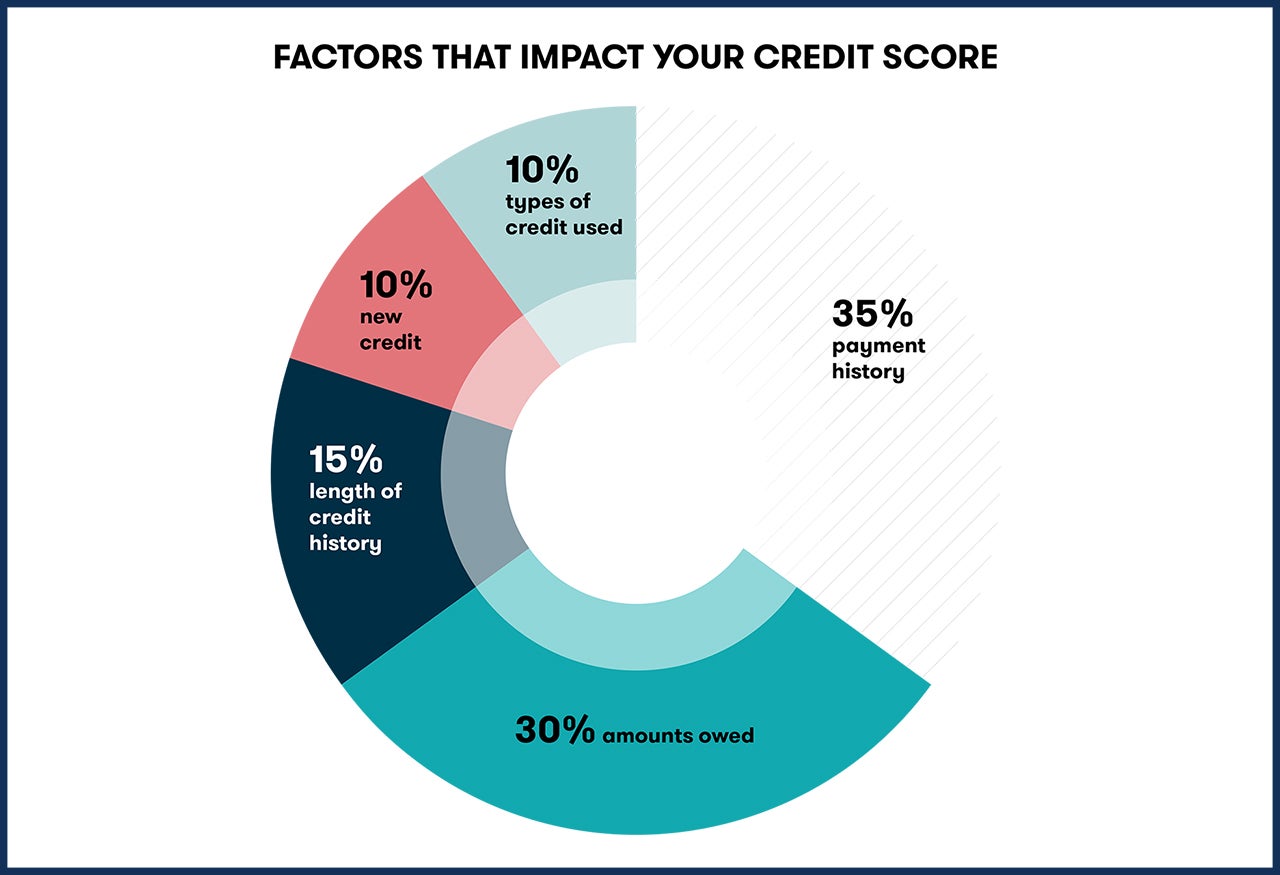

While the exact formula for calculating your credit score is kept secret, FICO is very transparent about the different factors they evaluate and the weight each factor places:

- Payment history. 35% of your FICO score is made up of your payment history. If you fall behind in your loan payments, it can lead to a decline. The longer and more recent the crime, the greater the negative impact on your credit score.

- Amount owed (use). 30% of your FICO score consists of the relative size of your current debt. Especially, yours debt to credit ratio is your total debt divided by the total amount of credit you’ve been extended across all accounts. Many people think it’s best to have a debt-to-credit ratio below 20%, but that’s not the magic number.

- Length of credit history. 15% of your score is based on the average length of all accounts in your credit history. This becomes an important factor for people with minimal credit history, such as young adults, recent immigrants, and anyone who has largely avoided credit. It can also be a factor for people who open and close accounts within a short period of time.

- New credit. Your most recent accounts determine 10% of your credit score. Opening too many accounts recently will lower your score, as the scoring model will interpret this as a sign of possible financial difficulties.

- Credit mix. 10% of your score is related to the number of different credit accounts you have, such as mortgages, auto loans, credit cards and store charge cards. While having larger loans is better than having fewer loans, no one recommends taking out unnecessary loans to increase your credit score.

Related: Ways to improve your credit score

An important factor for the Chase Sapphire card is your average account age. While a longer credit history will improve your score, many issuers focus on a one-year term. That means having an average account age of more than a year can increase your chances of approval. Conversely, you may have trouble getting approved with an 11-month credit history, even if your numerical credit score is very high.

Additionally, if you have any delinquencies or bankruptcies on your credit report, Chase may be hesitant to approve you for a new line of credit even if your score is solid.

It’s important to remember that your credit profile is more than just a number. It is a collection of information provided to the issuer to analyze your creditworthiness.

What to do if you get rejected

Don’t give up if your card application is initially received refuse. If you receive a rejection letter, you should first consider the reason for your rejection. By law, card issuers must send you a written or electronic notice explaining what factors prevented you from being approved.

Related: Basic guide to restrictions when applying for a credit card

Once you find out why you were denied, call Chase’s reconsideration line. Tell the person on the phone that you recently applied for a Chase credit card “and you were surprised to see your application denied and you’d like to talk to someone about reconsidering that decision.” “

From there, you have to build a case and convince the Chase agent over the phone why you deserve the credit card.

If you were rejected because your credit history was too short, you can point to your excellent on-time payment record. If you are denied because of missed payments, you can explain that it was a long time ago and that your records since then have been perfect. If you bank with Chase, mention that.

While there’s no guarantee that this strategy will work, there are many reports of review rejections, so it’s worth spending 15 minutes on the phone if it can help you get Get the card you want.

The other possible option is to let your application go into a “pending” state. This means you may (eventually) be approved, but Chase needs more time to review your application or new information to make a decision. If you receive this notice, you should definitely call the review line. You may only need to verify one detail on your application, or if you have other Chase cards, you may need to change your credit limit.

Bottom line

It’s no surprise that as one of the most premium cards available, the Chase Sapphire Reserve requires an excellent credit score to be approved.

That said, there are ways you can increase your odds, such as establishing a banking relationship with Chase. Alternatively, you can first sign up for the Chase Sapphire Preferred, receive a 75,000-point welcome bonus after spending $4,000 in purchases within the first three months, and then request a product change.

Read more:

New to the points and miles game? Check out our beginner’s guide for everything you need to know to get started!

Register here: Chase Sapphire Sanctuary and earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months.

Register here: Chase Sapphire preferred and earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months.